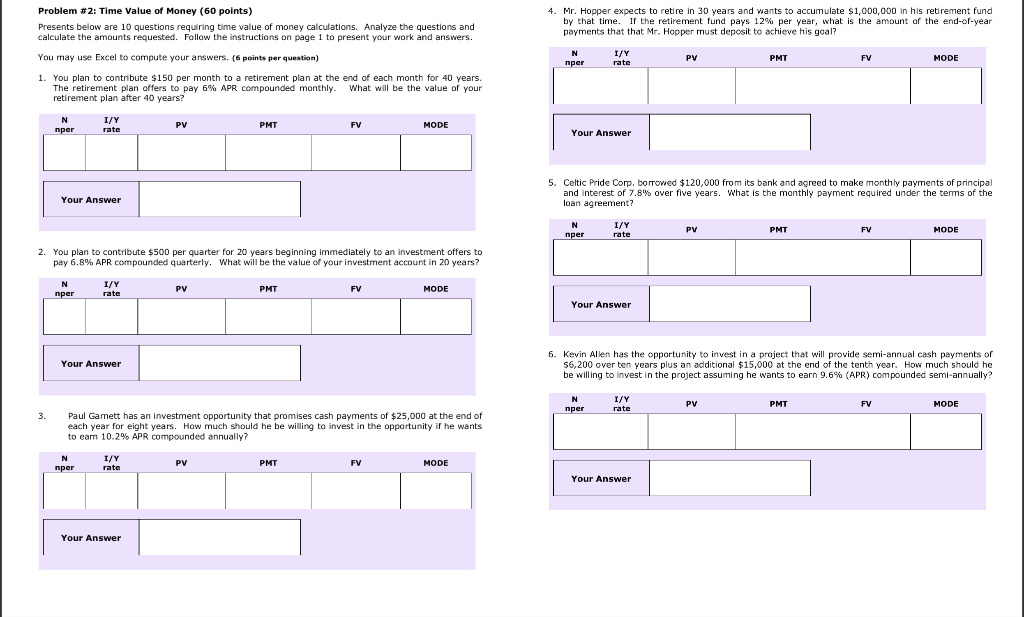

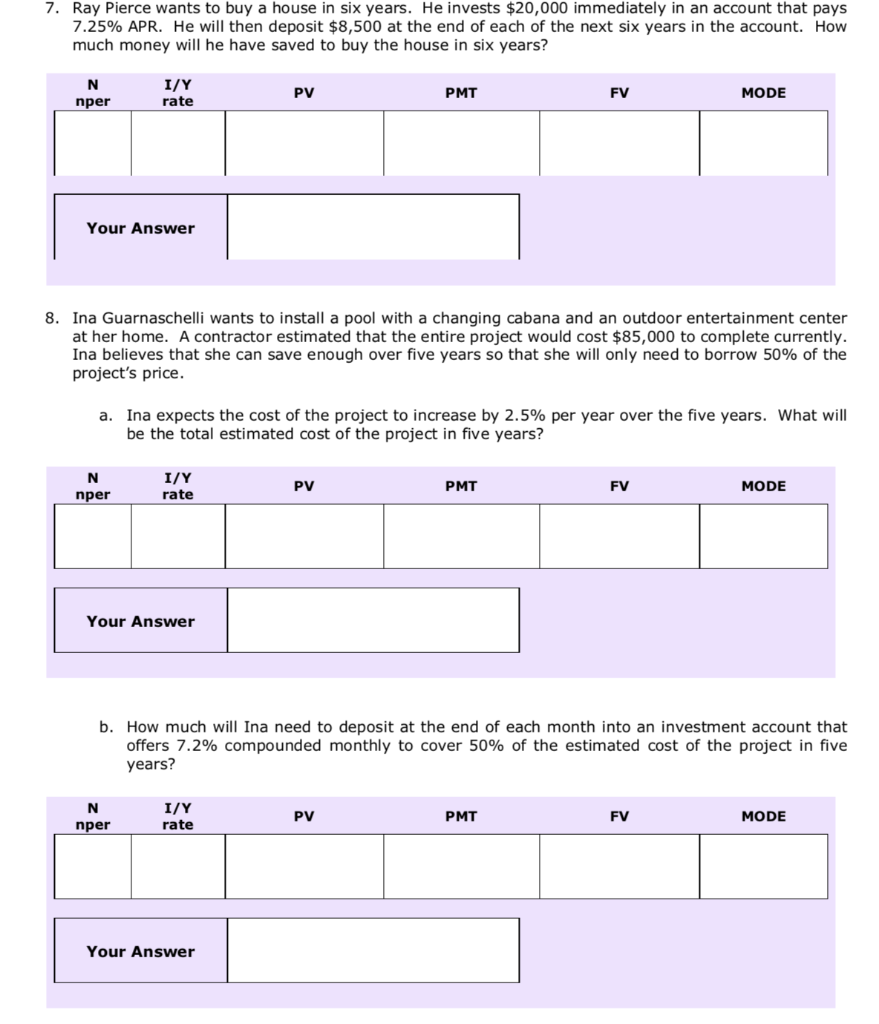

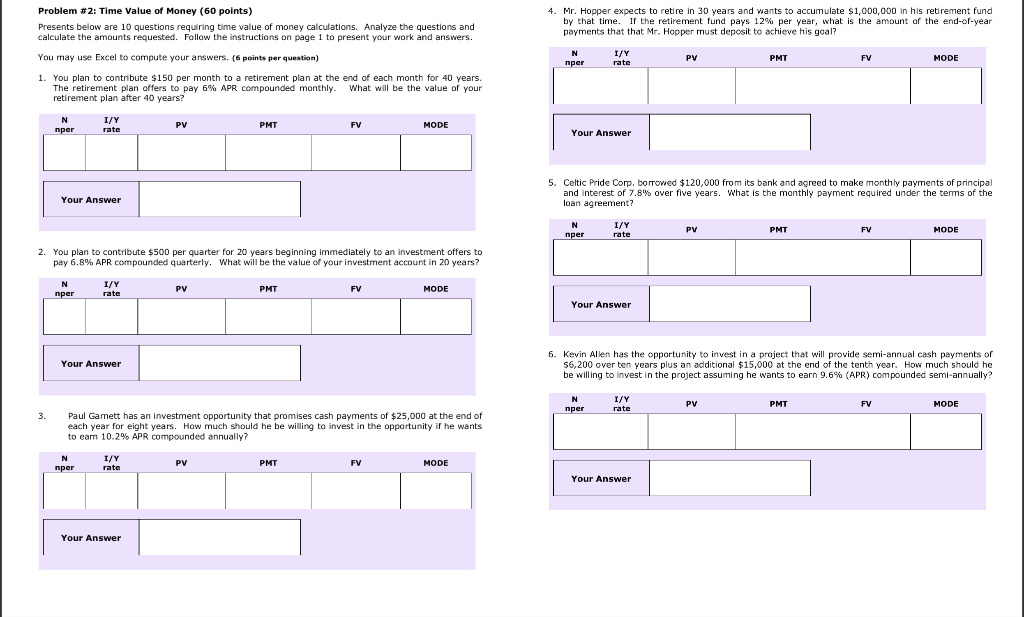

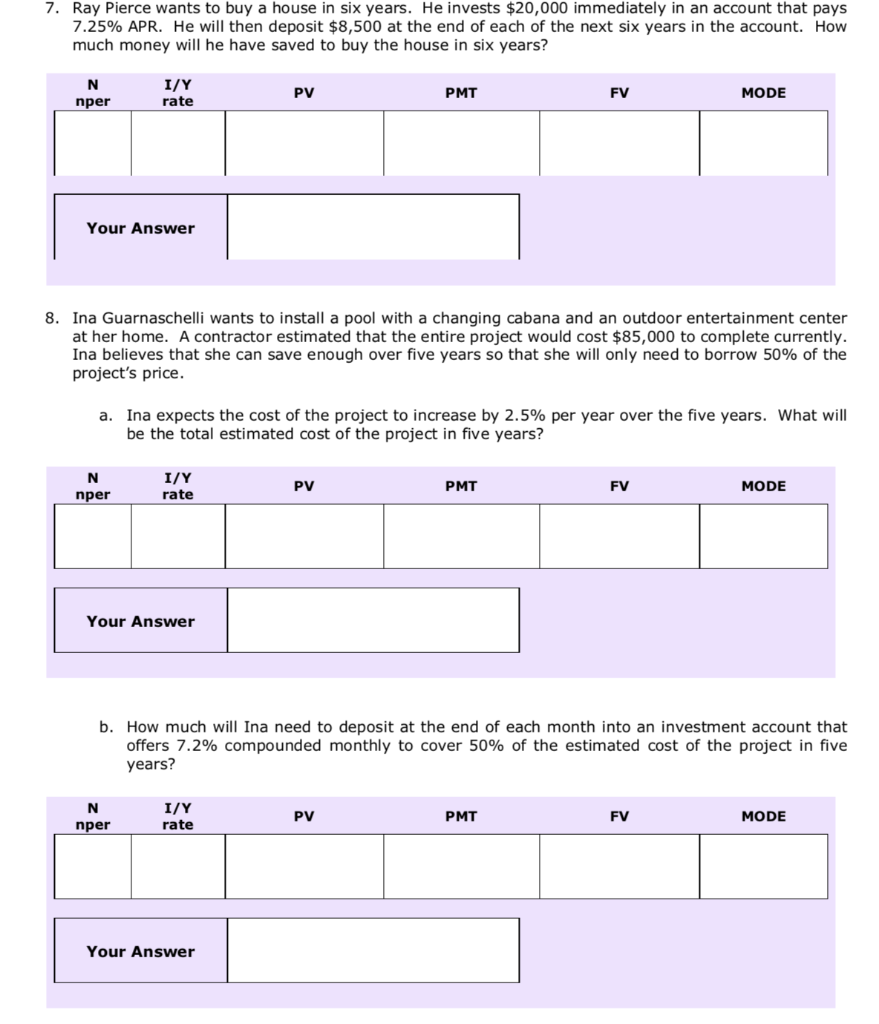

Problem #2: Time Value of Money (60 points) Presents below are 10 questions requiring time value of money calculations. Analyze the questions and calculate the amounts requested. Follow the instructions on page 1 to present your work and answers. 4. Mr. Hopper expects to retire in 30 years and wants to accumulate $1,000,000 in his retirement fund by that time. If the retirement fund pays 12% per year, what is the amount of the end-of-year payments that that Mr. Hopper must deposit to achieve his goal? You may use Excel to compute your answers. (6 points per question) N nper I/Y rate PV PMT FV MODE 1. You plan to contribute $150 per month to a retirement plan at the end of each month for 40 years. The retirement plan offers to pay 6% APR compounded monthly What will be the value of your retirement plan after 40 years? N nper I/Y rate PV PMT FV MODE Your Answer 5. Celtic Pride Corp. borrowed $120,000 