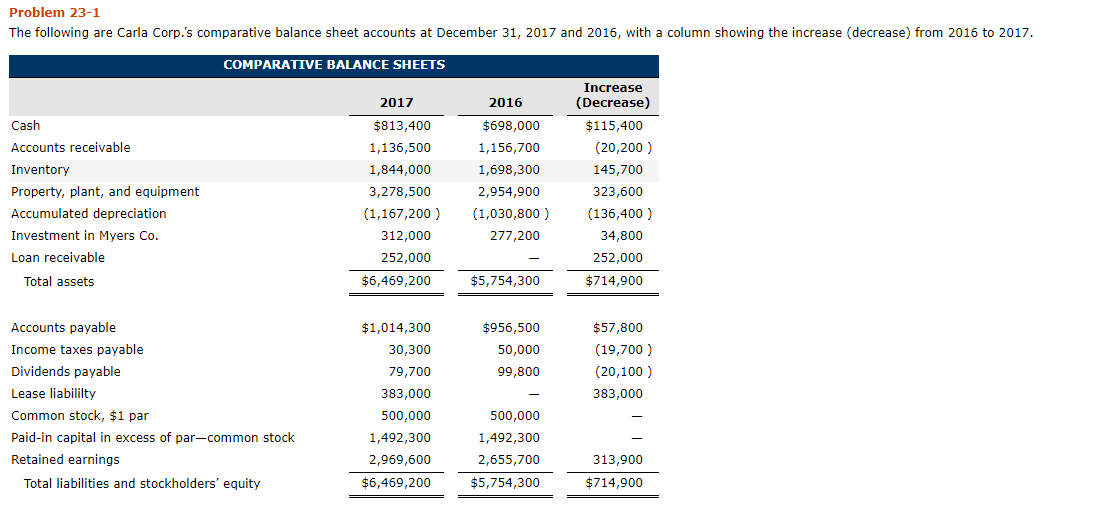

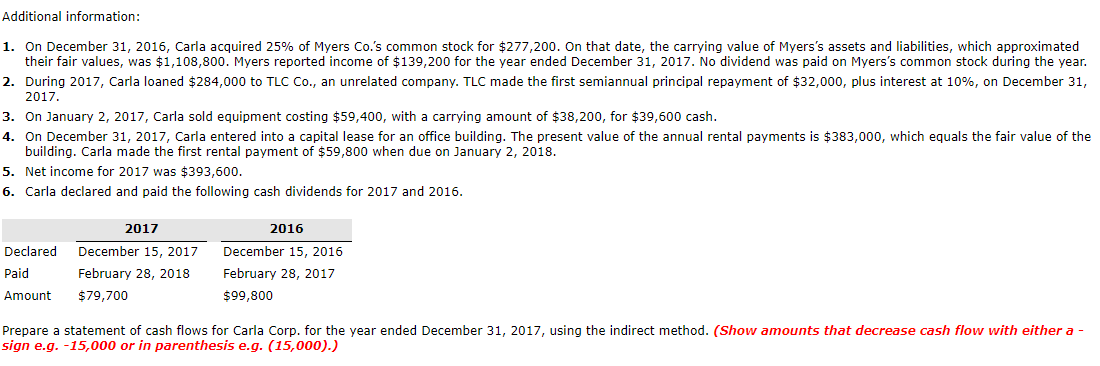

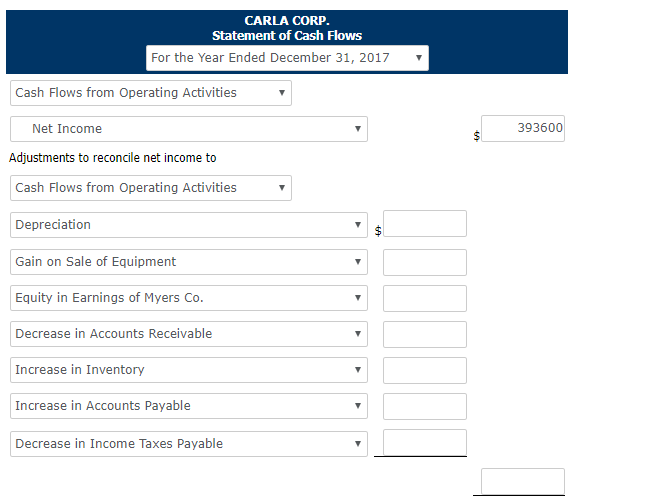

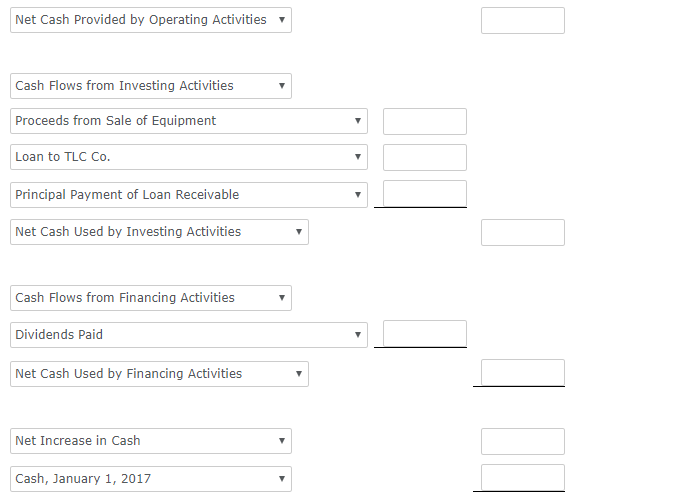

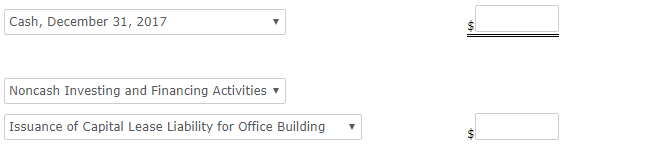

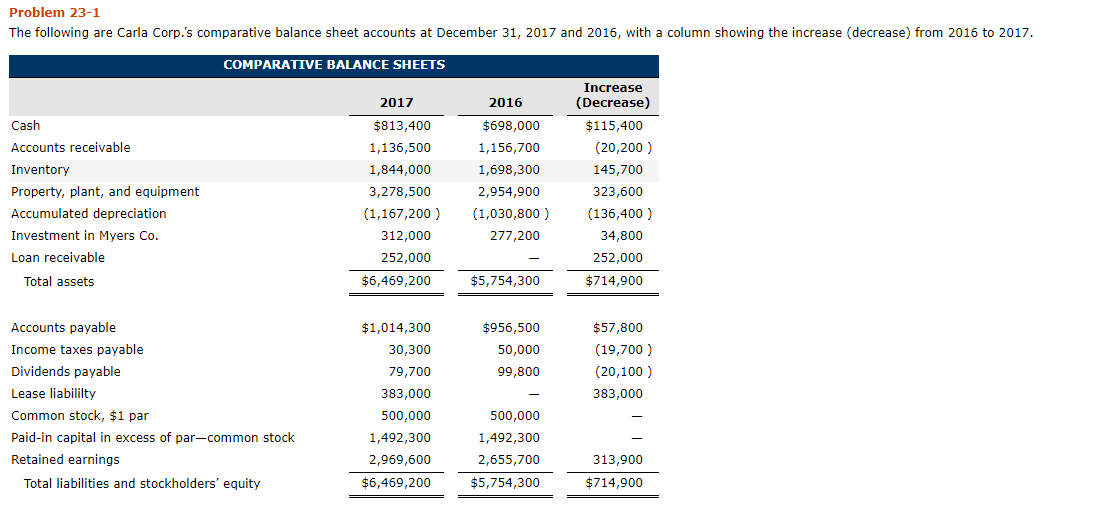

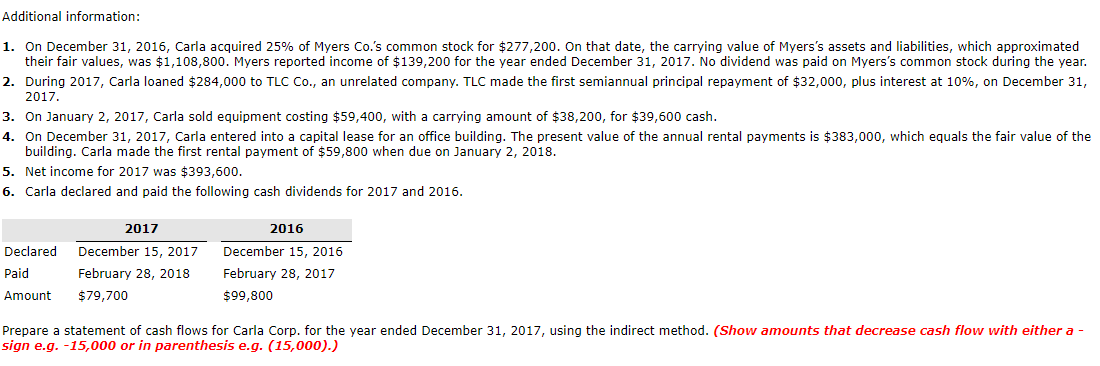

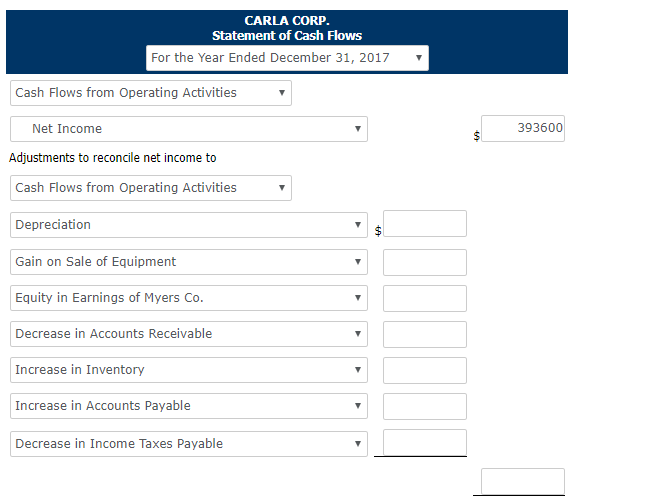

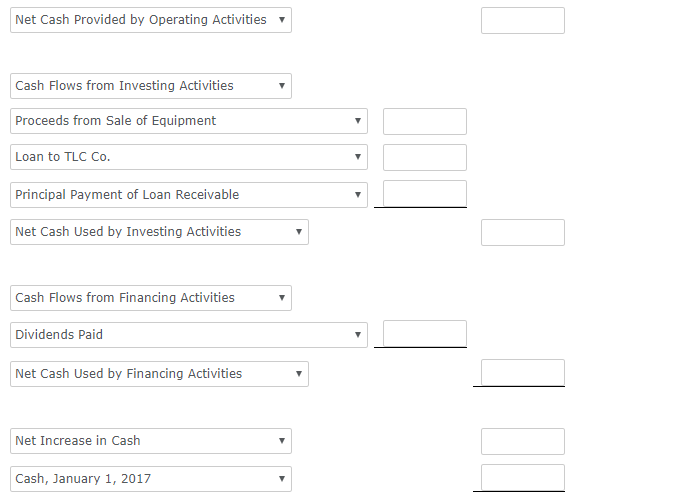

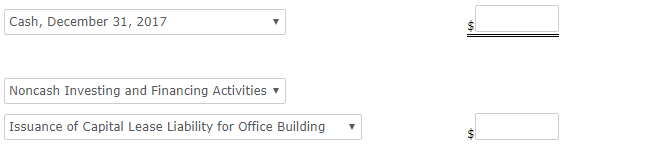

Problem 23-1 The following are Carla Corp.'s comparative balance sheet accounts at December 31, 2017 and 2016, with a column showing the increase (decrease) from 2016 to 2017. COMPARATIVE BALANCE SHEETS Cash Accounts receivable Inventory Property, plant, and equipment Accumulated depreciation Investment in Myers Co. Loan receivable Total assets 2017 $813,400 1,136,500 1,844,000 3,278,500 (1,167,200 ) 312,000 252,000 $6,469,200 2016 $698,000 1,156,700 1,698,300 2,954,900 (1,030,800 ) 277,200 Increase (Decrease) $115,400 (20,200 ) 145,700 323,600 (136,400) 34,800 252,000 $714,900 $5,754,300 $956,500 50,000 99,800 $57,800 (19,700 ) (20,100) 383,000 Accounts payable Income taxes payable Dividends payable Lease liabililty Common stock, $1 par