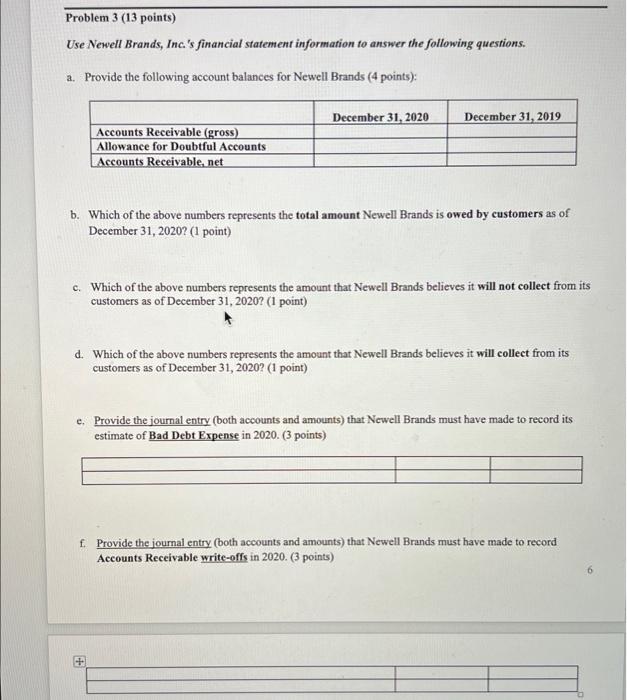

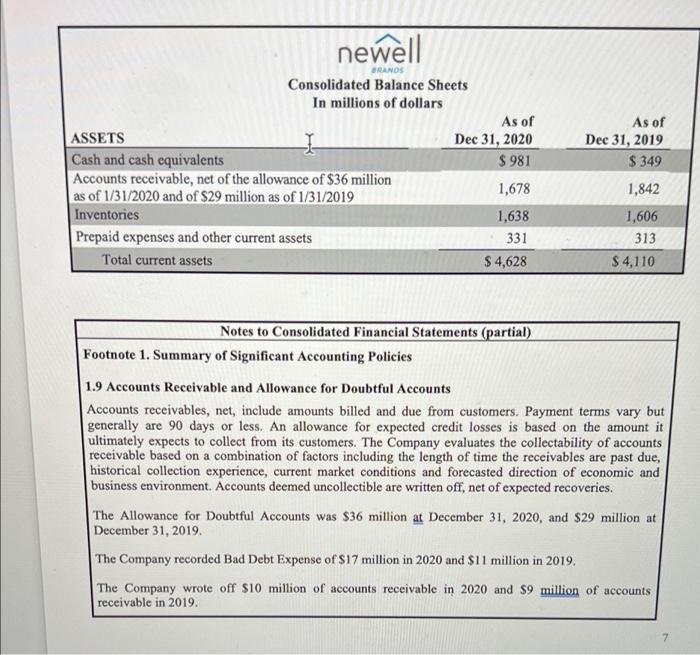

Problem 3 (13 points) Use Newell Brands, Inc.'s financial statement information to answer the following questions. a. Provide the following account balances for Newell Brands (4 points): December 31, 2020 December 31, 2019 Accounts Receivable (gross) Allowance for Doubtful Accounts Accounts Receivable, net b. Which of the above numbers represents the total amount Newell Brands is owed by customers as of December 31, 2020? (1 point) c. Which of the above numbers represents the amount that Newell Brands believes it will not collect from its customers as of December 31, 2020? (1 point) d. Which of the above numbers represents the amount that Newell Brands believes it will collect from its customers as of December 31, 2020? (1 point) e Provide the journal entry (both accounts and amounts) that Newell Brands must have made to record its estimate of Bad Debt Expense in 2020. (3 points) f. Provide the journal entry (both accounts and amounts) that Newell Brands must have made to record Accounts Receivable write-offs in 2020. (3 points) newell BRANDS Consolidated Balance Sheets In millions of dollars As of ASSETS Dec 31, 2020 Cash and cash equivalents $ 981 Accounts receivable, net of the allowance of $36 million 1,678 as of 1/31/2020 and of $29 million as of 1/31/2019 Inventories 1,638 Prepaid expenses and other current assets 331 Total current assets $ 4,628 As of Dec 31, 2019 $ 349 1,842 1,606 313 $ 4,110 Notes to Consolidated Financial Statements (partial) Footnote 1. Summary of Significant Accounting Policies 1.9 Accounts Receivable and Allowance for Doubtful Accounts Accounts receivables, net, include amounts billed and due from customers. Payment terms vary but generally are 90 days or less. An allowance for expected credit losses is based on the amount it ultimately expects to collect from its customers. The Company evaluates the collectability of accounts receivable based on a combination of factors including the length of time the receivables are past due, historical collection experience, current market conditions and forecasted direction of economic and business environment. Accounts deemed uncollectible are written off, net of expected recoveries. The Allowance for Doubtful Accounts was $36 million at December 31, 2020, and $29 million at December 31, 2019. The Company recorded Bad Debt Expense of $17 million in 2020 and $11 million in 2019. The Company wrote off $10 million of accounts receivable in 2020 and $9 million of accounts receivable in 2019. Problem 3 (13 points) Use Newell Brands, Inc.'s financial statement information to answer the following questions. a. Provide the following account balances for Newell Brands (4 points): December 31, 2020 December 31, 2019 Accounts Receivable (gross) Allowance for Doubtful Accounts Accounts Receivable, net b. Which of the above numbers represents the total amount Newell Brands is owed by customers as of December 31, 2020? (1 point) c. Which of the above numbers represents the amount that Newell Brands believes it will not collect from its customers as of December 31, 2020? (1 point) d. Which of the above numbers represents the amount that Newell Brands believes it will collect from its customers as of December 31, 2020? (1 point) e Provide the journal entry (both accounts and amounts) that Newell Brands must have made to record its estimate of Bad Debt Expense in 2020. (3 points) f. Provide the journal entry (both accounts and amounts) that Newell Brands must have made to record Accounts Receivable write-offs in 2020. (3 points) newell BRANDS Consolidated Balance Sheets In millions of dollars As of ASSETS Dec 31, 2020 Cash and cash equivalents $ 981 Accounts receivable, net of the allowance of $36 million 1,678 as of 1/31/2020 and of $29 million as of 1/31/2019 Inventories 1,638 Prepaid expenses and other current assets 331 Total current assets $ 4,628 As of Dec 31, 2019 $ 349 1,842 1,606 313 $ 4,110 Notes to Consolidated Financial Statements (partial) Footnote 1. Summary of Significant Accounting Policies 1.9 Accounts Receivable and Allowance for Doubtful Accounts Accounts receivables, net, include amounts billed and due from customers. Payment terms vary but generally are 90 days or less. An allowance for expected credit losses is based on the amount it ultimately expects to collect from its customers. The Company evaluates the collectability of accounts receivable based on a combination of factors including the length of time the receivables are past due, historical collection experience, current market conditions and forecasted direction of economic and business environment. Accounts deemed uncollectible are written off, net of expected recoveries. The Allowance for Doubtful Accounts was $36 million at December 31, 2020, and $29 million at December 31, 2019. The Company recorded Bad Debt Expense of $17 million in 2020 and $11 million in 2019. The Company wrote off $10 million of accounts receivable in 2020 and $9 million of accounts receivable in 2019