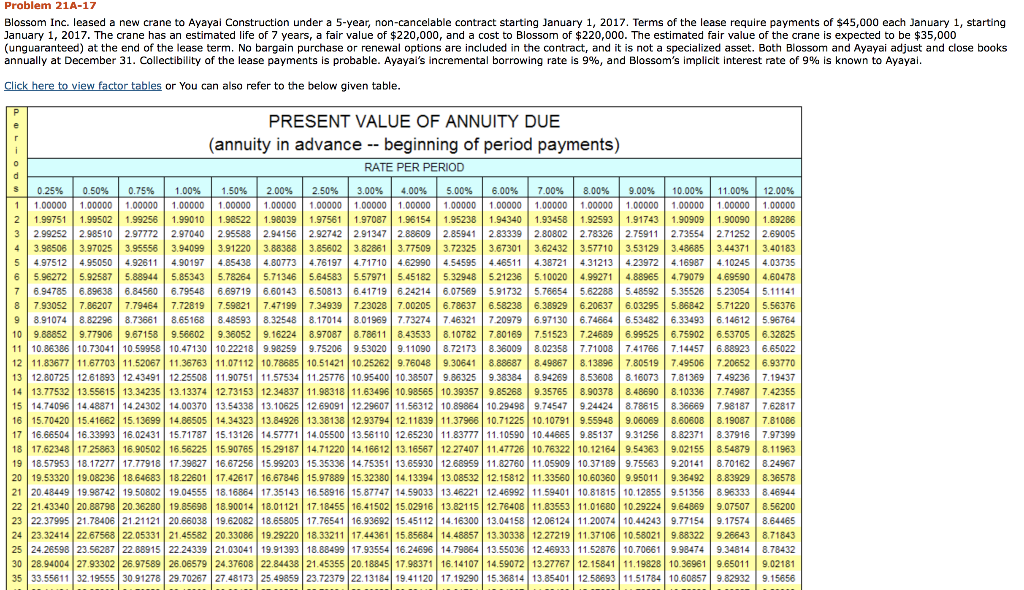

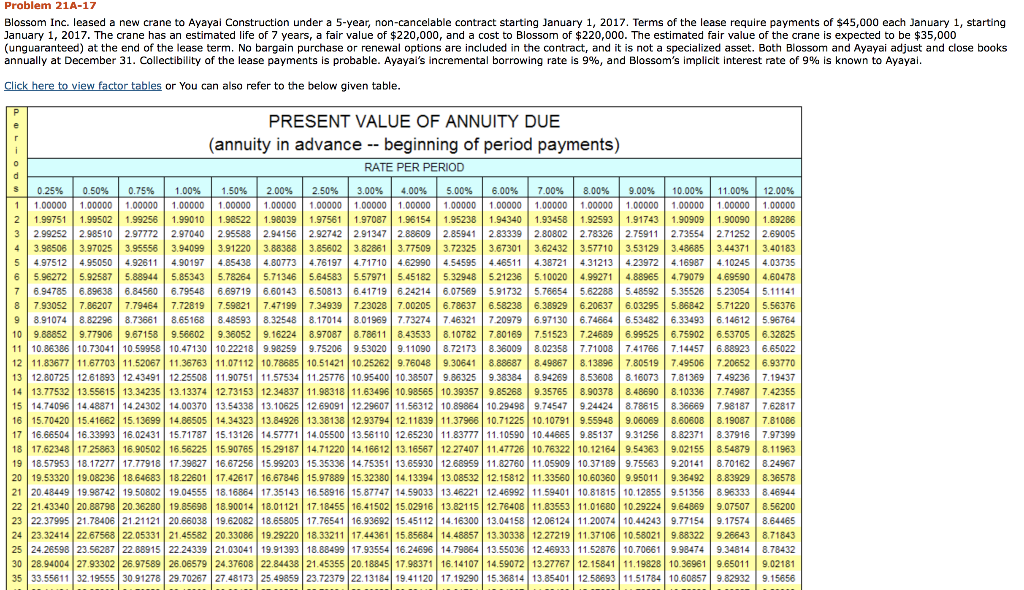

Problem 21A-17 Blossom Inc. leased a new crane to Ayayai Construction under a 5-year, non-cancelable contract starting January 1, 2017. Terms of the lease require payments of $45,000 each January 1, starting ears, a fair value of $220,000, and a cost to Blossom of $220,000. The estimated fair value of the crane is expected to be $35,000 (unguaranteed) at the end of the lease term. No bargain purchase or renewal options are included in the contract, and it is not a specialized asset. Both Blossom and Ayayai adjust and close books annually at December 31. Collectibility of the lease payments is probable. Ayayai's incremental borrowing rate is 9%, and Blossom's implicit interest rate of 9% is known to Ayayai. Click here to view factor tables or You can also refer to the below given table. PRESENT VALUE OF ANNUITY DUE (annuity in advance -- beginning of period payments) RATE PER PERIOD 0.25% 0.50% 0.75% 1.00% 1.50% 2.00% 2.50% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 1.00000 100000 1.00000 1.00000 100000 1.00000 100000 1.00000 1.00000 1.00000 100000 1.00000 100000 1.00000 100000 1.00000 1.00000 1.99751 1.995021.99256 1.99010 1.98522 1.98039 1.97561 1.97087 1.96154 1.952381.94340 1.93458 1.92593 1.917431.90909 1.90090 1.89286 2.99252 2.985102.97772 2.97040 2.95588 2.94156 2.92742 2.91347 2.886092.85941 2.83339 2.80802 2.78326 2.75911 2.735542.71252 2.69005 3.985063.97025 3.95556 3.94099 3.91220 3.88388 3.856023.82861 3.77509 3.72325 3.67301 3.62432 3.57710 3.53129 3.48685 3.44371 3.40183 4.97512 4.95050 4.926114.90197 4.85438 4.80773 4.761974.71710 4.62990 4.545954.46511 4.38721 4.312134.23972 4.169874.10245 4.03735 5.962725.92587 5.889445.853435.782645.71346 5.645835 .57971 5.451825.32948 5.21236 5.100204.99271 4.889654 .79079 4.69590 4.60478 6.947856.89638 6.84560 6.795486.697196 .60143 6.50813 6.417196.242146 .07569 5.91732 5.766545.62288 5.48592 5.35526 5230545.11141 8 7.93052 7.86207 7.79464 7.72819 7.59821 7.471997.349397 .23028 7.00205 6.78637 6.58238 6.389296.20637 6.032955.868425.71220 5.56376 9 8.910748.82296 8.73661 8.651688.48593 8.32548 8.17014 8.01969 7.732747.463217209796.97130 6.746646.534826.33493 6.14612 5.96764 109.88852 9.779069.671589.566029.360529.162248.970878.786118.435338.10782 7.801697.51523 7.246896.995256.75902 6.53705 6.32825 11 10.86386 10.73041 10.59958 10.47130 10.22218 9.98259 9.75206 9.53020 9.11090 8.72173 8.360098.02358 7.71008 7.41766 7.14457 6.88923 6.65022 12 11.8367711.67703 11.52067 11.36763 11.07112 10.78685 10.51421 10.25262 9.76048 9.306418.886878.49867 8.13896 7.805197.49506 7206526.93770 13 12.80725 12.61893 12.43491 12.25508 11.90751 11.57534 11.25778 10.95400 10.38507 9.86325 9.38384 8.942698.53808 8.160737.813697.492387.19437 