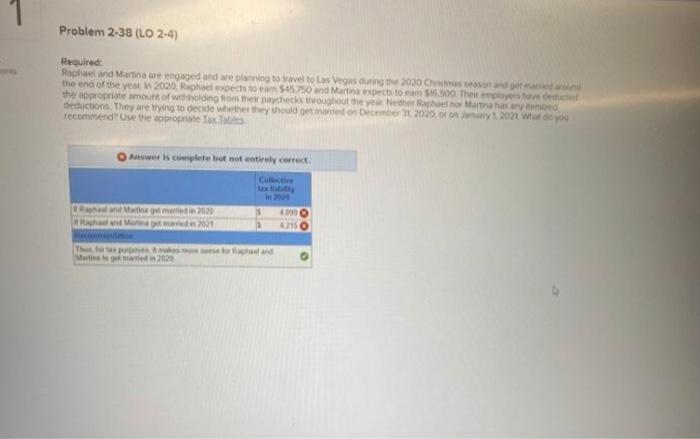

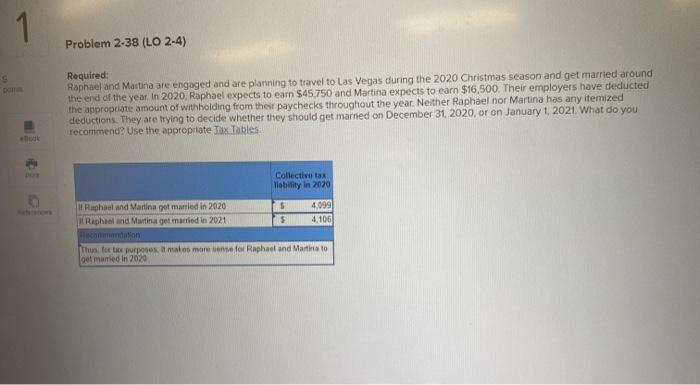

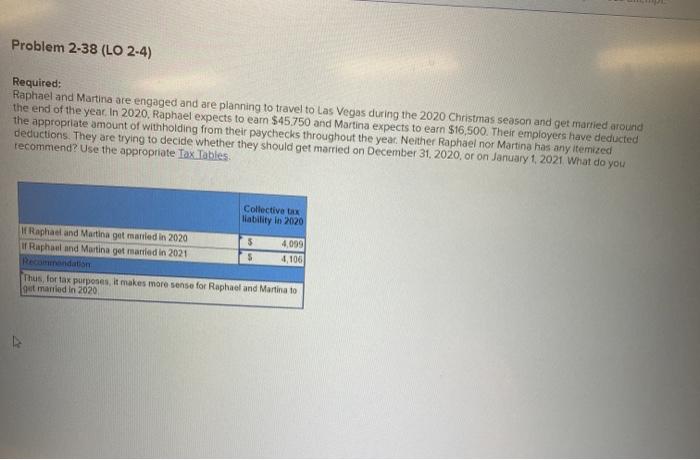

Problem 2-38 (LO 2-4) Required: Raphael and Martina are engaged and are planning to save to Las Vegas uring the 2030 sandard the end of the yemin 2020, Raphaespects to earn 545 750 and Martie expects to am 56.500 The employees to dete the appropriate amount of wholding from the paycheck oughout the year.NetherRachelor Marthasar med deduction. They are trying to decide whether they shouldered on December 2020. or on nyt 2021 What do you recommend Use the appropriate to Answer is complete but not entirely correct 200 201 and a 2150 The wind 2029 1 Problem 2-38 (LO 2-4) Required: Raphael and Martina are engaged and are planning to travel to Las Vegas during the 2020 Christmas season and get married around the end of the year. In 2020, Raphael expects to earn $45.750 and Martina expects to earn $16,500. Their employers have deducted the appropriate amount of withholding from their paychecks throughout the year. Neither Raphael nor Martina has any itemized deductions. They are trying to decide whether they should get married on December 31, 2020, or on January 1, 2021. What do you recommend? Use the appropriate Tax Tables Collective liability in 2020 Raphael and Martina got married in 2020 Raphael and Martina get married in 2021 5 5 4,099 4.106 Thus for a purposes. It make more sense for Raphael and Martina to get married in 2020 Problem 2-38 (LO 2-4) Required: Raphael and Martina are engaged and are planning to travel to Las Vegas during the 2020 Christmas season and get married around the end of the year. In 2020, Raphael expects to earn $45.750 and Martina expects to earn $16,500. Their employers have deducted the appropriate amount of withholding from their paychecks throughout the year. Neither Raphael nor Martina has any itemized deductions. They are trying to decide whether they should get married on December 31, 2020, or on January 1, 2021 What do you recommend? Use the appropriate Tax Tables Collective liability in 2020 Raphael and Martina get married in 2020 If Raphael and Martina get married in 2021 4,099 4106 5 Thus, for tax purposes. It makes more sense for Raphael and Martina to got married in 2020 Problem 2-38 (LO 2-4) Required: Raphael and Martina are engaged and are planning to save to Las Vegas uring the 2030 sandard the end of the yemin 2020, Raphaespects to earn 545 750 and Martie expects to am 56.500 The employees to dete the appropriate amount of wholding from the paycheck oughout the year.NetherRachelor Marthasar med deduction. They are trying to decide whether they shouldered on December 2020. or on nyt 2021 What do you recommend Use the appropriate to Answer is complete but not entirely correct 200 201 and a 2150 The wind 2029 1 Problem 2-38 (LO 2-4) Required: Raphael and Martina are engaged and are planning to travel to Las Vegas during the 2020 Christmas season and get married around the end of the year. In 2020, Raphael expects to earn $45.750 and Martina expects to earn $16,500. Their employers have deducted the appropriate amount of withholding from their paychecks throughout the year. Neither Raphael nor Martina has any itemized deductions. They are trying to decide whether they should get married on December 31, 2020, or on January 1, 2021. What do you recommend? Use the appropriate Tax Tables Collective liability in 2020 Raphael and Martina got married in 2020 Raphael and Martina get married in 2021 5 5 4,099 4.106 Thus for a purposes. It make more sense for Raphael and Martina to get married in 2020 Problem 2-38 (LO 2-4) Required: Raphael and Martina are engaged and are planning to travel to Las Vegas during the 2020 Christmas season and get married around the end of the year. In 2020, Raphael expects to earn $45.750 and Martina expects to earn $16,500. Their employers have deducted the appropriate amount of withholding from their paychecks throughout the year. Neither Raphael nor Martina has any itemized deductions. They are trying to decide whether they should get married on December 31, 2020, or on January 1, 2021 What do you recommend? Use the appropriate Tax Tables Collective liability in 2020 Raphael and Martina get married in 2020 If Raphael and Martina get married in 2021 4,099 4106 5 Thus, for tax purposes. It makes more sense for Raphael and Martina to got married in 2020