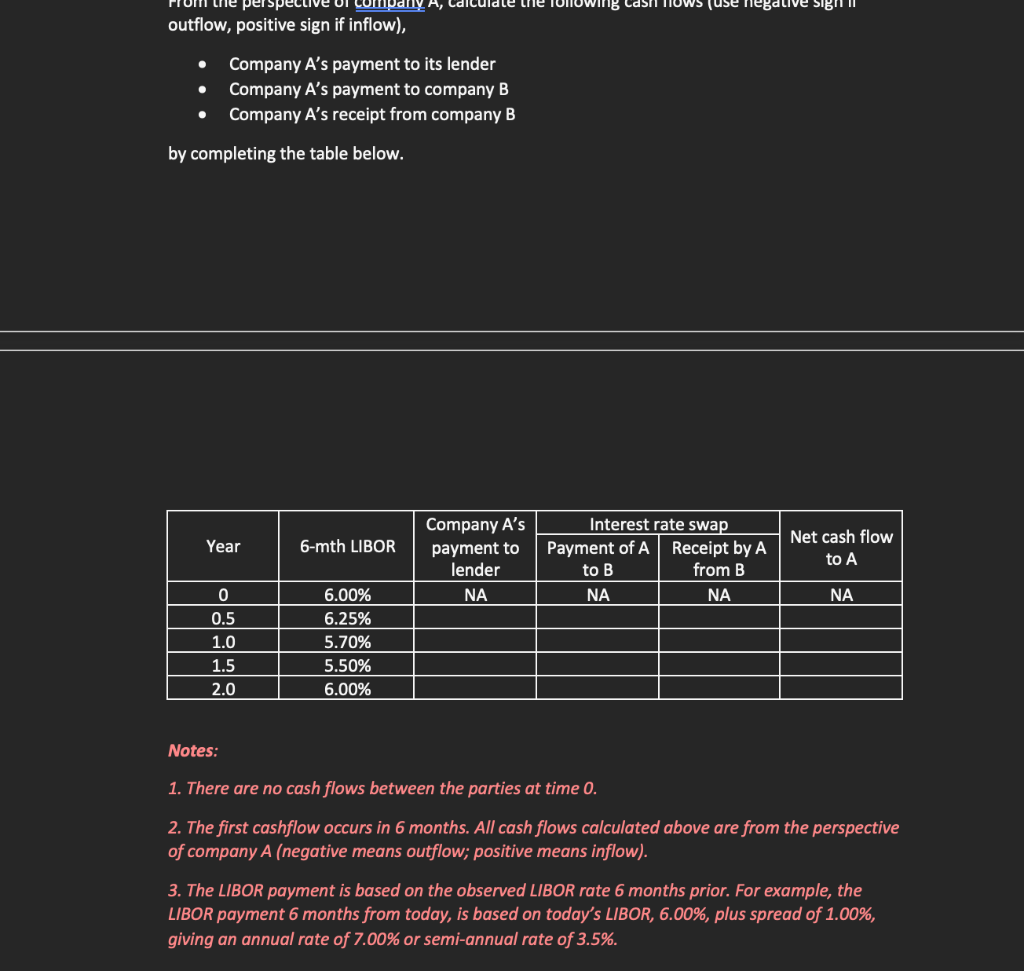

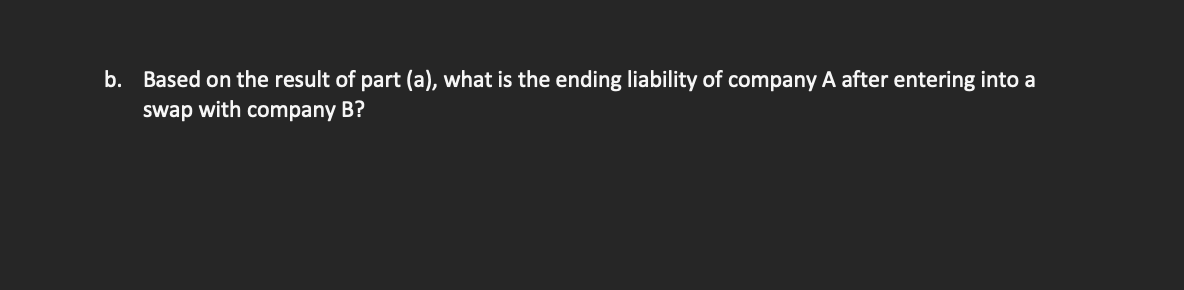

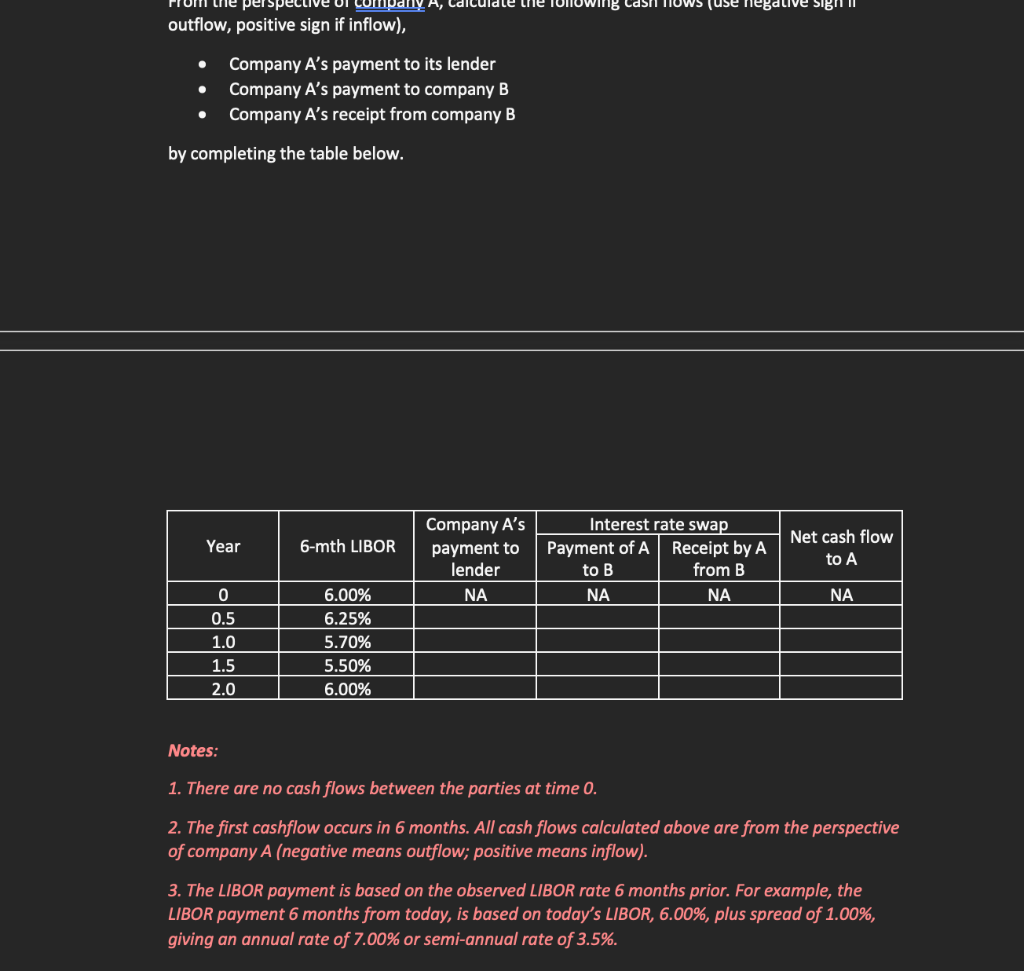

Problem 2. Transforming a floating-rate liability to fixed rate liability ( 40pts ) Company A has a floating-rate liability of $100 million, indexed to 6-month LIBOR +100 basis points. The payment is made every 6 months. The current term of the liability is 2 years. Company A decided to transform its floating-rate liability into a fixed-rate liability by entering into a 2year interest rate swap with company B. The notional amount of the swap is $100 million. Company A will pay B an annual fixed rate of 6.25% payable semi-annually and receive 6-month LIBOR flat. Net cash flows will be paid semi-annually. a. Assume that the 6-month LIBOR rates realized for the 2 years are as follows: From the perspective of company A, calculate the following cash flows (use negative sign if outflow, positive sign if inflow), outflow, positive sign if inflow), - Company A's payment to its lender - Company A's payment to company B - Company A's receipt from company B by completing the table below. Notes: 1. There are no cash flows between the parties at time 0 . 2. The first cashflow occurs in 6 months. All cash flows calculated above are from the perspective of company A (negative means outflow; positive means inflow). 3. The LIBOR payment is based on the observed LIBOR rate 6 months prior. For example, the LIBOR payment 6 months from today, is based on today's LIBOR, 6.00\%, plus spread of 1.00\%, giving an annual rate of 7.00% or semi-annual rate of 3.5%. Based on the result of part (a), what is the ending