Answered step by step

Verified Expert Solution

Question

1 Approved Answer

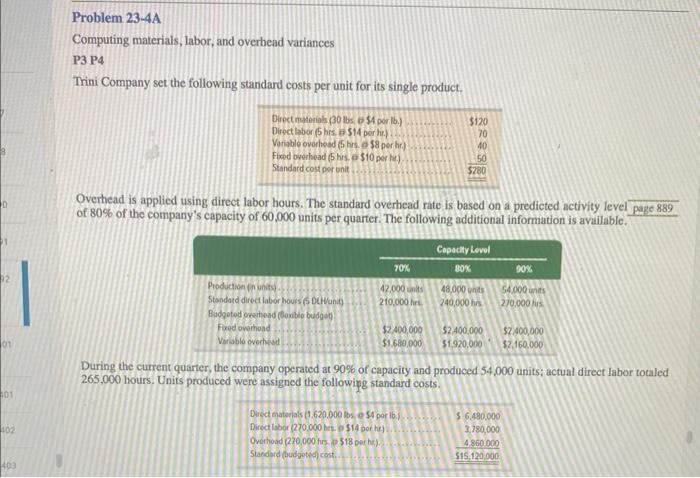

Problem 23-4A Computing materials, labor, and overhead variances P3 P4 Trini Company set the following standard costs per unit for its single product. Direct

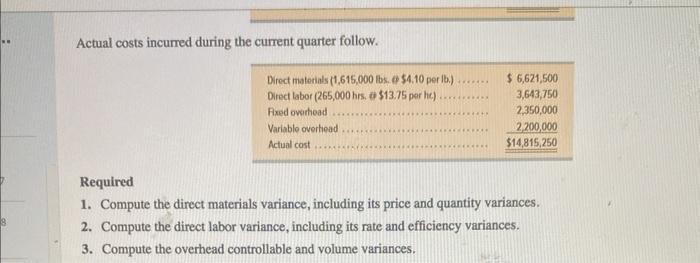

Problem 23-4A Computing materials, labor, and overhead variances P3 P4 Trini Company set the following standard costs per unit for its single product. Direct materials (30 lbs. $4 per lb.) Direct labor (5 hrs, $14 per hr.) $120 70 Variable overhead (5 hrs. Fixed overhead (5 hrs. $8 per hr.) 40 $10 per hr). 50 Standard cost per unit $280 0 Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level page 889 of 80% of the company's capacity of 60,000 units per quarter. The following additional information is available. 92 01 01 402 403 Capacity Level 70% 80% 90% Production (in units). 42,000 units 48,000 units Standard direct labor hours (5 DCH/uni 210,000 hr 240,000 hrs 54,000 units 270,000 hrs Budgeted overhead (Baxible budget) Fixed overhoad Variable overhead $2,400,000 $1.680,000 $2,400,000 $1,920,000 $2,160,000 $2,400,000 During the current quarter, the company operated at 90% of capacity and produced 54,000 units; actual direct labor totaled 265,000 hours. Units produced were assigned the following standard costs. Direct materials (1.620.000 lbs, $4 por lb.) Direct labor (270,000 hrs. $14 por hr.) Overhoad (270,000 hrs $18 per h). Standard (budgeted) cost.. $6.480.000 3,780,000 4,860,000 $15,120,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started