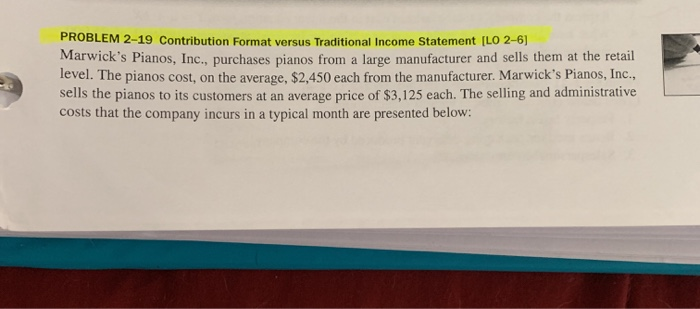

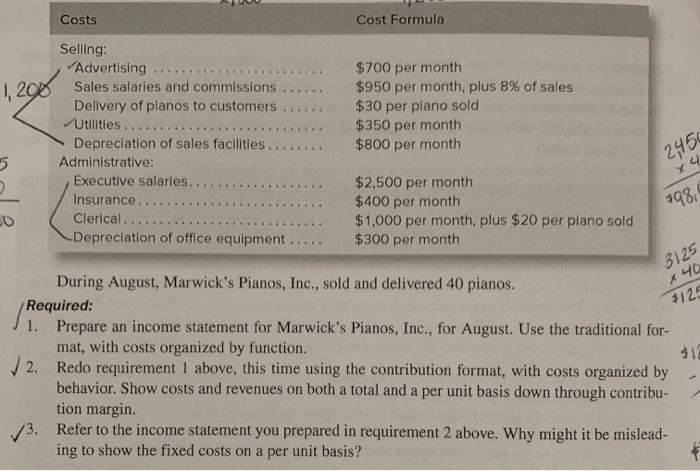

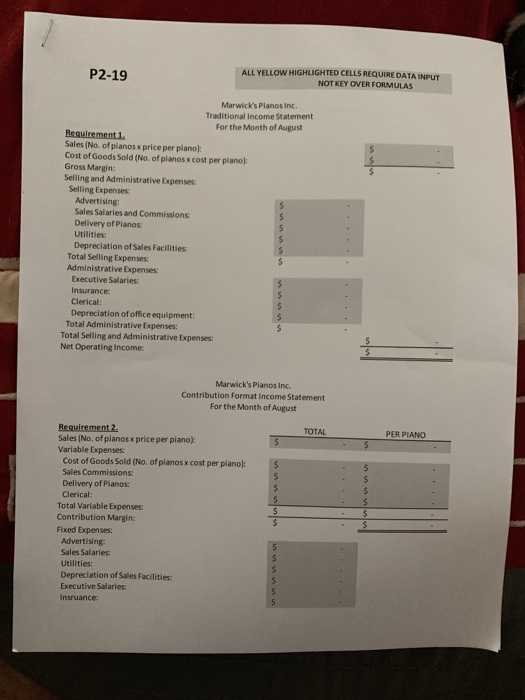

PROBLEM 2-19 Contribution Format versus Traditional Income Statement (LO 2-6) Marwick's Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail level. The pianos cost, on the average, $2,450 each from the manufacturer. Marwick's Pianos, Inc., sells the pianos to its customers at an average price of $3,125 each. The selling and administrative costs that the company incurs in a typical month are presented below: Costs Cost Formula 1,200 Selling: Advertising Sales salaries and commissions ...... Delivery of planos to customers ...... Utilities ......... Depreciation of sales facilities........ Administrative: Executive salaries......... Insurance.......................... Clerical. . . . . . . . . . . . . Depreciation of office equipment..... $700 per month $950 per month, plus 8% of sales $30 per piano sold $350 per month $800 per month 245 1981 $2,500 per month $400 per month $1,000 per month, plus $20 per piano sold $300 per month 3125 x 40 3122 311 During August, Marwick's Pianos, Inc., sold and delivered 40 pianos. Required: 1. Prepare an income statement for Marwick's Pianos, Inc., for August. Use the traditional for- mat, with costs organized by function 2. Redo requirement 1 above, this time using the contribution format, with costs organized by behavior. Show costs and revenues on both a total and a per unit basis down through contribu- tion margin. 3. Refer to the income statement you prepared in requirement 2 above. Why might it be mislead- ing to show the fixed costs on a per unit basis? P2-19 ALL YELLOW HIGHLIGHTED CELLS REQUIRE DATA INPUT NOT KEY OVER FORMULAS Marwick's Planos Inc. Traditional Income Statement For the Month of August Requirement1 Sales (No. of pianos x price per plano Cost of Goods Sold (No. of planos x cost per planos Gross Margin: Selling and Administrative Expenses: Selling Expenses Advertising Sales Salaries and Commissions Delivery of Pianos: Utilities: Depreciation of Sales Facilities: Total Selling Expenses Administrative Expenses: Executive Salaries: Insurance: Clerical: Depreciation of office equipment: Total Administrative Expenses: Total Selling and Administrative Expenses: Net Operating Income: Marwick's Planos Inc. Contribution Format Income Statement For the Month of August TOTAL PER PIANO Requirement 2 Sales (No. of pianosx price per piano): Variable Expenses: Cost of Goods Sold (No. of pianos x cost per piano Sales Commissions: Delivery of Planos: Clerical: Total Variable Expenses: Contribution Margin: Fixed Expenses: Advertising Sales Salaries: Utilities: Depreciation of Sales Facilities: Executive Salaries: Insruance: Us Clerical: Depreciation of Office Equipment: Total Fixed Expenses: Net Operating Income: Requirement 3. Write your answer to Requirement 3 below