Answered step by step

Verified Expert Solution

Question

1 Approved Answer

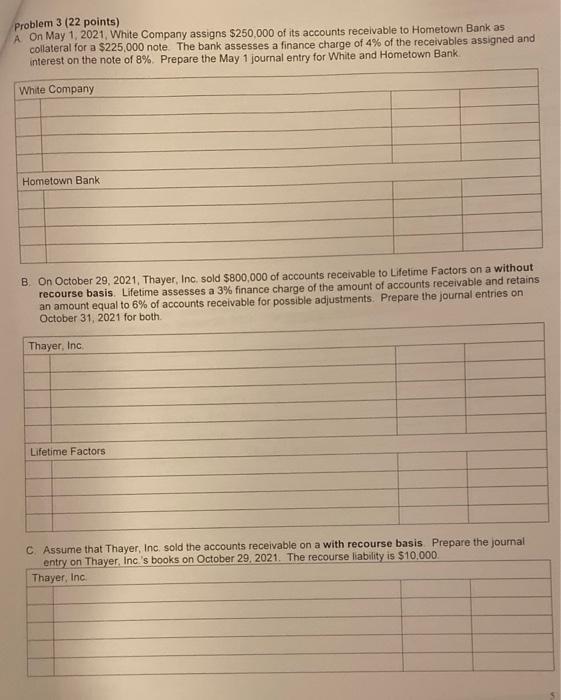

Problem 3 (22 points) A On May 1, 2021, White Company assigns $250,000 of its accounts receivable to Hometown Bank as collateral for a

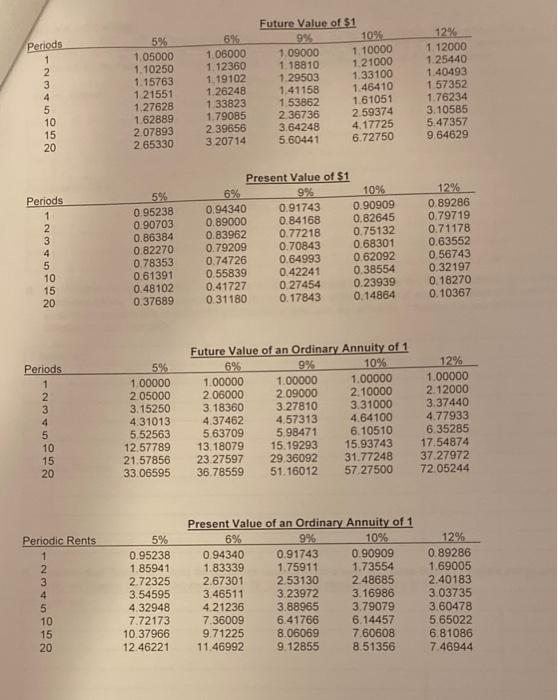

Problem 3 (22 points) A On May 1, 2021, White Company assigns $250,000 of its accounts receivable to Hometown Bank as collateral for a $225,000 note. The bank assesses a finance charge of 4% of the receivables assigned and interest on the note of 8%. Prepare the May 1 journal entry for White and Hometown Bank. White Company Hometown Bank B. On October 29, 2021, Thayer, Inc. sold $800,000 of accounts receivable to Lifetime Factors on a without recourse basis. Lifetime assesses a 3% finance charge of the amount of accounts receivable and retains an amount equal to 6% of accounts receivable for possible adjustments. Prepare the journal entries on October 31, 2021 for both. Thayer, Inc. Lifetime Factors C. Assume that Thayer, Inc. sold the accounts receivable on a with recourse basis Prepare the journal entry on Thayer, Inc.'s books on October 29, 2021. The recourse liability is $10,000. Thayer, Inc. Periods N 10 15 20 Periods INSTRUK9 1 2 3 4 5 10 15 20 Periods 1 2 3 4 5 10 15 20 Periodic Rents 1554555 10 20 5% 1,05000 1,10250 1.15763 1.21551 1.27628 1.62889 2.07893 265330 5% 0.95238 0.90703 0.86384 0.82270 0.78353 0.61391 0.48102 0.37689 5% 1.00000 2.05000 6% 1.06000 1.12360 1,19102 1.26248 3.15250 4.31013 1.33823 1.79085 2.39656 3.20714 6% 0.94340 0.89000 0.83962 0.79209 0.74726 0.55839 0.41727 0.31180 Future Value of $1 6% 0.94340 1.83339 2.67301 3.46511 1.09000 1.18810 5% 0.95238 1.85941 2.72325 3.54595 4.32948 7.72173 10.37966 12.46221 11.46992 4.21236 7.36009 9.71225 1.29503 1.41158 1.53862 2.36736 Present Value of $1 9% 3.64248 5.60441 0.91743 0.84168 0.77218 0.70843 0.64993 0.42241 0.27454 0.17843 Future Value of an Ordinary Annuity of 1 6% 9% 10% 1.00000 1.00000 1.00000 2.06000 2.09000 2,10000 3.18360 3.27810 3.31000 4.37462 4.57313 4.64100 5.52563 5.63709 5,98471 6.10510 12.57789. 13.18079 15.19293 15.93743 21.57856 23.27597 29.36092 31.77248 33.06595 36.78559 51.16012 57.27500 10% 1.10000 1,21000 1.33100 1.46410 Present Value of an Ordinary Annuity of 1 10% 0.90909 1.73554 2.48685 3.16986 9% 0.91743 1.75911 2.53130 3.23972 3.88965 1.61051 2.59374 4.17725 6.72750 6.41766 8.06069 9.12855 10% 0.90909 0.82645 0.75132 0.68301 0.62092 0.38554 0.23939 0.14864 3.79079 6.14457 7.60608 8.51356 12% 1.12000 1.25440 1.40493 1.57352 1.76234 3.10585 5.47357 9.64629 12% 0.89286 0.79719 0.71178 0.63552 0,56743 0.32197 0.18270 0.10367 12% 1.00000 2.12000 3.37440 4.77933 6.35285 17.54874 37.27972 72.05244 12% 0.89286 1.69005 2,40183 3.03735 3.60478 5.65022 6.81086 7.46944

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The answer is as follows A When a company takes loan or signs a note with a ban...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started