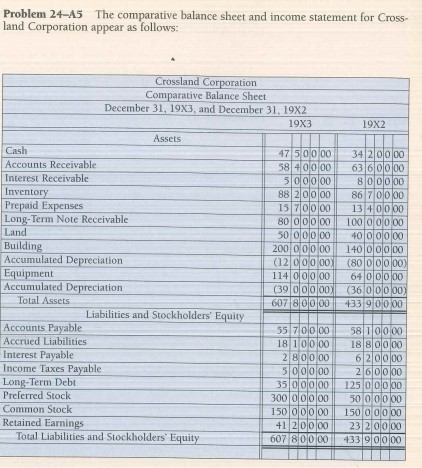

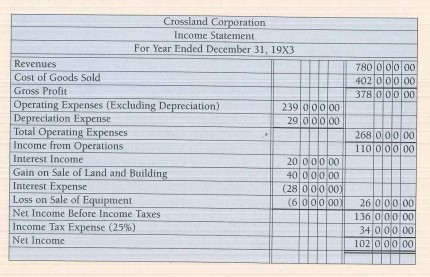

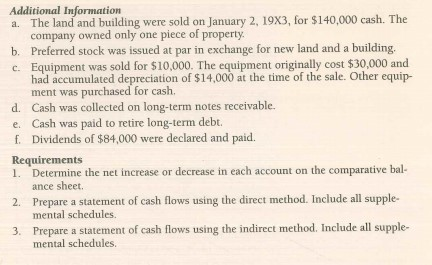

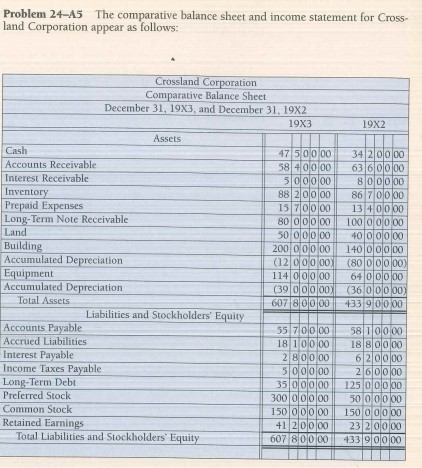

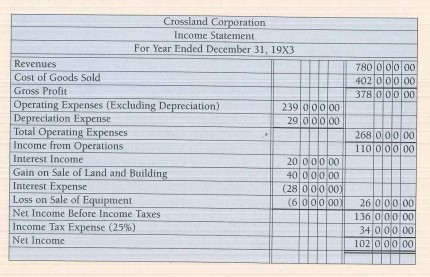

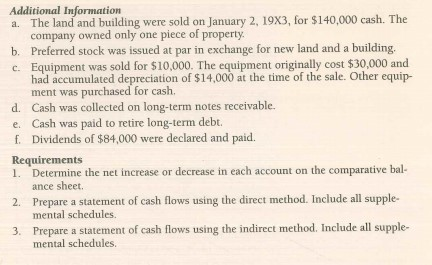

Problem 24-45 The comparative balance sheet and income statement for Cross- land Corporation appear as follows: 19X2 Crossland Corporation Comparative Balance Sheet December 31, 1983, and December 31, 19X2 19X3 Assets Cash 47 50 000 Accounts Receivable 58 40000 Interest Receivable 5 000 00 Inventory 88 20000 Prepaid Expenses 1517100100 Long-Term Note Receivable 80 OOOO Land 50 000 Building 200 00 00 Accumulated Depreciation (12 000 00 Equipment 114 000 00 Accumulated Depreciation (39 000) Total Assets 607 80000 Liabilities and Stockholders' Equity Accounts Payable 55 7 00 00 Accrued Liabilities 18 10000 Interest Payable 2 800.00 Income Taxes Payable 500000 Long-Term Debt 350 000 Preferred Stock 300 000 Common Stock 15000000 Retained Earnings 41 210000 Total Liabilities and Stockholders' Equity 607 80000 342 00 00 6360000 800000 86 70 000 13 40 000 10000000 40 000 140 00 00 (800000 6400000 (36 00000) 433 90000 58 100 100 18 8 0000 620000 2/60000 125 0000 500 0000 150 0 0000 23 20000 433 9 00 00 7800 00 00 402 olololoo 378 0 0000 Crossland Corporation Income Statement For Year Ended December 31, 1983 Revenues Cost of Goods Sold Gross Profit Operating Expenses (Excluding Depreciation) 239 000 Depreciation Expense 290 000 Total Operating Expenses Income from Operations Interest Income 20 000 00 Gain on Sale of Land and Building 400 00 00 Interest Expense (28 000 00 Loss on Sale of Equipment (600000 Net Income Before Income Taxes Income Tax Expense (25%) Net Income 268 000 00 110 00 00 260 00 00 136 000 00 34 000 00 102 00000 Additional Information a. The land and building were sold on January 2, 1983, for $140,000 cash. The company owned only one piece of property. b. Preferred stock was issued at par in exchange for new land and a building. c. Equipment was sold for $10,000. The equipment originally cost $30,000 and had accumulated depreciation of $14,000 at the time of the sale. Other equip- ment was purchased for cash. d. Cash was collected on long-term notes receivable. e. Cash was paid to retire long-term debt. f. Dividends of $84,000 were declared and paid. Requirements 1. Determine the net increase or decrease in each account on the comparative bal- ance sheet 2. Prepare a statement of cash flows using the direct method. Include all supple- mental schedules. 