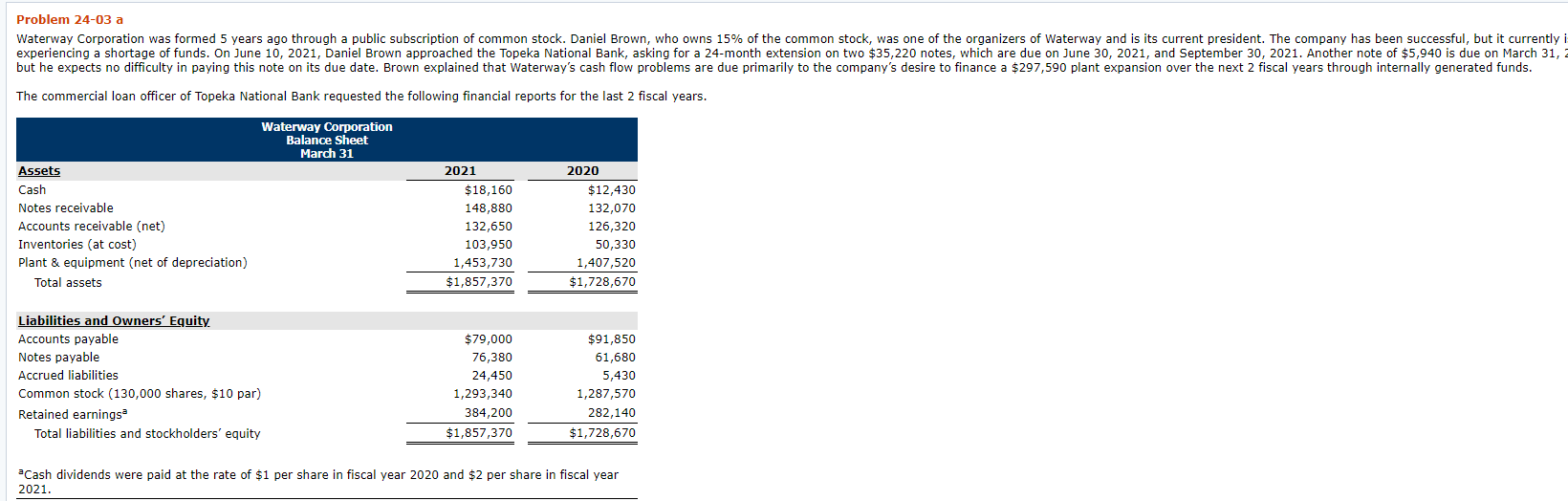

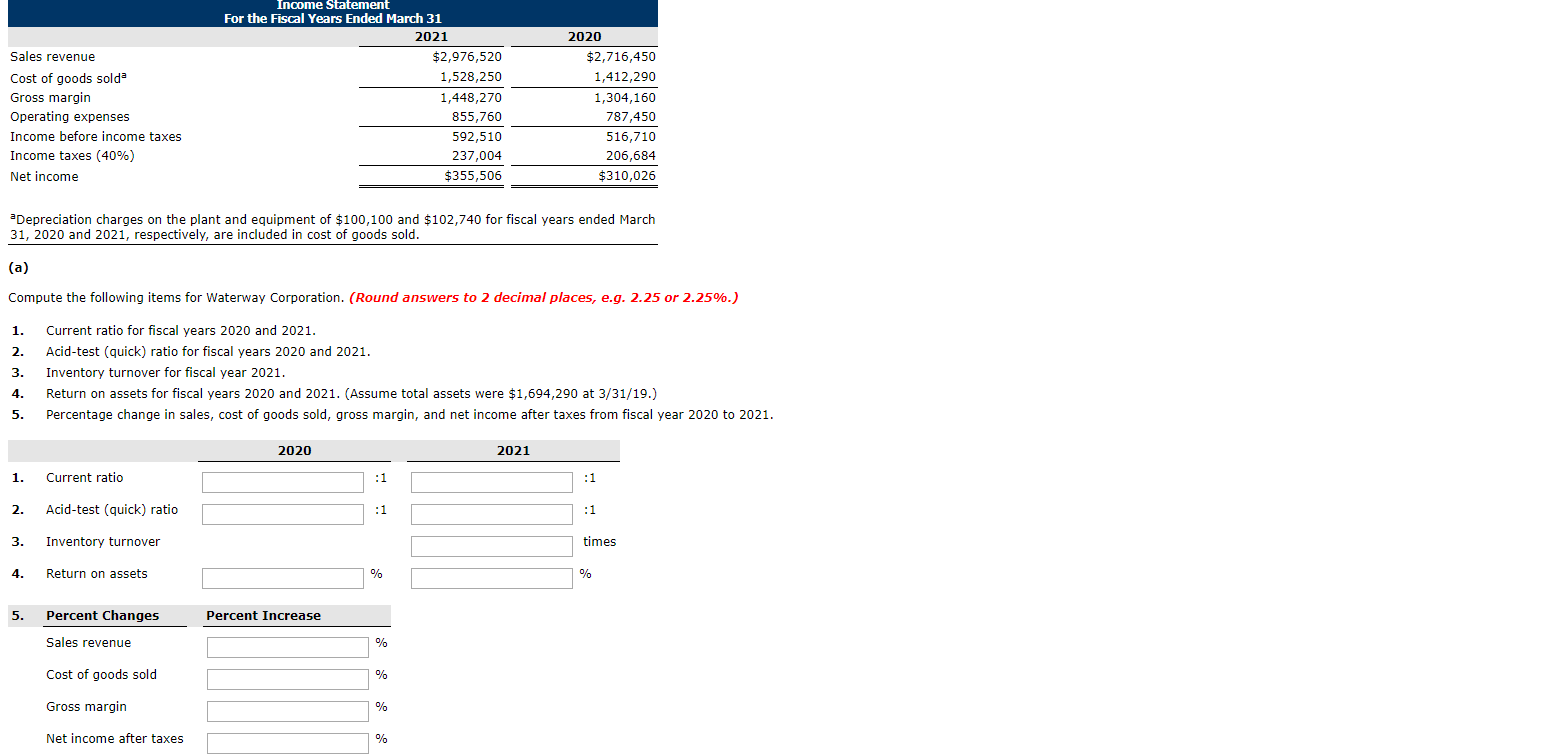

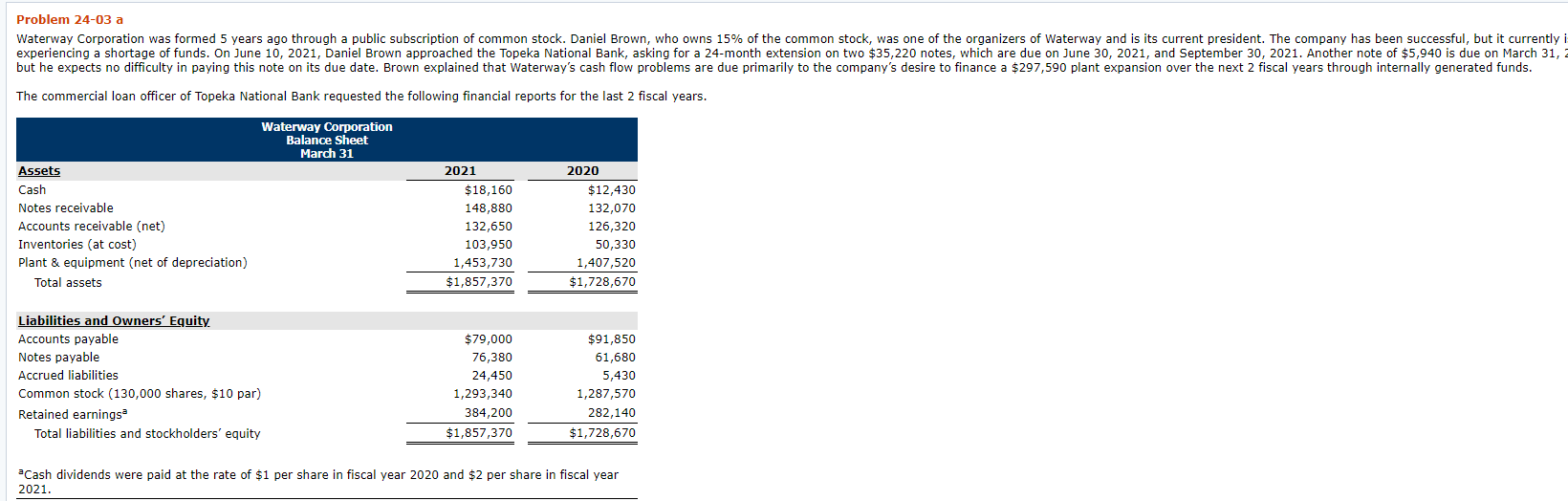

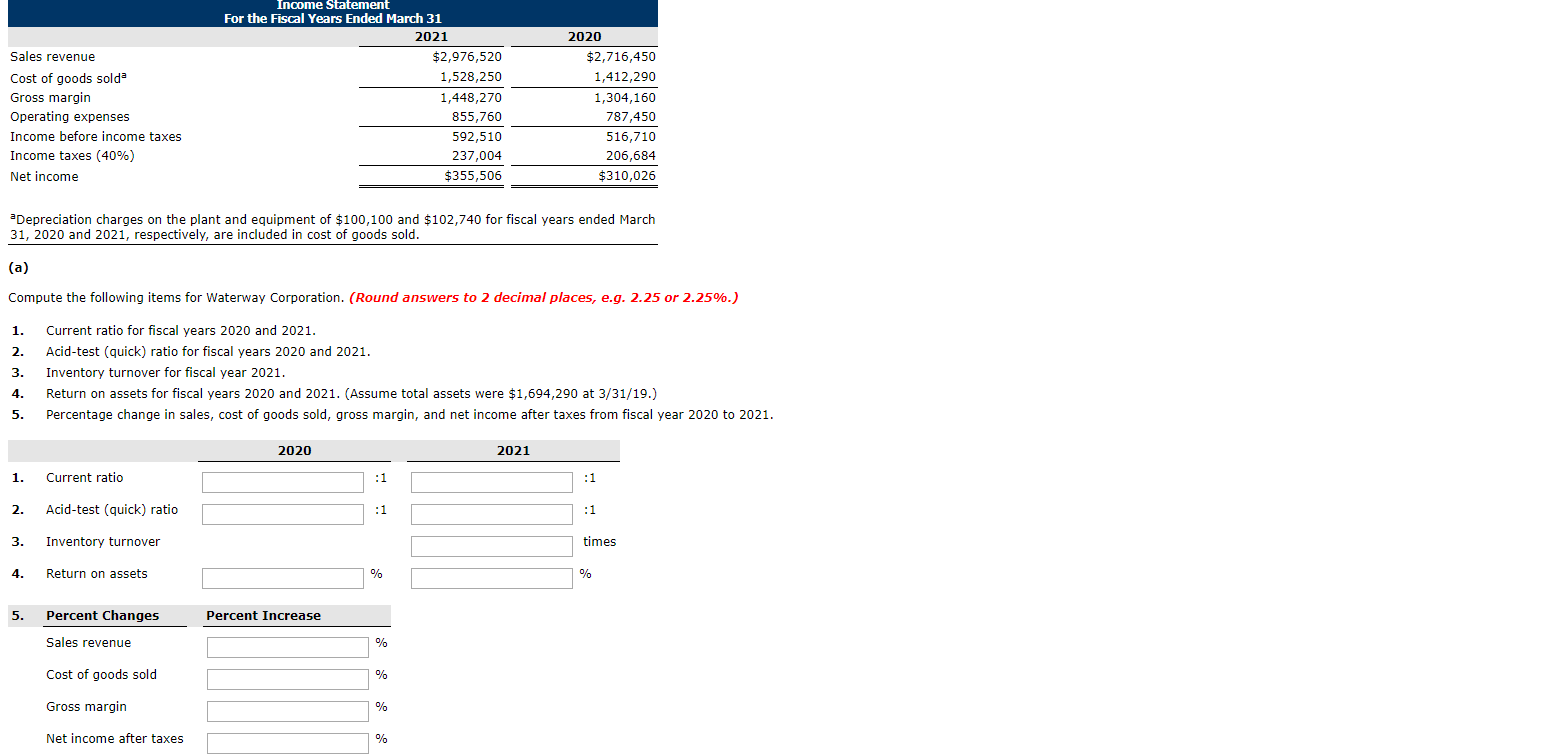

Problem 24-03 a Waterway Corporation was formed 5 years ago through a public subscription of common stock. Daniel Brown, who owns 15% of the common stock, was one of the organizers of Waterway and is its current president. The company has been successful, but it currently i experiencing a shortage of funds. On June 10, 2021, Daniel Brown approached the Topeka National Bank, asking for a 24-month extension on two $35,220 notes, which are due on June 30, 2021, and September 30, 2021. Another note of $5,940 is due on March 31, 2 but he expects no difficulty in paying