Answered step by step

Verified Expert Solution

Question

1 Approved Answer

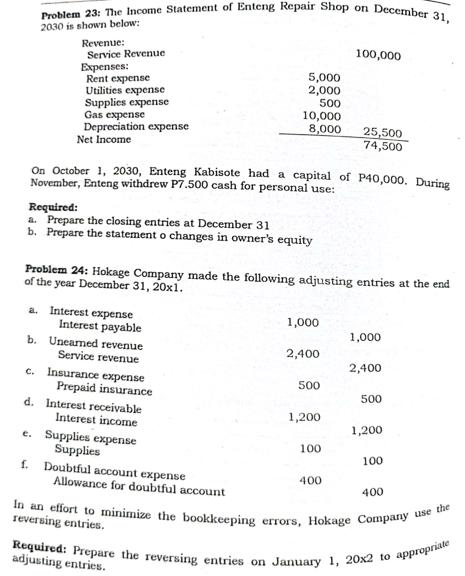

Problem 23: The Income Statement of Enteng Repair Shop on December 31, 2030 is shown below: Revenue: Service Revenue. Expenses: Rent expense Utilities expense

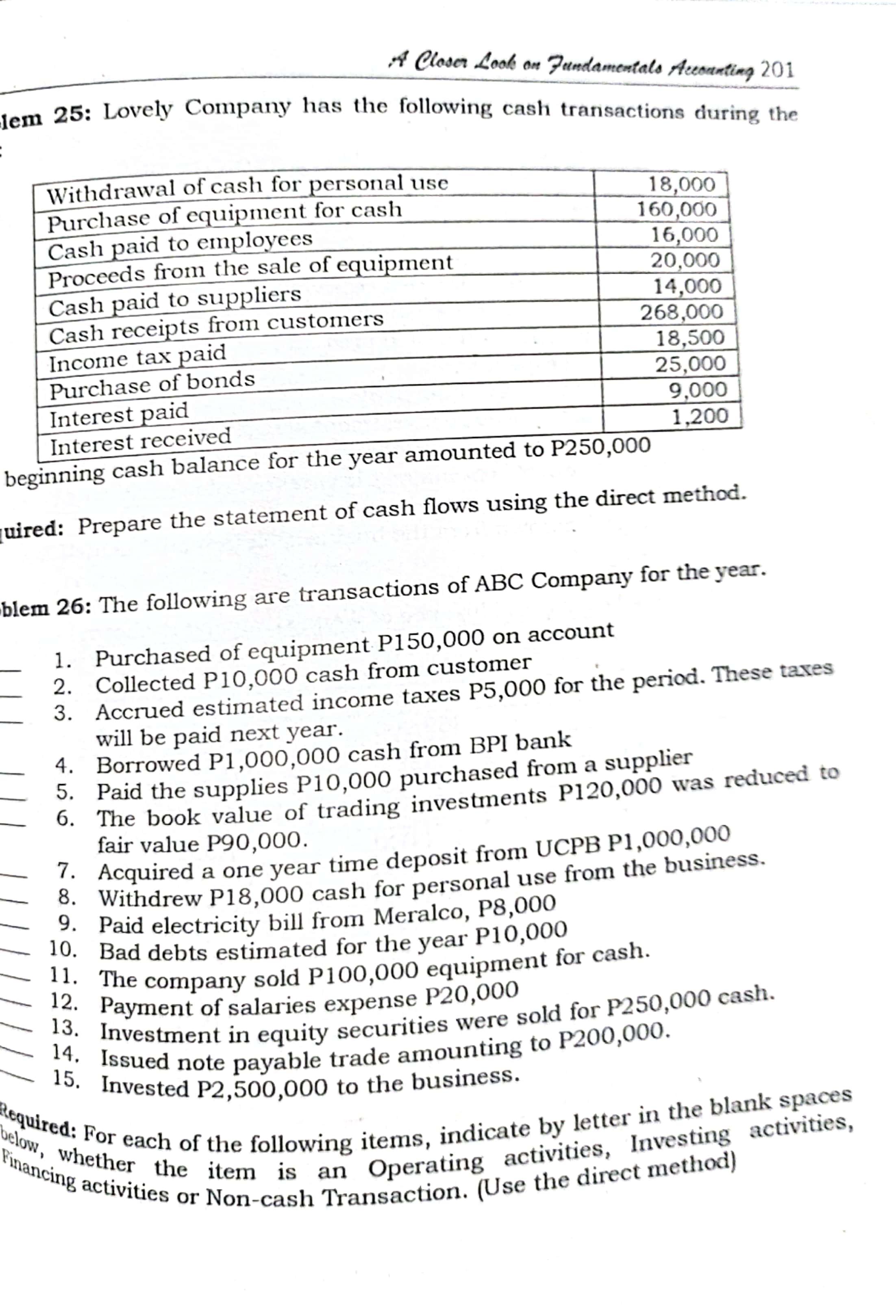

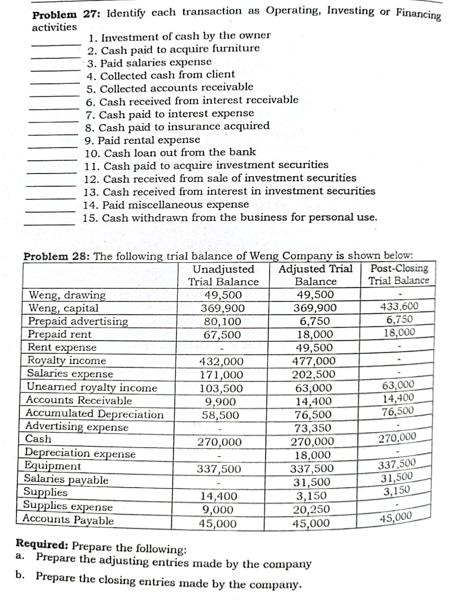

Problem 23: The Income Statement of Enteng Repair Shop on December 31, 2030 is shown below: Revenue: Service Revenue. Expenses: Rent expense Utilities expense Supplies expense Gas expense Depreciation expense Net Income C. Required: a. Prepare the closing entries at December 31 b. Prepare the statement o changes in owner's equity a. Interest expense Interest payable On October 1, 2030, Enteng Kabisote had a capital of P40,000. During November, Enteng withdrew P7.500 cash for personal use: b. Uneamed revenue Problem 24: Hokage Company made the following adjusting entries at the end of the year December 31, 20x1. Service revenue Insurance expense Prepaid insurance d. Interest receivable Interest income 5,000 2,000 500 e. Supplies expense Supplies 10,000 8,000 f. Doubtful account expense Allowance for doubtful account 1,000 2,400 500 1,200 100,000 100 25,500 74,500 400 1,000 2,400 500 1,200 100 reversing entries. In an effort to minimize the bookkeeping errors, Hokage Company use the 400 Required: Prepare the reversing entries on January 1, 20x2 to appropriate adjusting entries. A Closer Look on Fundamentals Accounting 201 dem 25: Lovely Company has the following cash transactions during the 18,000 160,000 16,000 20,000 14,000 268,000 18,500 25,000 9,000 1,200 Withdrawal of cash for personal use Purchase of equipment for cash Cash paid to employees Proceeds from the sale of equipment Cash paid to suppliers Cash receipts from customers Income tax paid Purchase of bonds Interest paid Interest received beginning cash balance for the year amounted to P250,000 quired: Prepare the statement of cash flows using the direct method. blem 26: The following are transactions of ABC Company for the year. 1. Purchased of equipment P150,000 on account Collected P10,000 cash from customer 2. 3. Accrued estimated income taxes P5,000 for the period. These taxes will be paid next year. 4. Borrowed P1,000,000 cash from BPI bank 5. Paid the supplies P10,000 purchased from a supplier 6. The book value of trading investments P120,000 was reduced to fair value P90,000. 