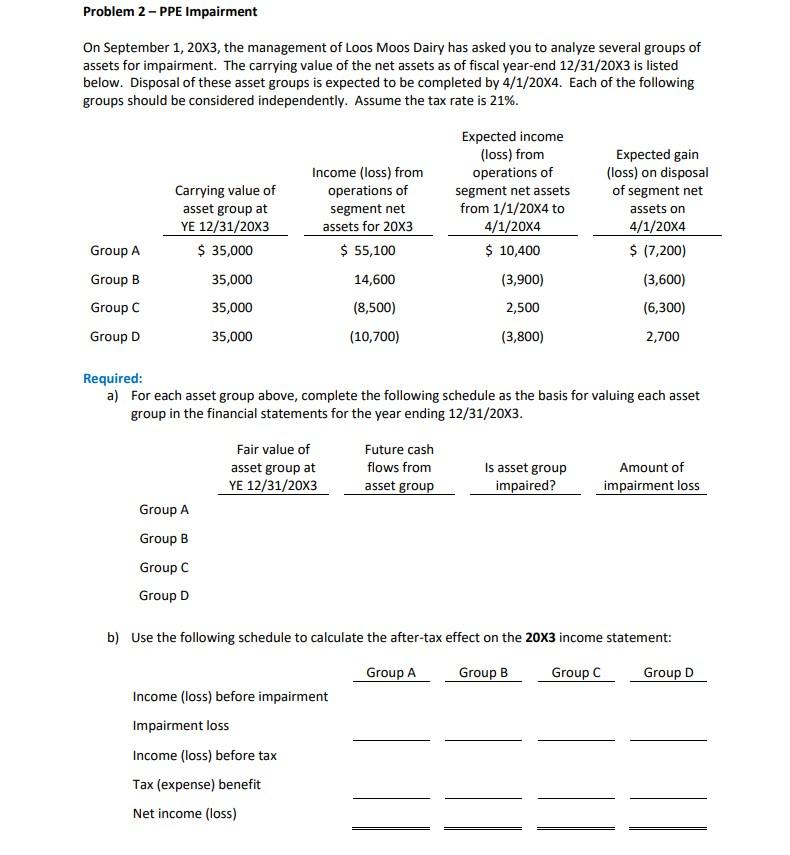

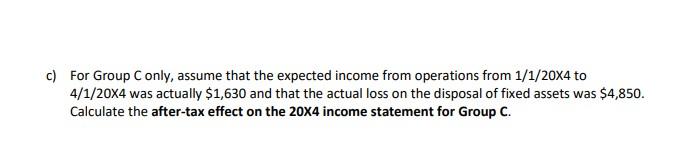

Problem 2-PPE Impairment On September 1, 20X3, the management of Loos Moos Dairy has asked you to analyze several groups of assets for impairment. The carrying value of the net assets as of fiscal year-end 12/31/20x3 is listed below. Disposal of these asset groups is expected to be completed by 4/1/20x4. Each of the following groups should be considered independently. Assume the tax rate is 21%. Carrying value of asset group at YE 12/31/20X3 $ 35,000 35,000 35,000 35,000 Expected income (loss) from operations of segment net assets from 1/1/2004 to 4/1/20X4 $ 10,400 (3,900) Income (loss) from operations of segment net assets for 20X3 $ 55,100 14,600 (8,500) (10,700) Group A Group B Group C Group D Expected gain (loss) on disposal of segment net assets on 4/1/20X4 $ (7,200) (3,600) (6,300) 2,500 (3,800) 2,700 Required: a) For each asset group above, complete the following schedule as the basis for valuing each asset group in the financial statements for the year ending 12/31/20x3. Fair value of asset group at YE 12/31/2003 Future cash flows from asset group Is asset group impaired? Amount of impairment loss Group A Group B Group C Group D b) Use the following schedule to calculate the after-tax effect on the 20x3 income statement: Group A Group B Group C Group D Income (loss) before impairment Impairment loss Income (loss) before tax Tax (expense) benefit Net income (loss) c) For Group Conly, assume that the expected income from operations from 1/1/20x4 to 4/1/20x4 was actually $1,630 and that the actual loss on the disposal of fixed assets was $4,850. Calculate the after-tax effect on the 20x4 income statement for Group C. Problem 2-PPE Impairment On September 1, 20X3, the management of Loos Moos Dairy has asked you to analyze several groups of assets for impairment. The carrying value of the net assets as of fiscal year-end 12/31/20x3 is listed below. Disposal of these asset groups is expected to be completed by 4/1/20x4. Each of the following groups should be considered independently. Assume the tax rate is 21%. Carrying value of asset group at YE 12/31/20X3 $ 35,000 35,000 35,000 35,000 Expected income (loss) from operations of segment net assets from 1/1/2004 to 4/1/20X4 $ 10,400 (3,900) Income (loss) from operations of segment net assets for 20X3 $ 55,100 14,600 (8,500) (10,700) Group A Group B Group C Group D Expected gain (loss) on disposal of segment net assets on 4/1/20X4 $ (7,200) (3,600) (6,300) 2,500 (3,800) 2,700 Required: a) For each asset group above, complete the following schedule as the basis for valuing each asset group in the financial statements for the year ending 12/31/20x3. Fair value of asset group at YE 12/31/2003 Future cash flows from asset group Is asset group impaired? Amount of impairment loss Group A Group B Group C Group D b) Use the following schedule to calculate the after-tax effect on the 20x3 income statement: Group A Group B Group C Group D Income (loss) before impairment Impairment loss Income (loss) before tax Tax (expense) benefit Net income (loss) c) For Group Conly, assume that the expected income from operations from 1/1/20x4 to 4/1/20x4 was actually $1,630 and that the actual loss on the disposal of fixed assets was $4,850. Calculate the after-tax effect on the 20x4 income statement for Group C