Answered step by step

Verified Expert Solution

Question

1 Approved Answer

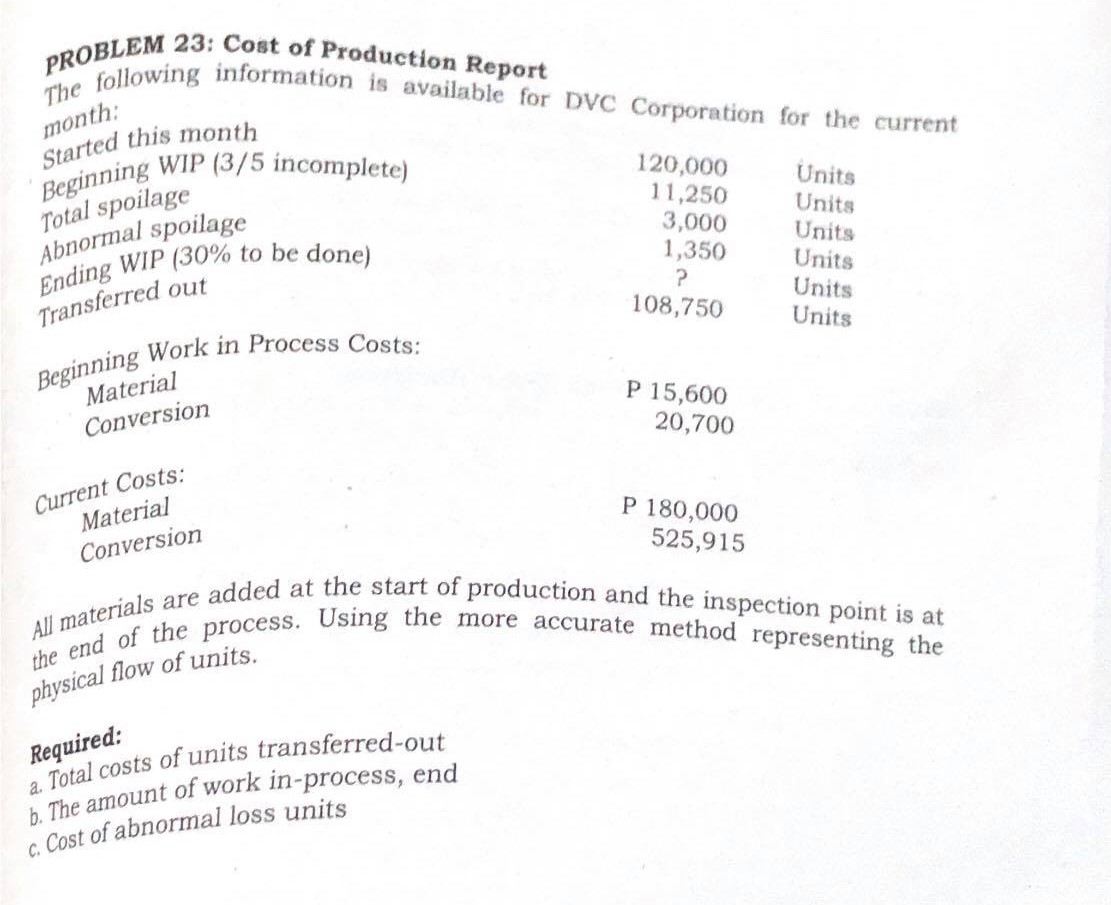

PROBLEM 23: Cost of Production Report month: The following information is available for DVC Corporation for the current Started this month Beginning WIP (3/5

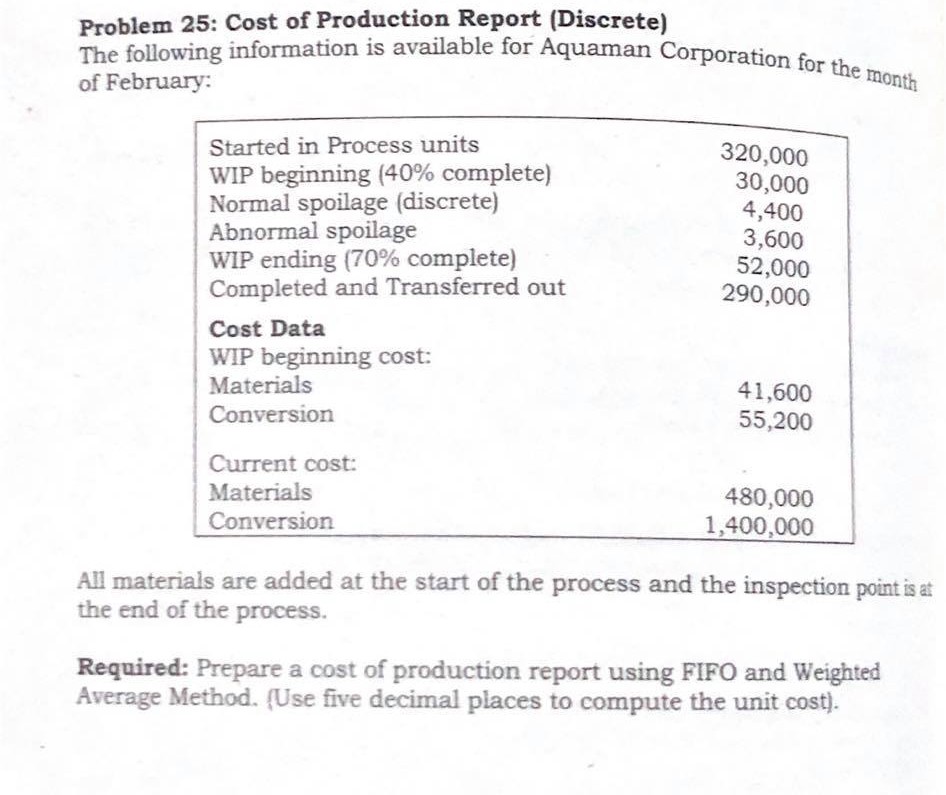

PROBLEM 23: Cost of Production Report month: The following information is available for DVC Corporation for the current Started this month Beginning WIP (3/5 incomplete) Total spoilage Abnormal spoilage Ending WIP (30% to be done) Transferred out Beginning Work in Process Costs: Material Conversion Current Costs: Material Conversion 120,000 Units 11,250 Units 3,000 Units 1,350 Units P Units 108,750 Units P 15,600 20,700 P 180,000 525,915 All materials are added at the start of production and the inspection point is at the end of the process. Using the more accurate method representing the physical flow of units. Required: a. Total costs of units transferred-out b. The amount of work in-process, end c. Cost of abnormal loss units Problem 25: Cost of Production Report (Discrete) The following information is available for Aquaman Corporation for the month of February: Started in Process units WIP beginning (40% complete) Abnormal spoilage 320,000 30,000 Normal spoilage (discrete) 4,400 3,600 WIP ending (70% complete) 52,000 Completed and Transferred out 290,000 Cost Data WIP beginning cost: Materials Conversion Current cost: Materials 41,600 55,200 480,000 1,400,000 Conversion All materials are added at the start of the process and the inspection point is at the end of the process. Required: Prepare a cost of production report using FIFO and Weighted Average Method. (Use five decimal places to compute the unit cost).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets prepare the Cost of Production Report using the FIFO and Weighted Average methods FIFO Met...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started