Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 3: Arbitrage connects the prices of different instruments in a portfolio and helps to keep everything correctly or fairly priced. Whenever Fo,t Soet,

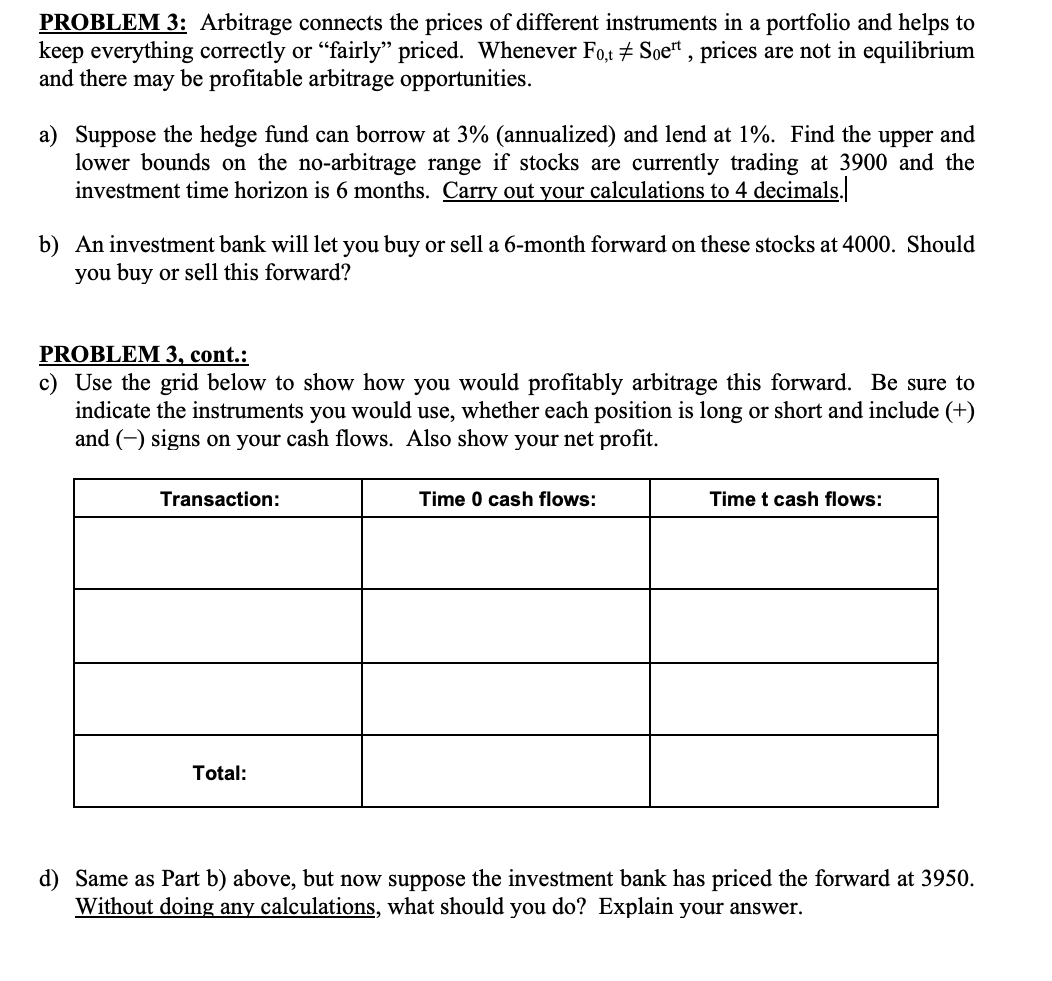

PROBLEM 3: Arbitrage connects the prices of different instruments in a portfolio and helps to keep everything correctly or "fairly" priced. Whenever Fo,t Soet, prices are not in equilibrium and there may be profitable arbitrage opportunities. a) Suppose the hedge fund can borrow at 3% (annualized) and lend at 1%. Find the upper and lower bounds on the no-arbitrage range if stocks are currently trading at 3900 and the investment time horizon is 6 months. Carry out your calculations to 4 decimals. b) An investment bank will let you buy or sell a 6-month forward on these stocks at 4000. Should you buy or sell this forward? PROBLEM 3, cont.: c) Use the grid below to show how you would profitably arbitrage this forward. Be sure to indicate the instruments you would use, whether each position is long or short and include (+) and (-) signs on your cash flows. Also show your net profit. Transaction: Total: Time 0 cash flows: Time t cash flows: d) Same as Part b) above, but now suppose the investment bank has priced the forward at 3950. Without doing any calculations, what should you do? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solving the Arbitrage Problem Part a NoArbitrage Range We can find the noarbitrage range using the cost of carry framework Heres how Upper Bound In th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started