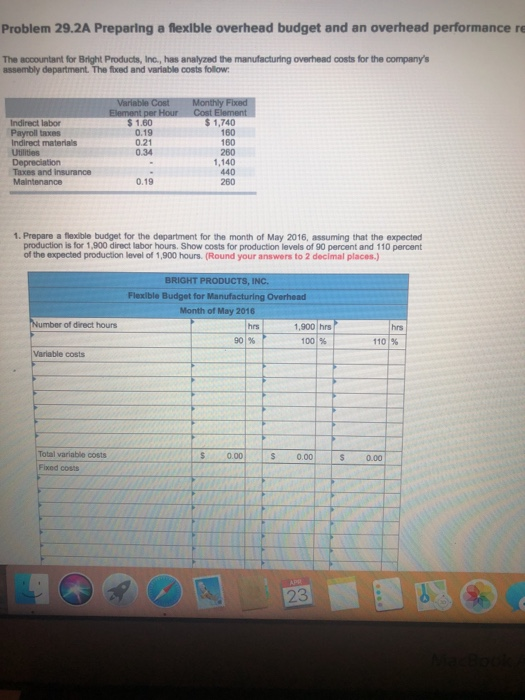

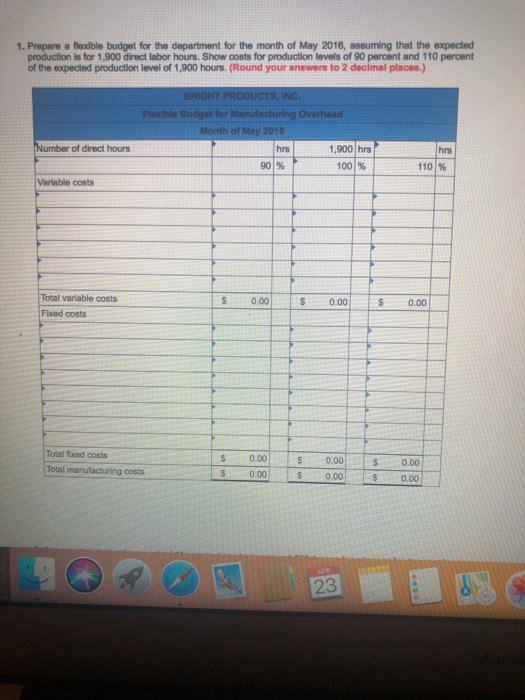

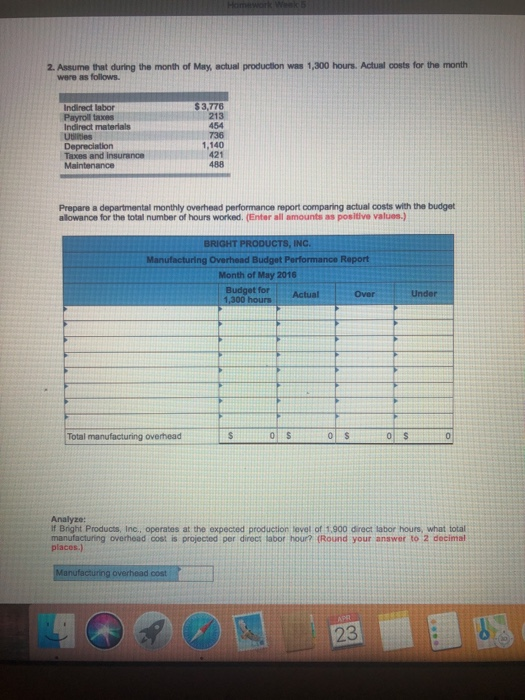

Problem 29.2A Preparing a flexlble overhead budget and an overhead performance re The accountant for Bright Products, Inc., has analyzed the manufacturing overhead costs for the company's assembly department. The fixed and variable costs follow 1,740 160 160 260 1,140 440 260 Indirect labor Payroll taxes Indirect materials Utilities $1.60 0.19 0.21 0.34 Taxes and insurance Maintenance 0.19 1.Prepare a flexible budget for the department for the month of May 2016, assuming that the expected production is for 1,900 direct labor hours. Show costs for production levels of 90 percent and 110 percent of the expected production level of 1,900 hours. (Round your answers to 2 decimal places) BRIGHT PRODUCTS, INC. Flexible Budget for Month of May 2016 of direct hours hrs 1,900 hrs 1001% hrs 901% 1101% Variable costs Total variable costs Fixed costs S 0.00 S 0.00 S 0.00 23 1. Prepare a flexible budget for the department for the month of May 2016, assuming that the expected production is for 1,900 direct labor hours. Show costs for production levels of 90 percent and 110 percent of the expected production level of 1,900 hours(Round your answers to 2 declmal places.) Flexible Budget for Manufacturing Overhead Month of May 2016 1,900 hrs 1001% Number of direct hours hrs hrs 901% 1101% Variable costs Total variable costs S 0.00 S s 0.00 $0.00 Flxed costs Total foxed costs $0.00S S0.00 S0.000.00 S0.00 Total costs 0.00 23 2. Assume that during the month of May, actual production was 1,300 hours. Actual costs for the month were as follows. $3,776 213 454 736 1,140 421 488 Indirect labor Payroll taxes Indirect materials Utilities Taxes and insurance Maintenance Prepare a departmental monthly overhead performance report comparing actual costs with the budget allowance for the total number of hours worked. (Enter all amounts as positive values.) BRIGHT PRODUCTS, INC. Manufacturing Overhead Budget Performance Report Month of May 2016 Budget for Actual Under Over Total manufacturing overhead If Bright Products, Inc., operates at the expected production level of 1,900 direct labor hours, what total manufacturing overhead cost is projected per direct labor hour? (Round your answer to 2 docimal places.) cost 23