Answered step by step

Verified Expert Solution

Question

1 Approved Answer

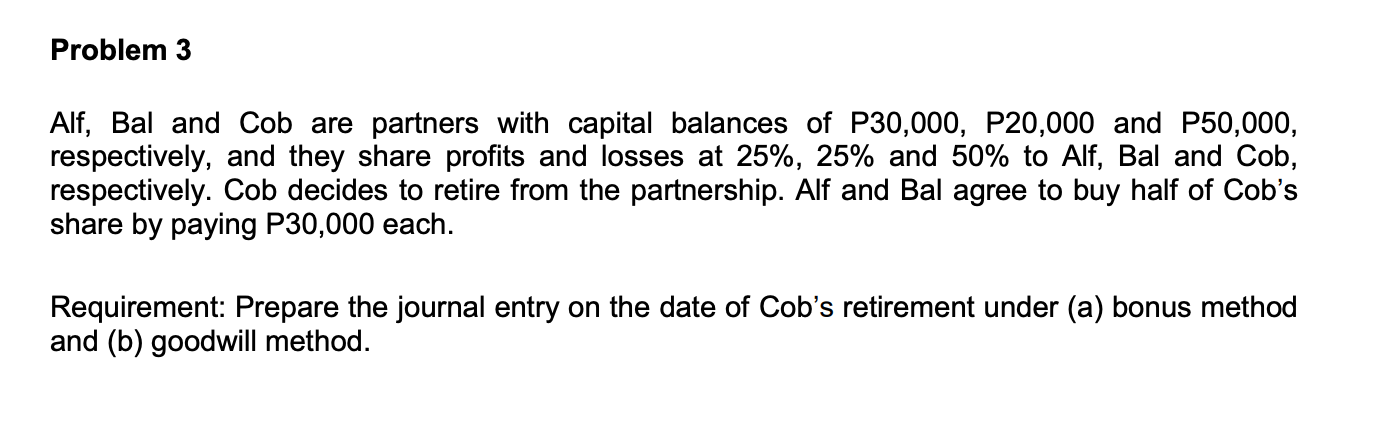

Problem 3 Alf, Bal and Cob are partners with capital balances of P30,000, P20,000 and P50,000, respectively, and they share profits and losses at

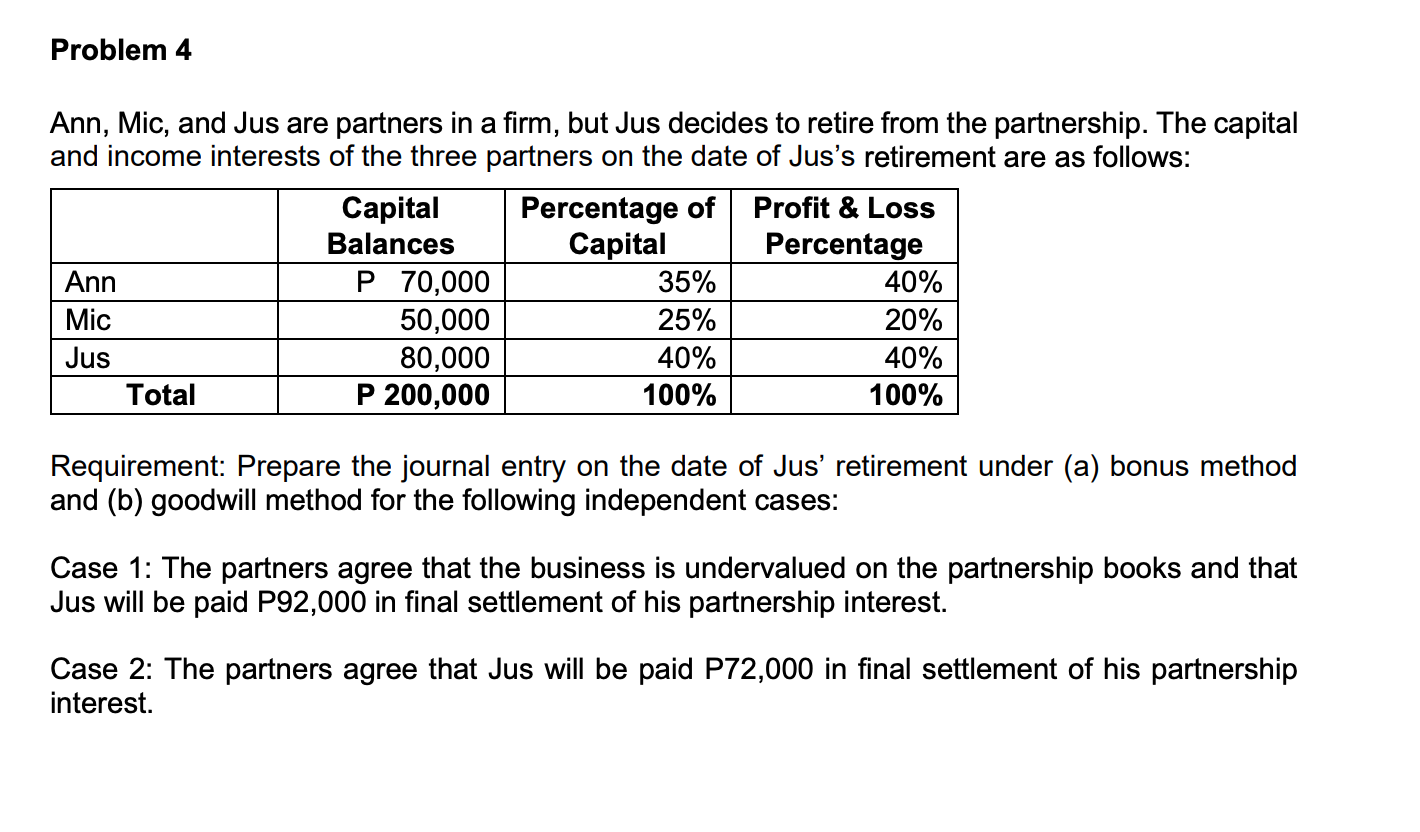

Problem 3 Alf, Bal and Cob are partners with capital balances of P30,000, P20,000 and P50,000, respectively, and they share profits and losses at 25%, 25% and 50% to Alf, Bal and Cob, respectively. Cob decides to retire from the partnership. Alf and Bal agree to buy half of Cob's share by paying P30,000 each. Requirement: Prepare the journal entry on the date of Cob's retirement under (a) bonus method and (b) goodwill method. Problem 4 Ann, Mic, and Jus are partners in a firm, but Jus decides to retire from the partnership. The capital and income interests of the three partners on the date of Jus's retirement are as follows: Capital Balances Percentage of Profit & Loss Ann Mic Jus Total P 70,000 50,000 80,000 P 200,000 Capital 35% 25% 40% 100% Percentage 40% 20% 40% 100% Requirement: Prepare the journal entry on the date of Jus' retirement under (a) bonus method and (b) goodwill method for the following independent cases: Case 1: The partners agree that the business is undervalued on the partnership books and that Jus will be paid P92,000 in final settlement of his partnership interest. Case 2: The partners agree that Jus will be paid P72,000 in final settlement of his partnership interest.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started