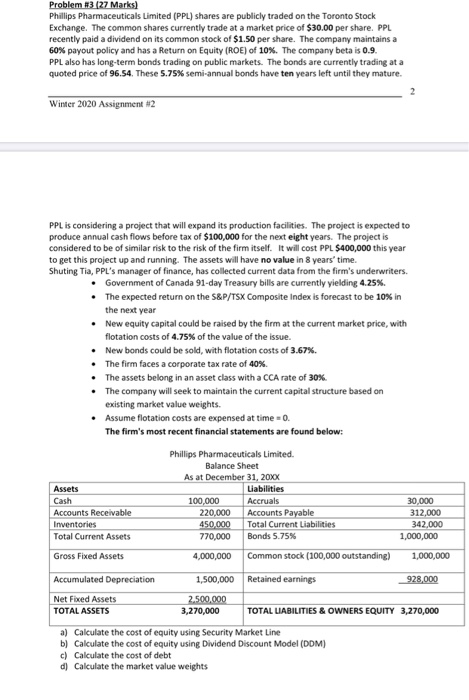

Problem #3 127 Marks) Phillips Pharmaceuticals Limited (PPL) shares are publicly traded on the Toronto Stock Exchange. The common shares currently trade at a market price of $30.00 per share. PPL recently paid a dividend on its common stock of $1.50 per share. The company maintains a 60% payout policy and has a Return on Equity (ROE) of 10%. The company beta is 0.9. PPL also has long-term bonds trading on public markets. The bonds are currently trading at a quoted price of 96.54. These 5.75% semi-annual bonds have ten years left until they mature. Winter 2020 Assignment #2 PPL is considering a project that will expand its production facilities. The project is expected to produce annual cash flows before tax of $100,000 for the next eight years. The project is considered to be of similar risk to the risk of the firm itself. It will cost PPL $400,000 this year to get this project up and running. The assets will have no value in 8 years' time. Shuting Tia, PPL's manager of finance, has collected current data from the firm's underwriters. . Government of Canada 91-day Treasury bills are currently yielding 4.25%. The expected return on the S&P/TSX Composite Index is forecast to be 10% in the next year New equity capital could be raised by the firm at the current market price, with flotation costs of 4.75% of the value of the issue. New bonds could be sold, with flotation costs of 3.67%. The firm faces a corporate tax rate of 40% The assets belong in an asset class with a CCA rate of 30% The company will seek to maintain the current capital structure based on existing market value weights. Assume flotation costs are expensed at time=0. The firm's most recent financial statements are found below: Assets Cash Accounts Receivable Inventories Total Current Assets Phillips Pharmaceuticals Limited. Balance Sheet As at December 31, 20XX Labilities 100.000 Accruals 220,000 Accounts Payable 450.000 Total Current Liabilities 770,000 Bonds 5.75% 30.000 312.000 342,000 1,000,000 Gross Fixed Assets 4,000,000 Common stock (100,000 outstanding) 1,000,000 Accumulated Depreciation 1,500,000 Retained earnings 928,000 Net Fixed Assets TOTAL ASSETS 2.500.000 3,270,000 TOTAL LIABILITIES & OWNERS EQUITY 3,270,000 a) Calculate the cost of equity using Security Market Line b) Calculate the cost of equity using Dividend Discount Model (DDM) c) Calculate the cost of debt d) Calculate the market value weights