this note on its due date. Brown explained that Waterway's cash flow problems are due primarily to the company's desire to finance a $297,590 plant expansion over the next 2 fiscal years through internally generated funds. The commercial loan officer of Topeka National Bank requested the following financial reports for the last 2 fiscal years. Waterway Corporation Balance Sheet March 31 Assets Cash Notes receivable Accounts receivable (net) Inventories (at cost) Plant & equipment (net of depreciation) Total assets 2021 $18,160 148,880 132,650 103,950 1,453,730 $1,857,370 2020 $12,430 132,070 126,320 50,330 1,407,520 $1,728,670 Liabilities and Owners' Equity. Accounts payable Notes payable Accrued liabilities Common stock (130,000 shares, $10 par) Retained earnings Total liabilities and stockholders' equity $ 79,000 76,380 24,450 1,293,340 384,200 $1,857,370 $91,850 61,680 5,430 1,287,570 282,140 $1,728,670 Cash dividends were paid at the rate of $1 per share in fiscal year 2020 and $2 per share in fiscal year 2021. Sales revenue Cost of goods solda Gross margin Operating expenses Income before income taxes Income taxes (40%) Net income Income Statement For the Fiscal Years Ended March 31 2021 $2,976,520 1,528,250 1,448,270 855,760 592,510 237,004 $355,506 2020 $2,716,450 1,412,290 1,304,160 787,450 516,710 206,684 $310,026 Depreciation charges on the plant and equipment of $100,100 and $102,740 for fiscal years ended March 31, 2020 and 2021, respectively, are included in cost of goods sold. (a) Compute the following items for Waterway Corporation. (Round answers to 2 decimal places, e.g. 2.25 or 2.25%.) 1. 2. Current ratio for fiscal years 2020 and 2021. Acid-test (quick) ratio for fiscal years 2020 and 2021. Inventory turnover for fiscal year 2021. Return on assets for fiscal years 2020 and 2021. (Assume total assets were $1,694,290 at 3/31/19.) Percentage change in sales, cost of goods sold, gross margin, and net income after taxes from fiscal year 2020 to 2021. 4. 5. 2020 2021 1. Current ratio 2. Acid-test (quick) ratio 3. Inventory turnover times 4. Return on assets % 5. Percent Changes Percent Increase Sales revenue Cost of goods sold Gross margin Net income after taxes