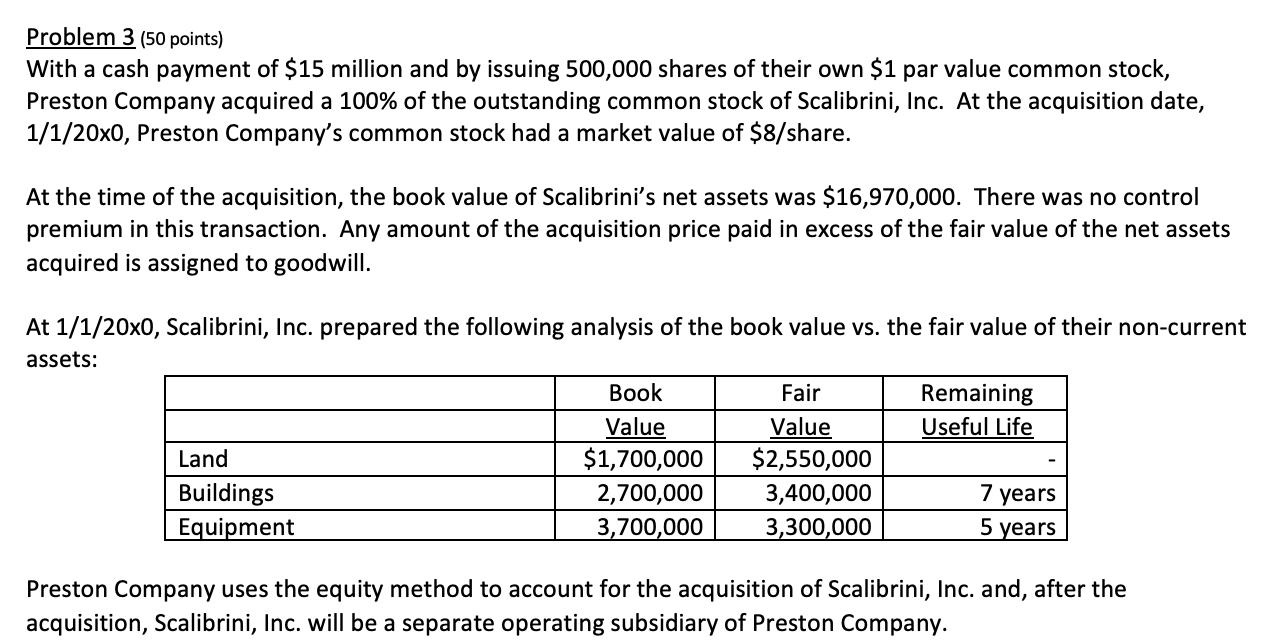

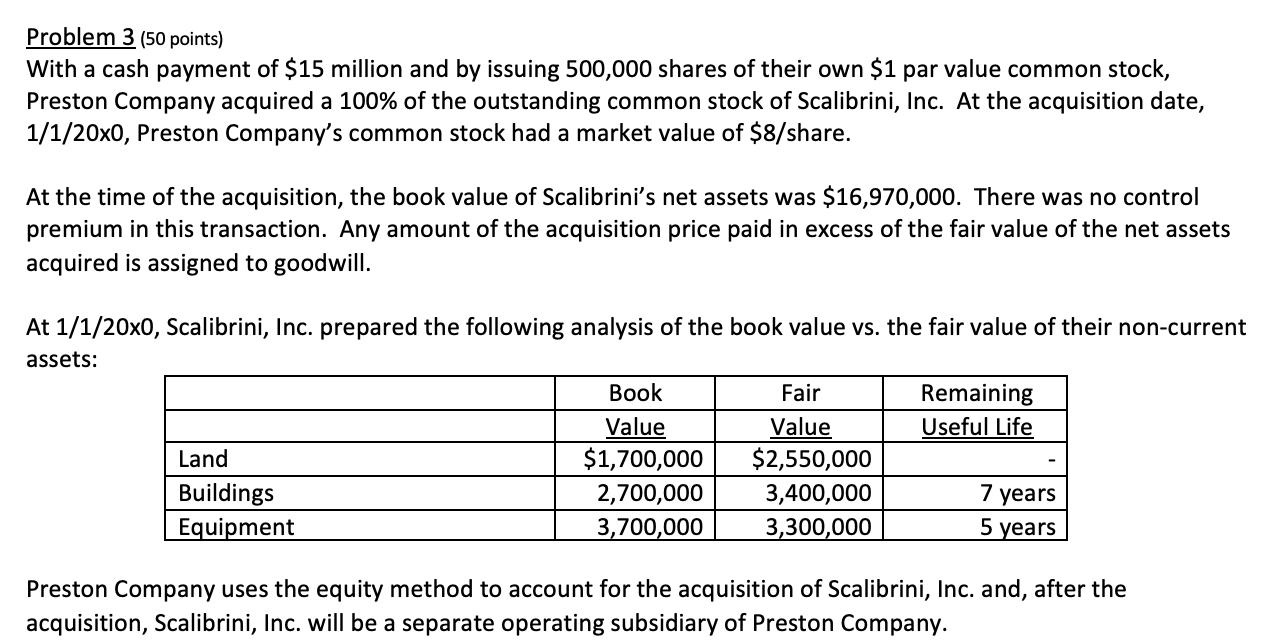

Problem 3 (50 points) With a cash payment of $15 million and by issuing 500,000 shares of their own $1 par value common stock, Preston Company acquired a 100% of the outstanding common stock of Scalibrini, Inc. At the acquisition date, 1/1/20x0, Preston Company's common stock had a market value of $8/share. At the time of the acquisition, the book value of Scalibrini's net assets was $16,970,000. There was no control premium in this transaction. Any amount of the acquisition price paid in excess of the fair value of the net assets acquired is assigned to goodwill. At 1/1/20x0, Scalibrini, Inc. prepared the following analysis of the book value vs. the fair value of their non-current assets: Book Fair Remaining Value Value Useful Life Land $1,700,000 $2,550,000 Buildings 2,700,000 3,400,000 Equipment 3,700,000 3,300,000 5 years 7 years Preston Company uses the equity method to account for the acquisition of Scalibrini, Inc. and, after the acquisition, Scalibrini, Inc. will be a separate operating subsidiary of Preston Company. Required: A. Prepare the journal entry to record Preston Company's investment in Scalibrini, Inc. @1/1/20x0. E. For information purposes, the Controller of Preston Company asks that you briefly summarize the implications for the consolidation accounting and the consolidating adjusting entries of an intra-entity transfer of a depreciable