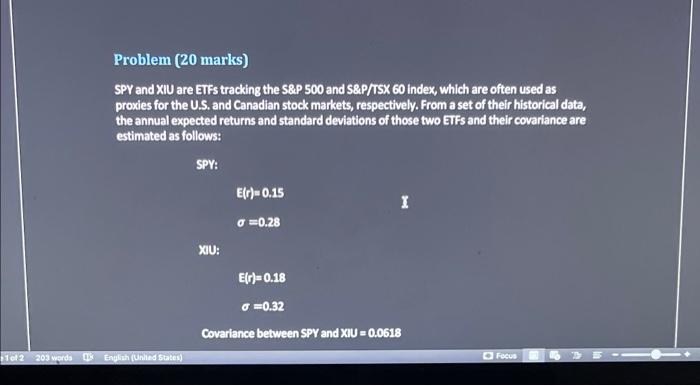

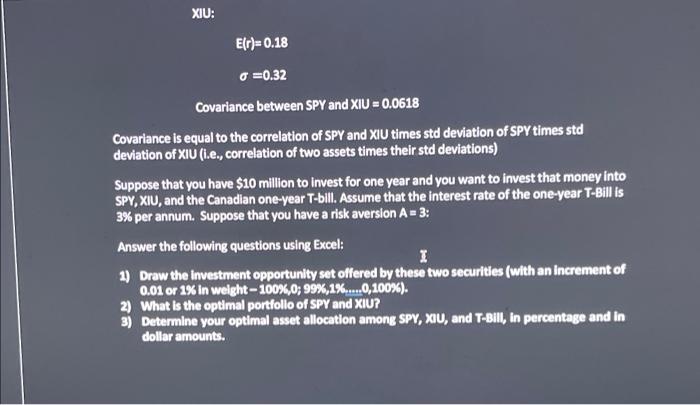

Problem (20 marks) SPY and XIU are EIFs tracking the S\&P 500 and S\&P/ISX 60 index, which are often used as proxies for the U.S. and Canadian stock markets, respectively. From a set of their historical data, the annual expected returns and standard deviations of those two ETFs and their covariance are estimated as follows: SPY: E(r)=0.15 =0.28 xu: E(r)=0.18=0.32 Covariance between SPY and XU=0.0618 XIU: E(r)=0.18=0.32 Covariance between SPY and XIU=0.0618 Covariance is equal to the correlation of SPY and XIU times std deviation of SPY times std deviation of XIU (i.e., correlation of two assets times their std deviations) Suppose that you have $10 million to invest for one year and you want to invest that money into SPY, XIU, and the Canadian one-year T-bill. Assume that the interest rate of the one-year T-Bill is 3% per annum. Suppose that you have a risk aversion A=3 : Answer the following questions using Excel: 1) Draw the investment opportunity set offered by these two securities (with an increment of 0.01 or 19 in weight 1000,0;99,1%%2..0,1006 ). 2) What is the optimal portfollo of SPY and XIU? 3) Determine your optimal asset allocation among SPY, XU, and T-BIII, in percentage and in dollar amounts. Problem (20 marks) SPY and XIU are EIFs tracking the S\&P 500 and S\&P/ISX 60 index, which are often used as proxies for the U.S. and Canadian stock markets, respectively. From a set of their historical data, the annual expected returns and standard deviations of those two ETFs and their covariance are estimated as follows: SPY: E(r)=0.15 =0.28 xu: E(r)=0.18=0.32 Covariance between SPY and XU=0.0618 XIU: E(r)=0.18=0.32 Covariance between SPY and XIU=0.0618 Covariance is equal to the correlation of SPY and XIU times std deviation of SPY times std deviation of XIU (i.e., correlation of two assets times their std deviations) Suppose that you have $10 million to invest for one year and you want to invest that money into SPY, XIU, and the Canadian one-year T-bill. Assume that the interest rate of the one-year T-Bill is 3% per annum. Suppose that you have a risk aversion A=3 : Answer the following questions using Excel: 1) Draw the investment opportunity set offered by these two securities (with an increment of 0.01 or 19 in weight 1000,0;99,1%%2..0,1006 ). 2) What is the optimal portfollo of SPY and XIU? 3) Determine your optimal asset allocation among SPY, XU, and T-BIII, in percentage and in dollar amounts