liability of company A after entering into a swap with company B? Problem 2. Transforming a floating-rate liability to fixed rate liability ( 40pts ) Company A has a floating-rate liability of $100 million, indexed to 6-month LIBOR +100 basis points. The payment is made every 6 months. The current term of the liability is 2 years. Company A decided to transform its floating-rate liability into a fixed-rate liability by entering into a 2year interest rate swap with company B. The notional amount of the swap is $100 million. Company A will pay B an annual fixed rate of 6.25% payable semi-annually and receive 6-month LIBOR flat. Net cash flows will be paid semi-annually. a. Assume that the 6-month LIBOR rates realized for the 2 years are as follows: From the perspective of company A, calculate the following cash flows (use negative sign if outflow, positive sign if inflow), outflow, positive sign if inflow), - Company A's payment to its lender - Company A's payment to company B - Company A's receipt from company B by completing the table below. Notes: 1. There are no cash flows between the parties at time 0 . 2. The first cashflow occurs in 6 months. All cash flows calculated above are from the perspective of company A (negative means outflow; positive means inflow). 3. The LIBOR payment is based on the observed LIBOR rate 6 months prior. For example, the LIBOR payment 6 months from today, is based on today's LIBOR, 6.00\%, plus spread of 1.00\%, giving an annual rate of 7.00% or semi-annual rate of 3.5%. Based on the result of part (a), what is the ending liability of company A after entering into a swap with company B