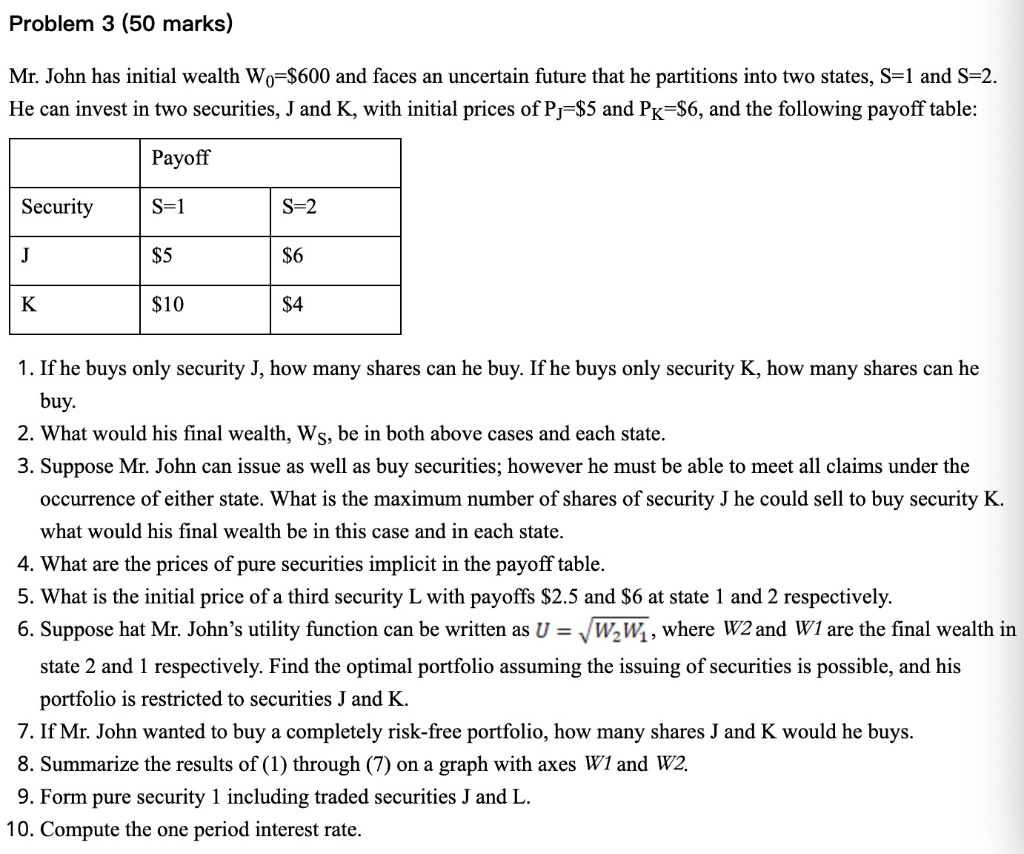

Problem 3 (50 marks) Mr. John has initial wealth Wo=$600 and faces an uncertain future that he partitions into two states, S=1 and S=2. He can invest in two securities, J and K, with initial prices of Pj=$5 and Pk=$6, and the following payoff table: Payoff Security S=1 S=2 J $5 $6 K $10 $4 1. If he buys only security J, how many shares can he buy. If he buys only security K, how many shares can he buy. 2. What would his final wealth, Ws, be in both above cases and each state. 3. Suppose Mr. John can issue as well as buy securities; however he must be able to meet all claims under the occurrence of either state. What is the maximum number of shares of security J he could sell to buy security K. what would his final wealth be in this case and in each state. 4. What are the prices of pure securities implicit in the payoff table. 5. What is the initial price of a third security L with payoffs $2.5 and $6 at state 1 and 2 respectively. 6. Suppose hat Mr. John's utility function can be written as U = W2W1, where W2 and W1 are the final wealth in state 2 and 1 respectively. Find the optimal portfolio assuming the issuing of securities is possible, and his portfolio is restricted to securities J and K. 7. If Mr. John wanted to buy a completely risk-free portfolio, how many shares J and K would he buys. 8. Summarize the results of (1) through (7) on a graph with axes W1 and W2. 9. Form pure security 1 including traded securities J and L. 10. Compute the one period interest rate. Problem 3 (50 marks) Mr. John has initial wealth Wo=$600 and faces an uncertain future that he partitions into two states, S=1 and S=2. He can invest in two securities, J and K, with initial prices of Pj=$5 and Pk=$6, and the following payoff table: Payoff Security S=1 S=2 J $5 $6 K $10 $4 1. If he buys only security J, how many shares can he buy. If he buys only security K, how many shares can he buy. 2. What would his final wealth, Ws, be in both above cases and each state. 3. Suppose Mr. John can issue as well as buy securities; however he must be able to meet all claims under the occurrence of either state. What is the maximum number of shares of security J he could sell to buy security K. what would his final wealth be in this case and in each state. 4. What are the prices of pure securities implicit in the payoff table. 5. What is the initial price of a third security L with payoffs $2.5 and $6 at state 1 and 2 respectively. 6. Suppose hat Mr. John's utility function can be written as U = W2W1, where W2 and W1 are the final wealth in state 2 and 1 respectively. Find the optimal portfolio assuming the issuing of securities is possible, and his portfolio is restricted to securities J and K. 7. If Mr. John wanted to buy a completely risk-free portfolio, how many shares J and K would he buys. 8. Summarize the results of (1) through (7) on a graph with axes W1 and W2. 9. Form pure security 1 including traded securities J and L. 10. Compute the one period interest rate