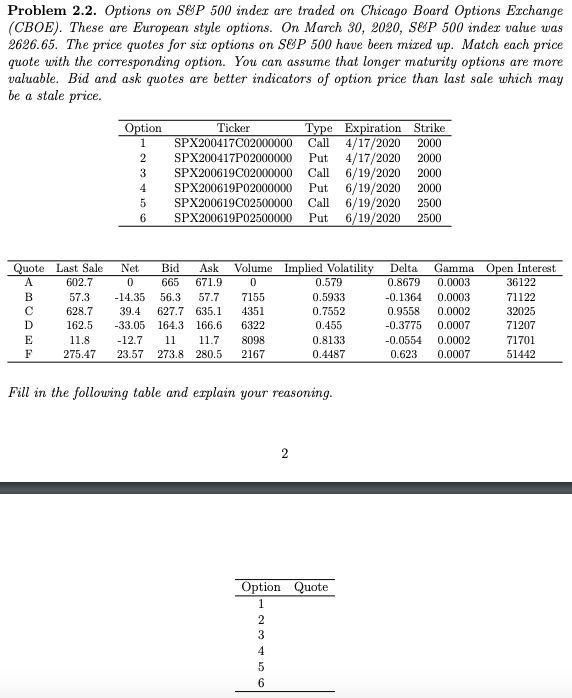

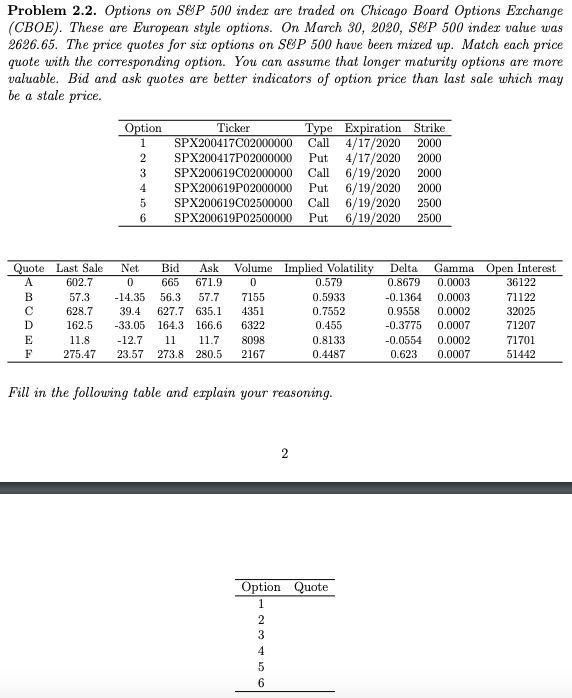

Problem 2.2. Options on S&P 500 index are traded on Chicago Board Options Exchange (CBOE). These are European style options. On March 30, 2020, S&P 500 index value was 2626.65. The price quotes for sit options on S&P 500 have been mixed up. Match each price quote with the corresponding option. You can assume that longer maturity options are more valuable. Bid and ask quotes are better indicators of option price than last sale which may be a stale price. Option 3 4 Ticker SPX200417C02000000 SPX200417P02000000 SPX200619C02000000 SPX200619P02000000 SPX200619C02500000 SPX200619P02500000 Type Expiration Call 4/17/2020 Put 4/17/2020 Call 6/19/2020 Put 6/19/2020 Call 6/19/2020 Put 6/19/2020 Strike 2000 2000 2000 2000 2500 2500 6 Quote Last Sale 602. 7 57.3 628.7 162.5 11.8 F 275.47 Net 0 -14.35 39.4 -33.05 -12.7 23.57 Bid Ask Volume Implied Volatility 665 671. 90 0.579 56.3 57.7 7155 0.5933 627.7 635.1 4351 0.7552 164.3 166.6 6322 0.455 11 11.7 8098 0.8133 273.8 280.5 2167 0.4487 Delta 0.8679 -0.1364 0.9558 -0.3775 -0.0554 0.623 Gamma Open Interest 0.0003 36122 0.0003 71122 0.0002 32025 0.0007 71207 0.0002 71701 0.0007 5 1442 Fill in the following table and explain your reasoning. Option Quote CON Problem 2.2. Options on S&P 500 index are traded on Chicago Board Options Exchange (CBOE). These are European style options. On March 30, 2020, S&P 500 index value was 2626.65. The price quotes for sit options on S&P 500 have been mixed up. Match each price quote with the corresponding option. You can assume that longer maturity options are more valuable. Bid and ask quotes are better indicators of option price than last sale which may be a stale price. Option 3 4 Ticker SPX200417C02000000 SPX200417P02000000 SPX200619C02000000 SPX200619P02000000 SPX200619C02500000 SPX200619P02500000 Type Expiration Call 4/17/2020 Put 4/17/2020 Call 6/19/2020 Put 6/19/2020 Call 6/19/2020 Put 6/19/2020 Strike 2000 2000 2000 2000 2500 2500 6 Quote Last Sale 602. 7 57.3 628.7 162.5 11.8 F 275.47 Net 0 -14.35 39.4 -33.05 -12.7 23.57 Bid Ask Volume Implied Volatility 665 671. 90 0.579 56.3 57.7 7155 0.5933 627.7 635.1 4351 0.7552 164.3 166.6 6322 0.455 11 11.7 8098 0.8133 273.8 280.5 2167 0.4487 Delta 0.8679 -0.1364 0.9558 -0.3775 -0.0554 0.623 Gamma Open Interest 0.0003 36122 0.0003 71122 0.0002 32025 0.0007 71207 0.0002 71701 0.0007 5 1442 Fill in the following table and explain your reasoning. Option Quote CON