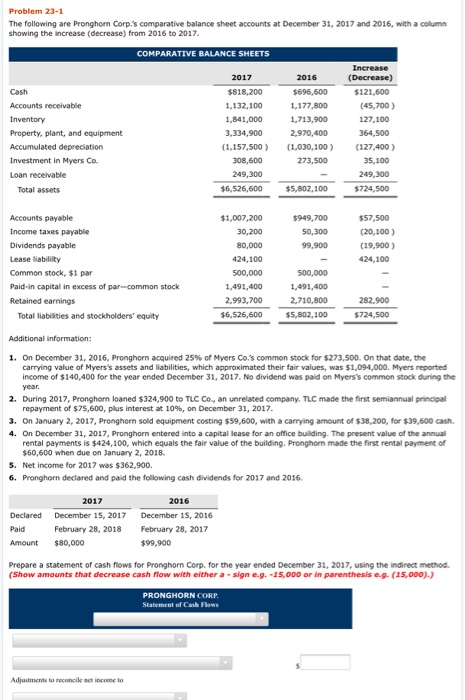

Problem 23-1 The following are Pronghorn Corp.'s comparative balance sheet accounts at December 31, 2017 and 2016, with a column showing the increase (decrease) from 2016 to 2017 COMPARATIVE BALANCE SHEETS 2016 Cash $818,200 $121,600 Accounts receivable 1.132,100 1.177,800 (45,700) 127,100 1,841,000 1,713,900 2,970,400 Property, plant, and equipment 3,334,900 364,500 (1,157,500 1,030,100127.400) Investment in Myers Co. 273,500 35,100 249,300 249,300 Loan receivable $6,526,600 $5,802,100 $724,500 Total assets $1,007,200 Accounts payable $949,700 $57,500 (20,100) Income taxes payable 30,200 50,300 Dividends payable 80,000 9,900 (19,900) Lease liabililty 424,100 500,000 Common stock, $1 par Paid-in capital in excess of par-common stock 1,491,400 1,491,400 2.993,700 2,710,800 Retained earnings 5,802,100SA $724,500 $6,526,6005502282,900 Total liabilities and stockholders' equity Additional information: 1. On December 31, 2016, Pronghorn acquired 25% of Myers Co.'s common stock for $273,500. On that date, the carrying value of Myers's assets and liabilities, which approximated their fair values, was $1,094,000. Myers reported income of $140,400 for the year ended December 31, 2017. No dividend was paid on Myers's common stock during the 2. During 2017, Pronghorn loaned $324,900 to TLC Co, an unrelated company. TLC made the first semiannual principal repayment of $75,600, plus interest at 10%, on December 31, 2017. 3. On January 2, 2017, Pronghorn sold equipment costing $59,600, with a carrying amount of $38,200, for $39,600 cash. 4. On December 31, 2017, Pronghorn entered into a capital lease for an office building. The present value of the annual rental payments is $424,100, which equals the fair value of the building. Pronghorn made the first rental payment of $60,600 when due on January 2, 2018. 5. Net income for 2017 was $362,900. 6. Pronghorn declared and paid the following cash dividends for 2017 and 2016 2017 2016 Declared December 15, 2017 December 15, 2016 Paid February 28, 2018 February 28, 2017 Amount $80,000 $99,900 Prepare a statement of cash fows for Pronghorn Corp, for the year ended December 31, 2017, using the indirect method (Show amounts that decrease cash flow, with either a-sign eq.-15,000 or in parenthesis eg. (15,000).) Adjustments to reconcik net income to Prepare a statement of cash flows for Pronghorn Corp. for the year ended December 31, 2017, using the indirect method (Show amounts that decrease cash flow with either a -sign e.g.-15,000 or in parenthesis eg. (15,000).) .ntments to "econcile ni, income to Click if you would like to Show Work for this question: Q Show Work