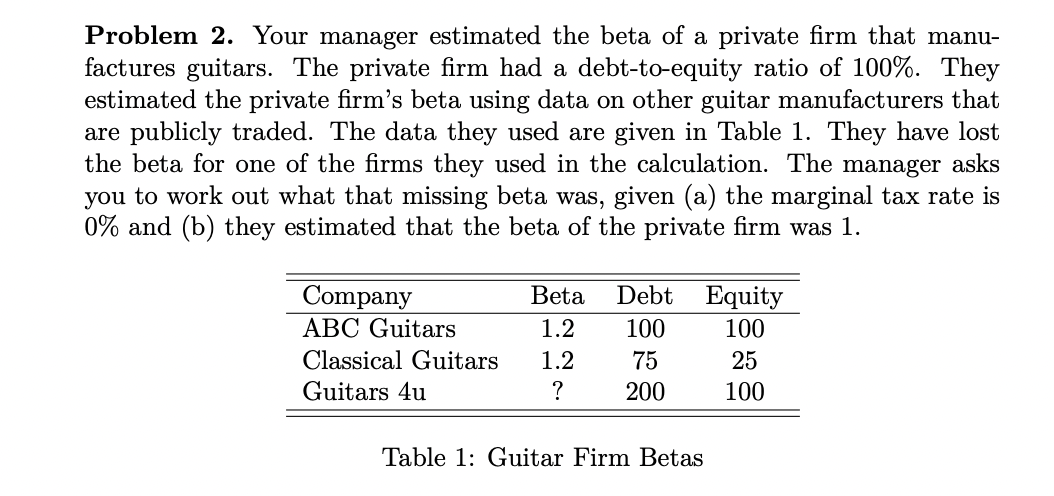

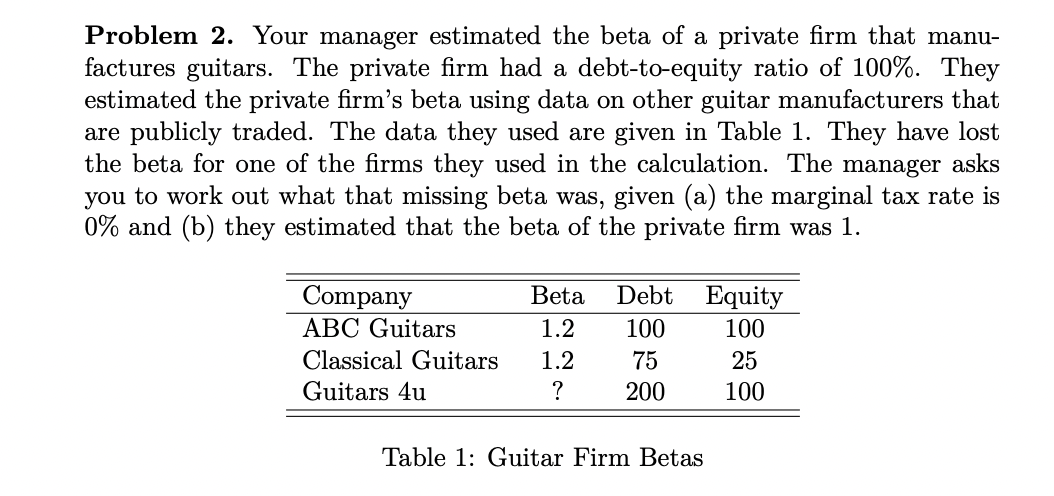

Problem 2. Your manager estimated the beta of a private firm that manufactures guitars. The private firm had a debt-to-equity ratio of 100%. They estimated the private firm's beta using data on other guitar manufacturers that are publicly traded. The data they used are given in Table 1 . They have lost the beta for one of the firms they used in the calculation. The manager asks you to work out what that missing beta was, given (a) the marginal tax rate is 0% and (b) they estimated that the beta of the private firm was 1 . Table 1: Guitar Firm Betas Problem 3. Consider a setting where the marginal tax rate is 0 , the market risk premium is 5%, and the risk-free rate is 2%. You work for a firm that has a default spread that is equal to 0.05 times its market beta. The firm is considering an investment project that has an expected return on equity that is greater than the firm's WACC. The project is small, and its risk is similar to the risk of the firm's existing projects. Which of the following is correct: a. The firm should proceed with the project. b. The firm should not proceed with the project. c. We can't answer this question without further information. Explain your answer. Problem 2. Your manager estimated the beta of a private firm that manufactures guitars. The private firm had a debt-to-equity ratio of 100%. They estimated the private firm's beta using data on other guitar manufacturers that are publicly traded. The data they used are given in Table 1 . They have lost the beta for one of the firms they used in the calculation. The manager asks you to work out what that missing beta was, given (a) the marginal tax rate is 0% and (b) they estimated that the beta of the private firm was 1 . Table 1: Guitar Firm Betas Problem 3. Consider a setting where the marginal tax rate is 0 , the market risk premium is 5%, and the risk-free rate is 2%. You work for a firm that has a default spread that is equal to 0.05 times its market beta. The firm is considering an investment project that has an expected return on equity that is greater than the firm's WACC. The project is small, and its risk is similar to the risk of the firm's existing projects. Which of the following is correct: a. The firm should proceed with the project. b. The firm should not proceed with the project. c. We can't answer this question without further information. Explain your