3. Prepare a statement of cash flows using the indirect method. Include all supple- mental schedules Problem 24-45 The comparative balance sheet and income statement for Cross- land Corporation appear as follows: 19X2 Crossland Corporation Comparative Balance Sheet December 31, 1983, and December 31, 19X2 19X3 Assets Cash 47 50 000 Accounts Receivable 58 40000 Interest Receivable 5 000 00 Inventory 88 20000 Prepaid Expenses 1517100100 Long-Term Note Receivable 80 OOOO Land 50 000 Building 200 00 00 Accumulated Depreciation (12 000 00 Equipment 114 000 00 Accumulated Depreciation (39 000) Total Assets 607 80000 Liabilities and Stockholders' Equity Accounts Payable 55 7 00 00 Accrued Liabilities 18 10000 Interest Payable 2 800.00 Income Taxes Payable 500000 Long-Term Debt 350 000 Preferred Stock 300 000 Common Stock 15000000 Retained Earnings 41 210000 Total Liabilities and Stockholders' Equity 607 80000 342 00 00 6360000 800000 86 70 000 13 40 000 10000000 40 000 140 00 00 (800000 6400000 (36 00000) 433 90000 58 100 100 18 8 0000 620000 2/60000 125 0000 500 0000 150 0 0000 23 20000 433 9 00 00 7800 00 00 402 olololoo 378 0 0000 Crossland Corporation Income Statement For Year Ended December 31, 1983 Revenues Cost of Goods Sold Gross Profit Operating Expenses (Excluding Depreciation) 239 000 Depreciation Expense 290 000 Total Operating Expenses Income from Operations Interest Income 20 000 00 Gain on Sale of Land and Building 400 00 00 Interest Expense (28 000 00 Loss on Sale of Equipment (600000 Net Income Before Income Taxes Income Tax Expense (25%) Net Income 268 000 00 110 00 00 260 00 00 136 000 00 34 000 00 102 00000 Additional Information a. The land and building were sold on January 2, 1983, for $140,000 cash. The company owned only one piece of property. b. Preferred stock was issued at par in exchange for new land and a building. c. Equipment was sold for $10,000. The equipment originally cost $30,000 and had accumulated depreciation of $14,000 at the time of the sale. Other equip- ment was purchased for cash. d. Cash was collected on long-term notes receivable. e. Cash was paid to retire long-term debt. f. Dividends of $84,000 were declared and paid. Requirements 1. Determine the net increase or decrease in each account on the comparative bal- ance sheet 2. Prepare a statement of cash flows using the direct method. Include all supple- mental schedules. 3. Prepare a statement of cash flows using the indirect method. Include all supple- mental schedules