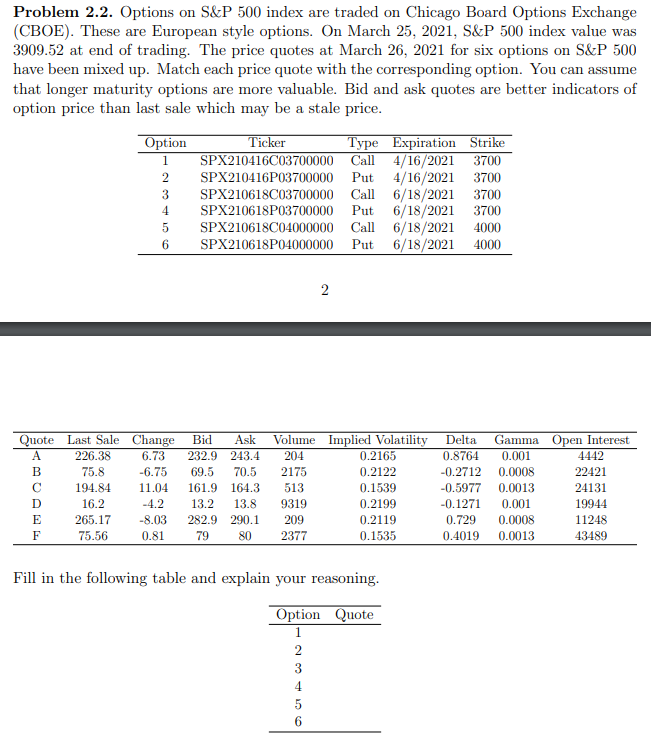

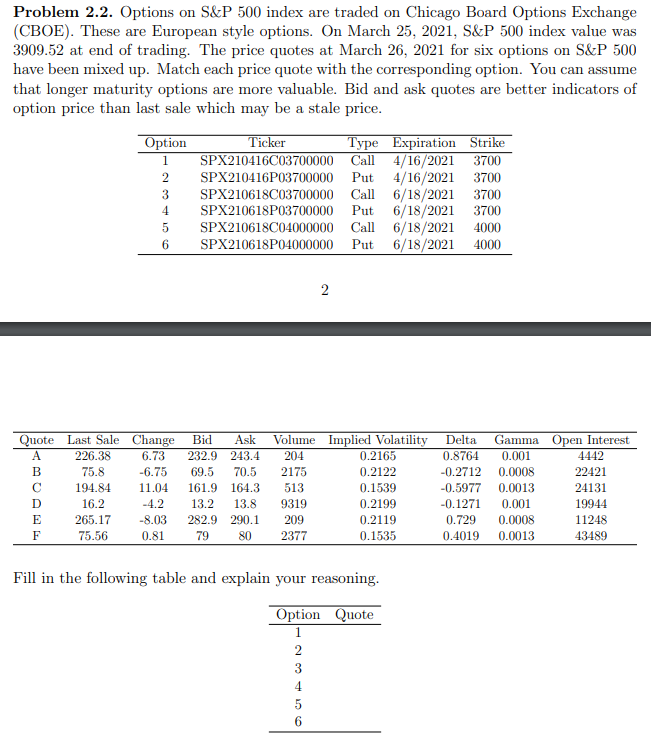

Problem 2.2. Options on S&P 500 index are traded on Chicago Board Options Exchange (CBOE). These are European style options. On March 25, 2021, S&P 500 index value was 3909.52 at end of trading. The price quotes at March 26, 2021 for six options on S&P 500 have been mixed up. Match each price quote with the corresponding option. You can assume that longer maturity options are more valuable. Bid and ask quotes are better indicators of option price than last sale which may be a stale price. Option 1 2 3 4 5 6 Ticker Type Expiration Strike SPX210416C03700000 Call 4/16/2021 3700 SPX210416P03700000 Put 4/16/2021 3700 SPX210618C03700000 Call 6/18/2021 3700 SPX210618P03700000 Put 6/18/2021 3700 SPX210618C04000000 Call 6/18/2021 4000 SPX210618P04000000 Put 6/18/2021 4000 2 Quote Last Sale Change A 226.38 6.73 B 75.8 -6.75 194.84 11.04 D 16.2 -4.2 E 265.17 -8.03 75.56 0.81 Bid Ask 232.9 243.4 69.5 70.5 161.9 164.3 13.2 13.8 282.9 290.1 79 80 Volume Implied Volatility 204 0.2165 2175 0.2122 513 0.1539 9319 0.2199 209 0.2119 2377 0.1535 Delta Gamma Open Interest 0.8764 0.001 4442 -0.2712 0.0008 22421 -0.5977 0.0013 24131 -0.1271 0.001 19944 0.729 0.0008 11248 0.4019 0.0013 43489 Fill in the following table and explain your reasoning. Option Quote 3 5 6 Problem 2.2. Options on S&P 500 index are traded on Chicago Board Options Exchange (CBOE). These are European style options. On March 25, 2021, S&P 500 index value was 3909.52 at end of trading. The price quotes at March 26, 2021 for six options on S&P 500 have been mixed up. Match each price quote with the corresponding option. You can assume that longer maturity options are more valuable. Bid and ask quotes are better indicators of option price than last sale which may be a stale price. Option 1 2 3 4 5 6 Ticker Type Expiration Strike SPX210416C03700000 Call 4/16/2021 3700 SPX210416P03700000 Put 4/16/2021 3700 SPX210618C03700000 Call 6/18/2021 3700 SPX210618P03700000 Put 6/18/2021 3700 SPX210618C04000000 Call 6/18/2021 4000 SPX210618P04000000 Put 6/18/2021 4000 2 Quote Last Sale Change A 226.38 6.73 B 75.8 -6.75 194.84 11.04 D 16.2 -4.2 E 265.17 -8.03 75.56 0.81 Bid Ask 232.9 243.4 69.5 70.5 161.9 164.3 13.2 13.8 282.9 290.1 79 80 Volume Implied Volatility 204 0.2165 2175 0.2122 513 0.1539 9319 0.2199 209 0.2119 2377 0.1535 Delta Gamma Open Interest 0.8764 0.001 4442 -0.2712 0.0008 22421 -0.5977 0.0013 24131 -0.1271 0.001 19944 0.729 0.0008 11248 0.4019 0.0013 43489 Fill in the following table and explain your reasoning. Option Quote 3 5 6