Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3 (15): The value of a company's equity is $4 million and its volatility is 60%. The debt that will have to be

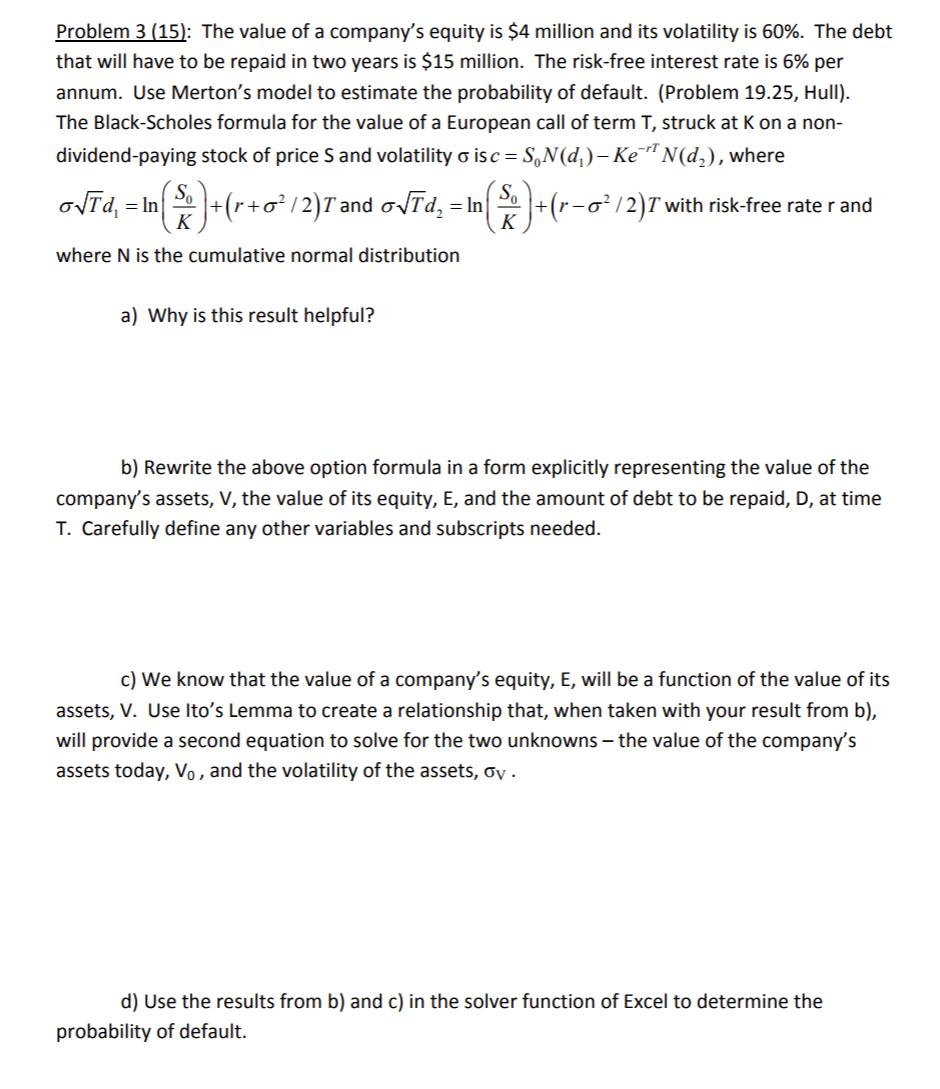

Problem 3 (15): The value of a company's equity is $4 million and its volatility is 60%. The debt that will have to be repaid in two years is $15 million. The risk-free interest rate is 6% per annum. Use Merton's model to estimate the probability of default. (Problem 19.25, Hull). The Black-Scholes formula for the value of a European call of term T, struck at K on a non- dividend-paying stock of price S and volatility is c = SN(d) - Kert N(d), where oTd = In (x) + (r+o / 2) T and oTd = In (3) + (r-o/2)T with risk-free rate rand K where N is the cumulative normal distribution K a) Why is this result helpful? b) Rewrite the above option formula in a form explicitly representing the value of the company's assets, V, the value of its equity, E, and the amount of debt to be repaid, D, at time T. Carefully define any other variables and subscripts needed. c) We know that the value of a company's equity, E, will be a function of the value of its assets, V. Use Ito's Lemma to create a relationship that, when taken with your result from b), will provide a second equation to solve for the two unknowns - the value of the company's assets today, Vo, and the volatility of the assets, ov. d) Use the results from b) and c) in the solver function of Excel to determine the probability of default.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started