14 13.77532 | 13.55615 13.34235 13.13374 12.7315312.34837 11.98318 11.63496 10.98565 10.39357 9.85268 9.35765 8.90378 8.48690 8.10336 7.749877.42355 15 14.74096 14.48871 14.2430214.00370 13.54338 13.10625 12.69091 12.29607 11.56312 10.89864 10.29498 9.745479.244248.78615 8.366697.981877.62817 15.70420 15.41662 15.13699 14.88505 14.34323 13.84926 13.38138 12.93794 12.11839 11.3796610.71225 10.10791 9.55948 9.060698.60608 8.190877.81086 16.66504 16.33993 16.02431 15.71787 15.13126 14.57771 14.05500 13.56110 12.65230 11.83777 11.10590 10.44665 9.851379.31256 8.823718.379167.97399 18 17.62348 17.25863 16.90502 16.5622515.90765 15.29187 14.71220 14.16612 13.16567 12 27407 11.47726 1076322 10.12164 9.54363 9.021558.54879 8.11963 19 18.57953 18.17277 17.77918 17.39827 16.67256 15.99203 15.35336 14.75351 13.65930 12.68959 11.82760 11.05909 10.37189 9.75563 9.20141 8.70162 8.24967 20 19.53320 19.0823618.64683 18.22601 17.4261716.67846 15.97889 15.32380 14.13394 13.08532 12.15812 11.33560 10.60360 9.95011 9.364928.83929 8.36578 21 20.48449 19.9874219.50802 19.04555 18.1686417.35143 | 16.58916 15.87747 14.59033 13.46221 12.46992 11.59401 10.81815 10.12855 9.513568.96333 8.46944 22 21.43340 20.88798 20.36280 19.85698 18.90014 18.01121 17.18455 16.41502 15.02916 13.82115 12.76408 11.83553 11.01680 10.29224 9.64869 9.07507 8.56200 23 22.37995 21.78406 21.21121 20.66038 19.62082 18.65805 17.76541 16.93692 15.45112 14.16300 13.04158 12.06124 11.20074 10.44243 9.771549.17574 8.64465 24 23.32414 22.67568 22.05331 21.45582 20.33086 19.29220 18.33211 17.44361 15.85684 14.48857 13.30338 | 12.2721911.37106 10.58021 9.883229266438.71843 24.26598 23.5628722.88915 22.24339 21.03041 19.91393 18.88499 17.93554 16.24696 14.79864 13.55036 12.46933 11.52876 10.70661 9.98474 9.348148.78432 28.94004 27.9330226.97589 26.06579 24.3760822.84438 21.45355 20.18845 17.98371 16.14107 14.5907213.27767 12.15841 11.19828 10.36961 9.65011 9.02181 33.5561132.19555 30.91278 29.70267 27.48173 25.4985923.72379 22.13184 19.41120 17.19290 15.36814 13.85401 12.58693 11.51784 10.60857 9.82932 9.15656 Prepare all the entries related to the lease contract and leased asset for the year 2017 for the lessee and lessor, assuming Ayayal uses straight-line amortization for all similar leased assets, and Blossom depreciates the asset on a straight-line basis with a salvage value of $15,000. (Credit account tities are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25125 and the final answer to O decimal places e.g. 58,972.) Debit Credit Date Account Titles and Explanation Lessee's Entries 1/1/17 (To record lease.) 1/1/17 (To record lease payment.) 12/31/17 (To record interest and amortization expense.) Lessor's Entries 1/1/17 (To record expenses.) 12/31/17 (To record depreciation.) 12/31/17 (To record lease revenue.)