Paid-in capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity $1,014,300 30,300 79,700 383,000 500,000 1,492,300 2,969,600 $6,469,200 500,000 1,492,300 2,655,700 $5,754,300 313,900 $714,900 Additional information: 1. On December 31, 2016, Carla acquired 25% of Myers Co.'s common stock for $277,200. On that date, the carrying value of Myers's assets and liabilities, which approximated their fair values, was $1,108,800. Myers reported income of $139,200 for the year ended December 31, 2017. No dividend was paid on Myers's common stock during the year. 2. During 2017, Carla loaned $284,000 to TLC Co., an unrelated company. TLC made the first semiannual principal repayment of $32,000, plus interest at 10%, on December 31, 2017. 3. On January 2, 2017, Carla sold equipment costing $59,400, with a carrying amount of $38,200, for $39,600 cash. 4. On December 31, 2017, Carla entered into a capital lease for an office building. The present value of the annual rental payments is $383,000, which equals the fair value of the building. Carla made the first rental payment of $59,800 when due on January 2, 2018. 5. Net income for 2017 was $393,600. 6. Carla declared and paid the following cash dividends for 2017 and 2016. Declared Paid Amount 2017 December 15, 2017 February 28, 2018 $79,700 2016 December 15, 2016 February 28, 2017 $99,800 Prepare a statement of cash flows for Carla Corp. for the year ended December 31, 2017, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) CARLA CORP. Statement of Cash Flows For the Year Ended December 31, 2017 Cash Flows from Operating Activities Net Income 393600 Adjustments to reconcile net income to Cash Flows from Operating Activities Depreciation Gain on Sale of Equipment Equity in Earnings of Myers Co. Decrease in Accounts Receivable Increase in Inventory Increase in Accounts Payable Decrease in Income Taxes Payable Net Cash Provided by Operating Activities Cash Flows from Investing Activities Proceeds from Sale of Equipment Loan to TLC Co. Principal Payment of Loan Receivable Net Cash Used by Investing Activities Cash Flows from Financing Activities Dividends Paid Net Cash Used by Financing Activities Net Increase in Cash Cash, January 1, 2017 Cash, December 31, 2017 Noncash Investing and Financing Activities Issuance of Capital Lease Liability for Office Building