asset, i.e. between Preston and Scalibrini. Problem 3 (50 points) With a cash payment of $15 million and by issuing 500,000 shares of their own $1 par value common stock, Preston Company acquired a 100% of the outstanding common stock of Scalibrini, Inc. At the acquisition date, 1/1/20x0, Preston Company's common stock had a market value of $8/share. At the time of the acquisition, the book value of Scalibrini's net assets was $16,970,000. There was no control premium in this transaction. Any amount of the acquisition price paid in excess of the fair value of the net assets acquired is assigned to goodwill. At 1/1/20x0, Scalibrini, Inc. prepared the following analysis of the book value vs. the fair value of their non-current assets: Book Fair Remaining Value Value Useful Life Land $1,700,000 $2,550,000 Buildings 2,700,000 3,400,000 Equipment 3,700,000 3,300,000 5 years 7 years Preston Company uses the equity method to account for the acquisition of Scalibrini, Inc. and, after the acquisition, Scalibrini, Inc. will be a separate operating subsidiary of Preston Company. Required: A. Prepare the journal entry to record Preston Company's investment in Scalibrini, Inc. @1/1/20x0. E. For information purposes, the Controller of Preston Company asks that you briefly summarize the implications for the consolidation accounting and the consolidating adjusting entries of an intra-entity transfer of a depreciable asset, i.e. between Preston and Scalibrini