Answered step by step

Verified Expert Solution

Question

1 Approved Answer

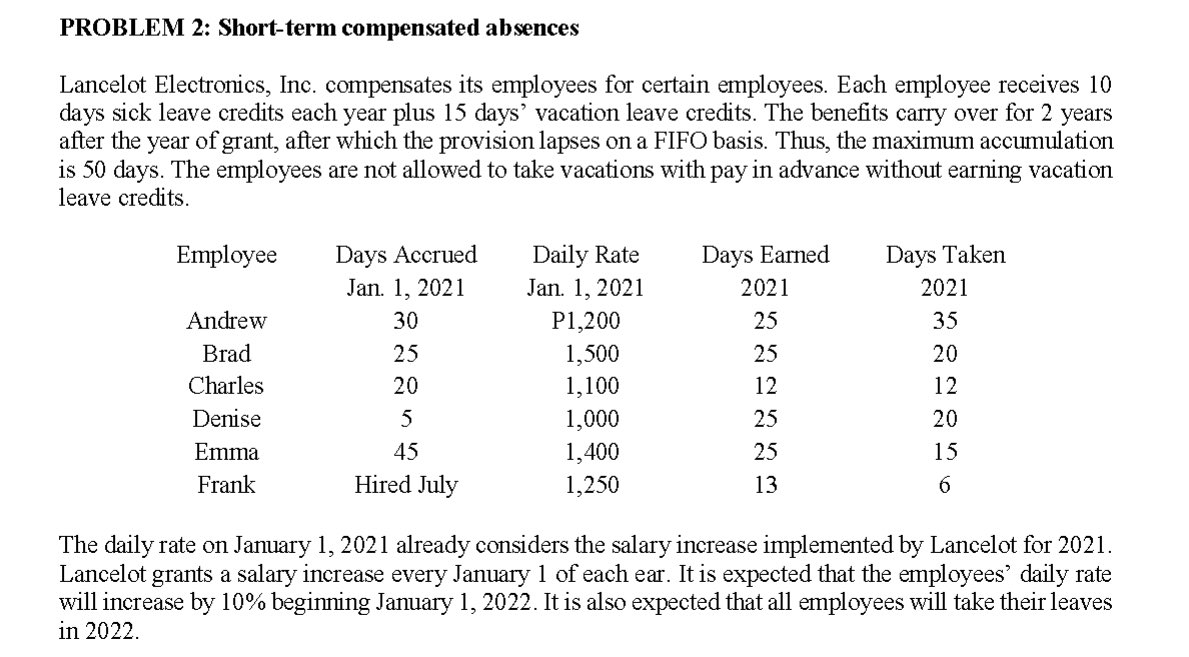

PROBLEM 2: Short-term compensated absences Lancelot Electronics, Inc. compensates its employees for certain employees. Each employee receives 10 days sick leave credits each year plus

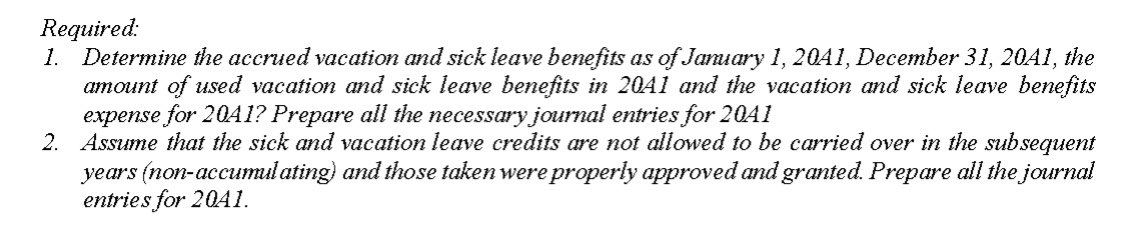

PROBLEM 2: Short-term compensated absences Lancelot Electronics, Inc. compensates its employees for certain employees. Each employee receives 10 days sick leave credits each year plus 15 days' vacation leave credits. The benefits carry over for 2 years after the year of grant, after which the provision lapses on a FIFO basis. Thus, the maximum accumulation is 50 days. The employees are not allowed to take vacations with pay in advance without earning vacation leave credits. The daily rate on January 1,2021 already considers the salary increase implemented by Lancelot for 2021. Lancelot grants a salary increase every January 1 of each ear. It is expected that the employees' daily rate will increase by 10% beginning January 1,2022 . It is also expected that all employees will take their leaves in 2022 . Required: 1. Determine the accrued vacation and sick leave benefits as of Jamuary 1,20A1, December 31, 20A1, the amount of used vacation and sick leave benefits in 20A1 and the vacation and sick leave benefits expense for 20A1? Prepare all the necessary journal entries for 20Al 2. Assume that the sick and vacation leave credits are not allowed to be carried over in the subsequent years (non-accumulating) and those taken were properly approved and granted. Prepare all the journal entries for 20A1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started