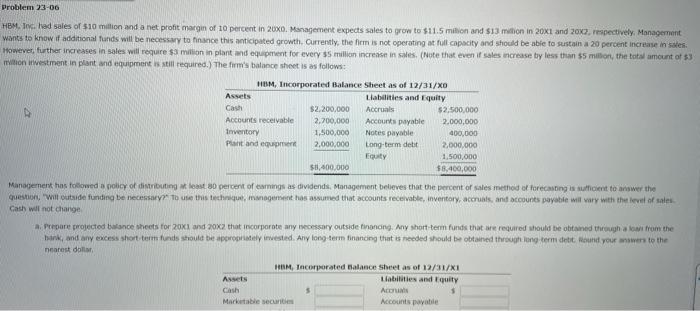

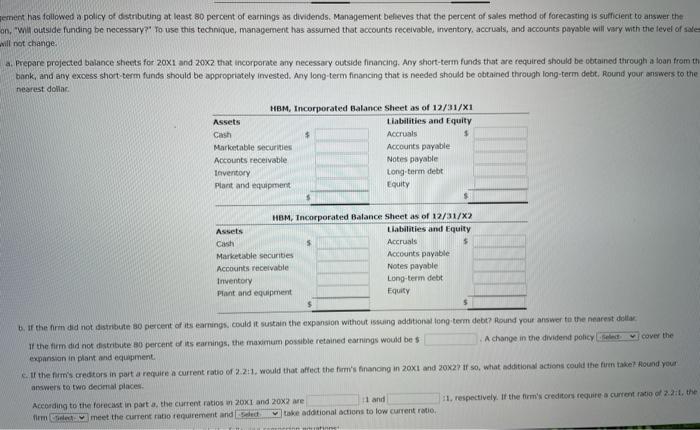

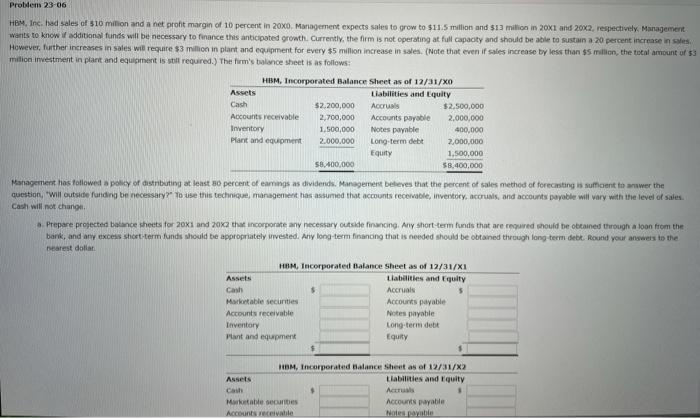

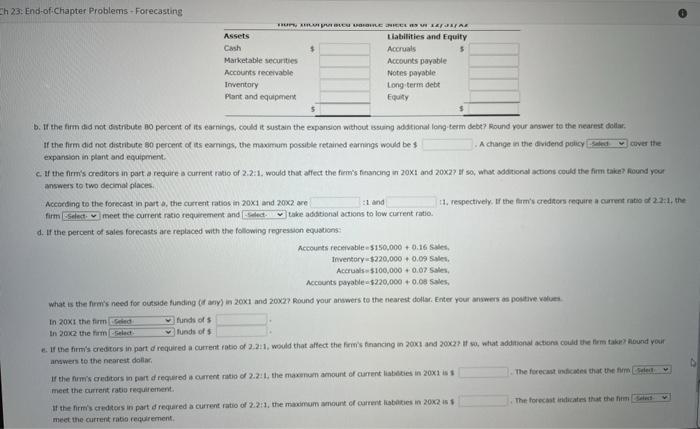

Problem 23-00 HBM. Dr. Ved sales of $10 million and a net profit margin of 10 percent in 20x0. Management expects sales to grow to $11.5 million and 13 million in 201 and 2003, respectively, Management wants to know if additional funds will be necessary to finance this anticipated growth. Currently, the firm is not operating at full capacity and should be able to sustain a 20 percent increase in sales However, further increases in sales will require 53 milion in plant and equipment for every $5 million increase in sales. (Note that even if sales increase by less than 5 million, the total amount of 3 ition westment in plant and equipment is still required.) The firm's balance sheet is as follows: HOM, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $2,200,000 Accruals $2.500.000 Accounts receivable 2,700,000 Accounts payable 2,000,000 Inventory 1,500,000 Notes payable 400,000 Pin and equipment 2,000,000 Long-term debit 2.000.000 1,500,000 $3,400,000 $8.400,000 Management hos followed policy of distributing at least 80 percent of earnings as dividends. Management believes that the percent of sales method of forecasting is sufficient tower the question will outside tunding be necessary to use this technique agement has assured that accounts receivable, inventory, accruals and accounts payable wil vary with the level of sales Cashs will not change Prepare projectod balance sheets for 20X1 and 20x2 that incorporate any necessary outside financing. Any short-term funds that are required should be obtained through a low from the hink, and any excess short term funds should be appropriately invested. Any long term financing that is needed should be obtained through long term detit wound your swers to the nearest dollar HM Incorporated Balance sheet as of 12/31/X1 ANS Llabilities and Equity Cash Acer Marble securities Accounts payable ement has followed a policy of distributing at least 80 percent of earnings as dividends. Management believes that the percent of sales method of forecasting is sufficient to answer the on, wil outside funding be necessary to use this technique, management has assumed that accounts receivable, inventory, accruals, and accounts payable will vary with the level of sale will not change a. Prepare projected balance sheets for 2oX1 and 20x2 that incorporate any necessary outside financing. Any short-term funds that are required should be obtained through a loan from th book, and any excess short term funds should be appropriately invested. Any long-term financing that is needed should be obtained through long-term debe, Round your answers to the nearest dollar HBM, Incorporated Balance Sheet as of 12/31/X1 Assets Liabilities and Equity Cash Accruals $ Marketable securities Accounts payable Accounts receivable Notes payable Inventory Long-term debit plant and equipment Equity HBM, Incorporated Balance Sheet as of 12/31/X2 Asse Liabilities and Equity Cash Accruals 5 Marketable securities Accounts payable Accounts receivable Notes payable Inventory Long-term debt Plant and equipment Equity . If the firm did not distribute 80 percent of its earnings could it sustain the expansion without issuing additional long term debt? Round your answer to the nearest dollar If the firm did not distribute 30 percent of its carnings, the maximum possible retained earnings would be $ A change in the dividend policy Cover the expansion in plant and equipment c. If the firm's creditors in part a require a current ratio of 22:1. would that affect the firm's financing in 20xi and 20x2? If so, what additional actions could the fu takel Round your answers to two deorral places According to the forecast in part a, the current ratios in 20X1 and 20x2 me 11 and 11, respectively. If the firm's creditors require a current ratio of 2.2. the firmed meet the current ratio requirement added take additional actions to low current ratio Cash Problem 23-06 