from its bank and agreed to make monthly payments of principal and interest of 7.8% over five years. What is the monthly payment required under the terms of the loan agreement? Your Answer N nper I/Y rate PV PMT FV MODE 2. You plan to contribute $500 per quarter for 20 years beginning immediately to an investment offers to pay 6.8% APR compounded quarterly. What will be the value of your investment account in 20 years? N nper I/Y rate PV PMT FV MODE Your Answer Your Answer 6. Kevin Allen has the opportunity to invest in a project that will provide semi-annual cash payments of 56,200 over ten years plus an additional $15,000 at the end of the tenth year. How much should he be willing to invest in the project assuming he wants to earn 9.6% (APR) compounded semi-annually? N nper I/Y rate PV PMT FV MODE 3. Paul Gamett has an investment opportunity that promises cash payments of $25,000 at the end of each year for eight years. How much should he be willing to invest in the opportunity if he wants to eam 10.2% APR compounded annually? N nper I/Y rate PV PMT FV MODE Your Answer Your Answer 7. Ray Pierce wants to buy a house in six years. He invests $20,000 immediately in an account that pays 7.25% APR. He will then deposit $8,500 at the end of each of the next six years in the account. How much money will he have saved to buy the house in six years? N nper I/Y rate PV PMT FV MODE Your Answer 8. Ina Guarnaschelli wants to install a pool with a changing cabana and an outdoor entertainment center at her home. A contractor estimated that the entire project would cost $85,000 to complete currently. Ina believes that she can save enough over five years so that she will only need to borrow 50% of the project's price. a. Ina expects the cost of the project to increase by 2.5% per year over the five years. What will be the total estimated cost of the project in five years? N nper I/Y rate PV PMT FV MODE Your Answer b. How much will Ina need to deposit at the end of each month into an investment account that offers 7.2% compounded monthly to cover 50% of the estimated cost of the project in five years? N nper I/Y rate PV PMT FV MODE Your