Answered step by step

Verified Expert Solution

Question

1 Approved Answer

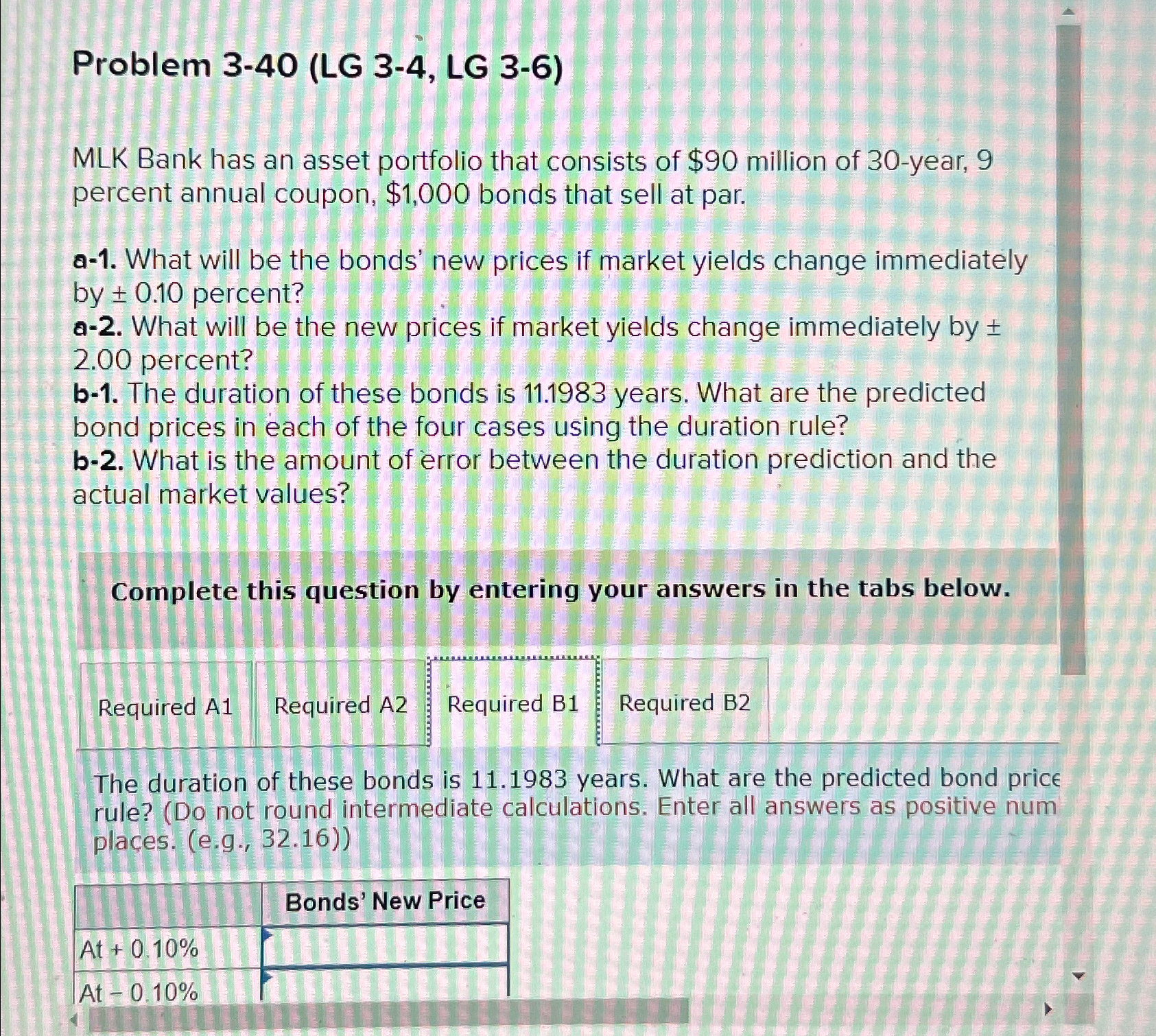

Problem 3 - 4 0 ( LG 3 - 4 , LG 3 - 6 ) MLK Bank has an asset portfolio that consists of

Problem LG LG

MLK Bank has an asset portfolio that consists of $ million of year, percent annual coupon, $ bonds that sell at par.

a What will be the bonds' new prices if market yields change immediately by percent?

a What will be the new prices if market yields change immediately by percent?

b The duration of these bonds is years. What are the predicted bond prices in each of the four cases using the duration rule?

What is the amount of error between the duration prediction and the actual market values?

Complete this question by entering your answers in the tabs below.

Required A

Required A

Required B

Required B

What will be the new prices if market yields change immediately by perc calculations. Enter all answers as positive numbers. Round your answers to de

tableBonds' New PriceAt At

Problem LG LG

MLK Bank has an asset portfolio that consists of $ million of year, percent annual coupon, $ bonds that sell at par.

a What will be the bonds' new prices if market yields change immediately by percent?

a What will be the new prices if market yields change immediately by percent?

b The duration of these bonds is years. What are the predicted bond prices in each of the four cases using the duration rule?

What is the amount of error between the duration prediction and the actual market values?

Complete this question by entering your answers in the tabs below.

Required A

Required A

Required B

Required B

The duration of these bonds is years. What are the predicted bond price rule? Do not round intermediate calculations. Enter all answers as positive num plaeseg

tableBonds' New Price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started