HBM, Inc. had sales of 10 milion and a net profit margin of 10 percent in 20x0, Management expects sales to grow to $11.5 million and $12 million in 20x1 and 20x2, respectively Management wants to know additional funds will be necessary to finance this anticipated growth. Currently, the firm is not operating at full capacity and should be able to sustain a 20 percent increase in sales However, further increases in sales will require $3 million in plant and equipment for every $5 million increase in sales. (Note that even if sales increase by less than $5 million, the total amount of 53 million investment in plant and equipment is still required.) The firm's balance sheet is as follows: HIM, Incorporated Balance Sheet as of 12/31/XO Assets Liabilities and Equity $2,200,000 Accrual $2.500,000 Accounts receivable 2,700,000 Accounts payable 2,000,000 Inventory 1.500,000 Notes payable 400,000 Plant and equipment 2.000.000 Long-term debit 2,000,000 Equity 1,500,000 58.400,000 58,400,000 Management has followed a policy of distributing at least so percent of eamings as dividends. Management believes that the percent of sales method of forecasting is sugent to awer the question will outside funding be necessary to use this technique, management has assumed that accounts receivable, inventory, accruins, and accounts payable will vary with the level of sales. Cash will not change Prepare projected balance sheets for 201 and 200 that incorporate any necessary outside financing. Any short-term funds that are required should be obtained through a foon from the bank and an excess short-term funds should be appropriately invested. Any long-term finanong that is needed should be obtained through long term dett. Round your answers to the est dollar HBM. Incorporated Balance Sheet as of 12/31/X1 Assets Liabilities and Equity Cash Accruals Marketable securities Accounts payable Accounts receivable Notes payable Inventory Long-term det Plant and equipment Equity HOM, Incorporated Balance sheet as of 12/31/X2 Assets Llabilities and Equity Actuals Mortable secure Accounts payable Accounts receivable Ch 23. End-of Chapter Problems - Forecasting FOR OPEN LENKELE KETIAK Assets Liabilities and Equity Cash Accruals $ Marketable securities Accounts payable Accounts receivable Notes payable Inventory Long term dett Plant and equipment Equity b. If the firm ad not distribute 50 percent of its earnings, could it sustain the expansion without soung adational long-term debe? Round your answer to the nearest dotat, If the firm did not distribute 80 percent of its earnings, the maximum possible retained earnings would be A change in the dividend policy test cover the expansion in plant and equipment. cut the firm's creditors in part a require a current ratio of 2.2.1. would that affect the fiens financing in 20X1 and 20x2?ut, what additional actions could the firm take? Roond your answers to two decimal places According to the forecast in part, the current ratios in 20X1 and 20x2 are Land 11. respectively. If the firm's creditors require a current ratio of 22:1, the firm select meet the current ratio requirement and take additional actions to low current ratio. d. It the percent of sales forecasts are replaced with the following regression equations: Accounts receivable $150,000+ 0.16 Inventory$220,000+ 0.09 Se Accruals $100,000+ 0.07 Sales, Accounts payable $220,000+ 0.08 Sales, what is the firm's need for outside funding ny) in 201 and 20x27 Round your answers to the nearest dolor. Enter your answers as positive In 20XI the firm and w funds of s In 20x2 the time Runds of c. the firm's creditors in port d required a current ratio of 2.2.1. would that affect the firstnancing in 2011 and 20x2? It so, what addition action could be to take Round your answers to the nearest dollar If the firm's creditors in part d required current ratio of 2.2:1, the maximum amount of current liabities in 2013 The forecast indicates that there meet the current ratio requirement If therm's creditors in part drequred a current ratio of 2.2:1, the maximum amount of current