7. Acquired a one year time deposit from UCPB P1,000,000 8. Withdrew P18,000 cash for personal use from the business. 9. Paid electricity bill from Meralco, P8,000 10. Bad debts estimated for the year P10,000 11. The company sold P100,000 equipment for cash. 12. Payment of salaries expense P20,000 13. Investment in equity securities were sold for P250,000 cash. 14. Issued note payable trade amounting to P200,000. 15. Invested P2,500,000 to the business. Required: For each of the following items, indicate by letter in the blank spaces below, whether the item is an Operating activities, Investing activities, Financing activities or Non-cash Transaction. (Use the direct method) Problem 27: Identify each transaction as Operating, Investing or Financing activities 1. Investment of cash by the owner 2. Cash paid to acquire furniture 3. Paid salaries expense 4. Collected cash from client 5. Collected accounts receivable 6. Cash received from interest receivable 7. Cash paid to interest expense 8. Cash paid to insurance acquired 9. Paid rental expense 10. Cash loan out from the bank 11. Cash paid to acquire investment securities 12. Cash received from sale of investment securities 13. Cash received from interest in investment securities 14. Paid miscellaneous expense 15. Cash withdrawn from the business for personal use. Problem 28: The following trial balance of Weng Company is shown below: Unadjusted Adjusted Trial Post-Closing Trial Balance Trial Balance Weng, drawing Weng, capital Prepaid advertising Prepaid rent Rent expense Royalty income. Salaries expense Unearned royalty income Accounts Receivable Accumulated Depreciation Advertising expense Cash Depreciation expense Equipment Salaries payable Supplies Supplies expense Accounts Payable 49,500 369,900 80,100 67,500 432,000 171,000 103,500 9,900 58,500 270,000 337,500 14,400 9,000 45,000 Balance 49,500 369,900 6,750 18,000 49,500 477,000 202,500 63,000 14,400 76,500 73,350 270,000 18,000 337,500 31,500 3,150 20,250 45,000 Required: Prepare the following: a. Prepare the adjusting entries made by the company b. Prepare the closing entries made by the company. 433,600 6,750 18,000 63,000 14,400 76,500 270,000 337,500 31,500 3,150 45,000

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Problem 23 a Closing Entries Date December 31 2030 Account Service Revenue Debit 74500 Credit 74500 Account Rent Expense Debit 2000 Credit 2000 Account Utilities Expense Debit 500 Credit 500 Account S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started