Question

Problem 2: What if & ratios ratios Below is a base year scenario In columns Dto F are assumptions for two possible scenarios for the

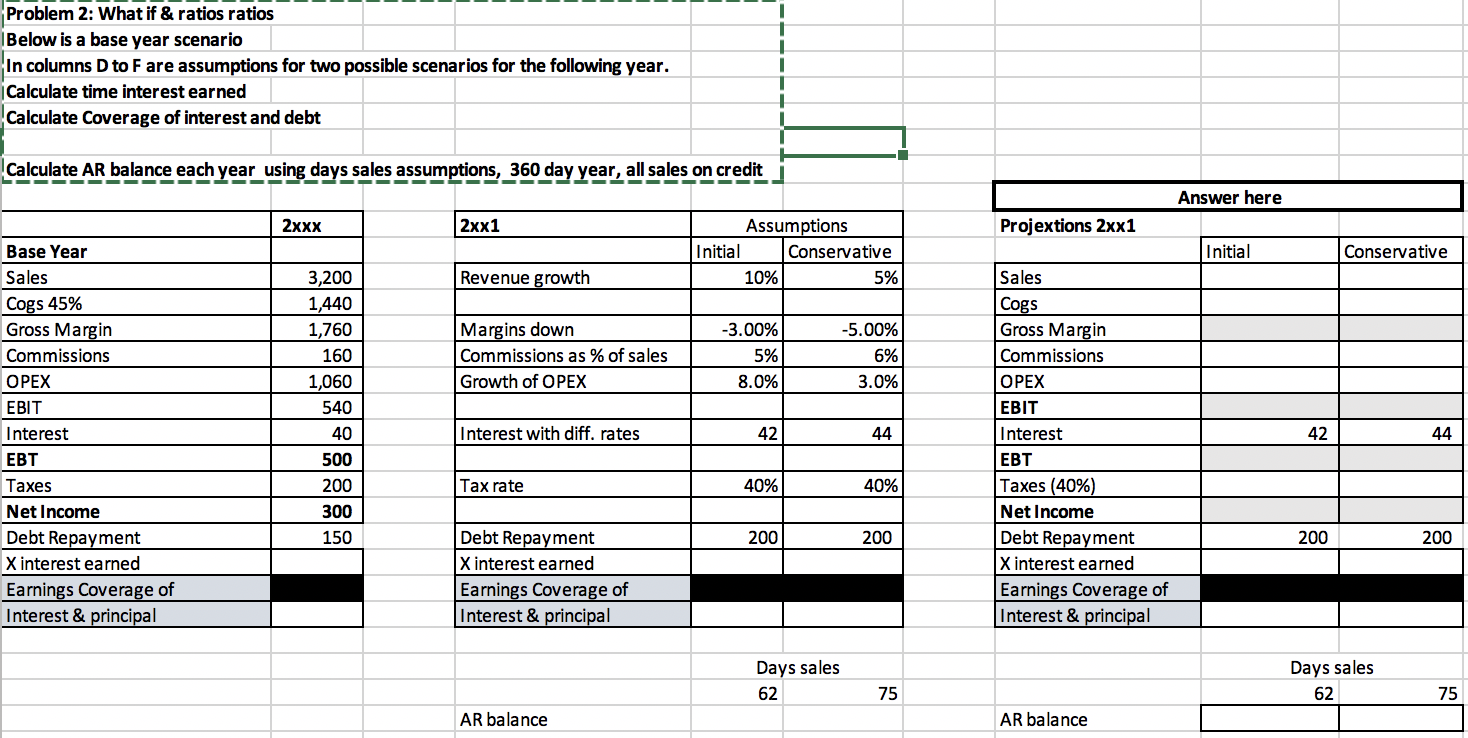

Problem 2: What if & ratios ratios Below is a base year scenario In columns Dto F are assumptions for two possible scenarios for the following year. Calculate time interest earned Calculate Coverage of interest and debt Calculate AR balance each year using days sales assumptions, 360 day year, all sales on credit Answer here 2xxx 2xx1 Projextions 2xx1 Assumptions Initial Conservative 10% 5% Initial Conservative Revenue growth Margins down Commissions as % of sales Growth of OPEX -3.00% 5% 8.0% -5.00% 6% 3.0% Base Year Sales Cogs 45% Gross Margin Commissions OPEX EBIT Interest EBT Taxes Net Income Debt Repayment X interest earned Earnings Coverage of Interest & principal 3,200 1,440 1,760 160 1,060 540 40 500 200 300 150 Interest with diff. rates 42 44 42 44 Sales Cogs Gross Margin Commissions OPEX EBIT Interest EBT Taxes (40%) Net Income Debt Repayment X interest earned Earnings Coverage of Interest & principal Tax rate 40% 40% 200 200 200 200 Debt Repayment X interest earned Earnings Coverage of Interest & principal Days sales 62 Days sales 62 75 75 AR balance AR balance

Problem 2: What if & ratios ratios Below is a base year scenario In columns Dto F are assumptions for two possible scenarios for the following year. Calculate time interest earned Calculate Coverage of interest and debt Calculate AR balance each year using days sales assumptions, 360 day year, all sales on credit Answer here 2xxx 2xx1 Projextions 2xx1 Assumptions Initial Conservative 10% 5% Initial Conservative Revenue growth Margins down Commissions as % of sales Growth of OPEX -3.00% 5% 8.0% -5.00% 6% 3.0% Base Year Sales Cogs 45% Gross Margin Commissions OPEX EBIT Interest EBT Taxes Net Income Debt Repayment X interest earned Earnings Coverage of Interest & principal 3,200 1,440 1,760 160 1,060 540 40 500 200 300 150 Interest with diff. rates 42 44 42 44 Sales Cogs Gross Margin Commissions OPEX EBIT Interest EBT Taxes (40%) Net Income Debt Repayment X interest earned Earnings Coverage of Interest & principal Tax rate 40% 40% 200 200 200 200 Debt Repayment X interest earned Earnings Coverage of Interest & principal Days sales 62 Days sales 62 75 75 AR balance AR balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started