abaties in 2012 The forecast indicates that the meet the current ratio requirement Problem 23-00 HBM. Dr. Ved sales of $10 million and a net profit margin of 10 percent in 20x0. Management expects sales to grow to $11.5 million and 13 million in 201 and 2003, respectively, Management wants to know if additional funds will be necessary to finance this anticipated growth. Currently, the firm is not operating at full capacity and should be able to sustain a 20 percent increase in sales However, further increases in sales will require 53 milion in plant and equipment for every $5 million increase in sales. (Note that even if sales increase by less than 5 million, the total amount of 3 ition westment in plant and equipment is still required.) The firm's balance sheet is as follows: HOM, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $2,200,000 Accruals $2.500.000 Accounts receivable 2,700,000 Accounts payable 2,000,000 Inventory 1,500,000 Notes payable 400,000 Pin and equipment 2,000,000 Long-term debit 2.000.000 1,500,000 $3,400,000 $8.400,000 Management hos followed policy of distributing at least 80 percent of earnings as dividends. Management believes that the percent of sales method of forecasting is sufficient tower the question will outside tunding be necessary to use this technique agement has assured that accounts receivable, inventory, accruals and accounts payable wil vary with the level of sales Cashs will not change Prepare projectod balance sheets for 20X1 and 20x2 that incorporate any necessary outside financing. Any short-term funds that are required should be obtained through a low from the hink, and any excess short term funds should be appropriately invested. Any long term financing that is needed should be obtained through long term detit wound your swers to the nearest dollar HM Incorporated Balance sheet as of 12/31/X1 ANS Llabilities and Equity Cash Acer Marble securities Accounts payable ement has followed a policy of distributing at least 80 percent of earnings as dividends. Management believes that the percent of sales method of forecasting is sufficient to answer the on, wil outside funding be necessary to use this technique, management has assumed that accounts receivable, inventory, accruals, and accounts payable will vary with the level of sale will not change a. Prepare projected balance sheets for 2oX1 and 20x2 that incorporate any necessary outside financing. Any short-term funds that are required should be obtained through a loan from th book, and any excess short term funds should be appropriately invested. Any long-term financing that is needed should be obtained through long-term debe, Round your answers to the nearest dollar HBM, Incorporated Balance Sheet as of 12/31/X1 Assets Liabilities and Equity Cash Accruals $ Marketable securities Accounts payable Accounts receivable Notes payable Inventory Long-term debit plant and equipment Equity HBM, Incorporated Balance Sheet as of 12/31/X2 Asse Liabilities and Equity Cash Accruals 5 Marketable securities Accounts payable Accounts receivable Notes payable Inventory Long-term debt Plant and equipment Equity . If the firm did not distribute 80 percent of its earnings could it sustain the expansion without issuing additional long term debt? Round your answer to the nearest dollar If the firm did not distribute 30 percent of its carnings, the maximum possible retained earnings would be $ A change in the dividend policy Cover the expansion in plant and equipment c. If the firm's creditors in part a require a current ratio of 22:1. would that affect the firm's financing in 20xi and 20x2? If so, what additional actions could the fu takel Round your answers to two deorral places According to the forecast in part a, the current ratios in 20X1 and 20x2 me 11 and 11, respectively. If the firm's creditors require a current ratio of 2.2. the firmed meet the current ratio requirement added take additional actions to low current ratio Cash Problem 23-06 HBM, Inc. had sales of 10 milion and a net profit margin of 10 percent in 20x0, Management expects sales to grow to $11.5 million and $12 million in 20x1 and 20x2, respectively Management wants to know additional funds will be necessary to finance this anticipated growth. Currently, the firm is not operating at full capacity and should be able to sustain a 20 percent increase in sales However, further increases in sales will require $3 million in plant and equipment for every $5 million increase in sales. (Note that even if sales increase by less than $5 million, the total amount of 53 million investment in plant and equipment is still required.) The firm's balance sheet is as follows: HIM, Incorporated Balance Sheet as of 12/31/XO Assets Liabilities and Equity $2,200,000 Accrual $2.500,000 Accounts receivable 2,700,000 Accounts payable 2,000,000 Inventory 1.500,000 Notes payable 400,000 Plant and equipment 2.000.000 Long-term debit 2,000,000 Equity 1,500,000 58.400,000 58,400,000 Management has followed a policy of distributing at least so percent of eamings as dividends. Management believes that the percent of sales method of forecasting is sugent to awer the question will outside funding be necessary to use this technique, management has assumed that accounts receivable, inventory, accruins, and accounts payable will vary with the level of sales. Cash will not change Prepare projected balance sheets for 201 and 200 that incorporate any necessary outside financing. Any short-term funds that are required should be obtained through a foon from the bank and an excess short-term funds should be appropriately invested. Any long-term finanong that is needed should be obtained through long term dett. Round your answers to the est dollar HBM. Incorporated Balance Sheet as of 12/31/X1 Assets Liabilities and Equity Cash Accruals Marketable securities Accounts payable Accounts receivable Notes payable Inventory Long-term det Plant and equipment Equity HOM, Incorporated Balance sheet as of 12/31/X2 Assets Llabilities and Equity Actuals Mortable secure Accounts payable Accounts receivable Ch 23. End-of Chapter Problems - Forecasting FOR OPEN LENKELE KETIAK Assets Liabilities and Equity Cash Accruals $ Marketable securities Accounts payable Accounts receivable Notes payable Inventory Long term dett Plant and equipment Equity b. If the firm ad not distribute 50 percent of its earnings, could it sustain the expansion without soung adational long-term debe? Round your answer to the nearest dotat, If the firm did not distribute 80 percent of its earnings, the maximum possible retained earnings would be A change in the dividend policy test cover the expansion in plant and equipment. cut the firm's creditors in part a require a current ratio of 2.2.1. would that affect the fiens financing in 20X1 and 20x2?ut, what additional actions could the firm take? Roond your answers to two decimal places According to the forecast in part, the current ratios in 20X1 and 20x2 are Land 11. respectively. If the firm's creditors require a current ratio of 22:1, the firm select meet the current ratio requirement and take additional actions to low current ratio. d. It the percent of sales forecasts are replaced with the following regression equations: Accounts receivable $150,000+ 0.16 Inventory$220,000+ 0.09 Se Accruals $100,000+ 0.07 Sales, Accounts payable $220,000+ 0.08 Sales, what is the firm's need for outside funding ny) in 201 and 20x27 Round your answers to the nearest dolor. Enter your answers as positive In 20XI the firm and w funds of s In 20x2 the time Runds of c. the firm's creditors in port d required a current ratio of 2.2.1. would that affect the firstnancing in 2011 and 20x2? It so, what addition action could be to take Round your answers to the nearest dollar If the firm's creditors in part d required current ratio of 2.2:1, the maximum amount of current liabities in 2013 The forecast indicates that there meet the current ratio requirement If therm's creditors in part drequred a current ratio of 2.2:1, the maximum amount of current abaties in 2012 The forecast indicates that the meet the current ratio requirement