Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3. (Binomial model, 23') Consider a European call option with a maturity of 6 months and a strike of $41. The current spot stock

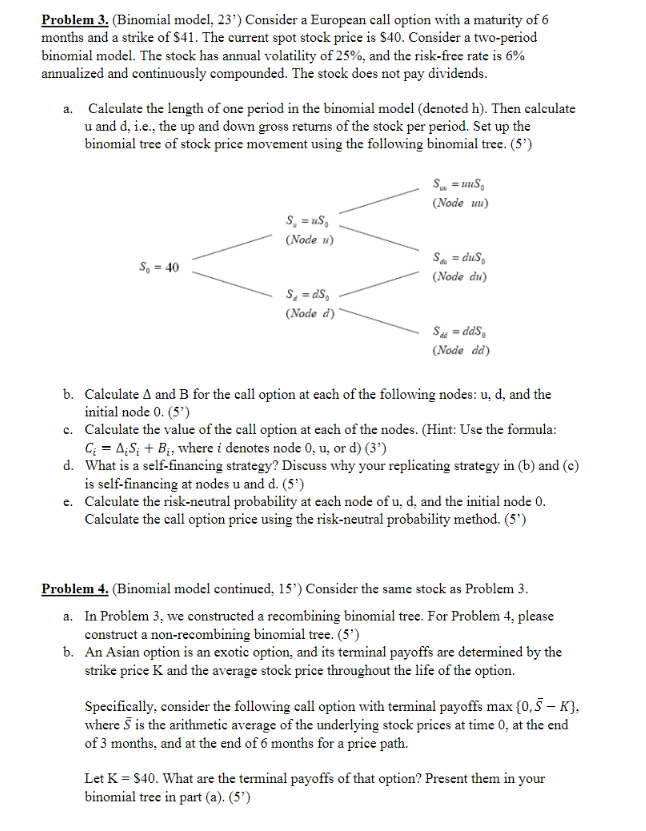

Problem 3. (Binomial model, 23') Consider a European call option with a maturity of 6 months and a strike of $41. The current spot stock price is $40. Consider a two-period binomial model. The stock has annual volatility of 25%, and the risk-free rate is 6% annualized and continuously compounded. The stock does not pay dividends. a. Calculate the length of one period in the binomial model (denoted h ). Then calculate u and d, i.e., the up and down gross returns of the stock per period. Set up the binomial tree of stock price movement using the following binomial tree. (5') b. Calculate and B for the call option at each of the following nodes: u,d, and the initial node 0.(5) c. Calculate the value of the call option at each of the nodes. (Hint: Use the formula: Ci=iSi+Bi, where i denotes node 0 , u, or d) (3') d. What is a self-financing strategy? Discuss why your replicating strategy in (b) and (c) is self-financing at nodes u and d. (5') e. Calculate the risk-neutral probability at each node of u,d, and the initial node 0 . Calculate the call option price using the risk-neutral probability method. (5') Problem 4. (Binomial model continued, 15') Consider the same stock as Problem 3. a. In Problem 3, we constructed a recombining binomial tree. For Problem 4, please construct a non-recombining binomial tree. (5') b. An Asian option is an exotic option, and its terminal payoffs are determined by the strike price K and the average stock price throughout the life of the option. Specifically, consider the following call option with terminal payoffs max{0,SK}, where S is the arithmetic average of the underlying stock prices at time 0 , at the end of 3 months, and at the end of 6 months for a price path. Let K=$40. What are the terminal payoffs of that option? Present them in your binomial tree in part (a). (5')

Problem 3. (Binomial model, 23') Consider a European call option with a maturity of 6 months and a strike of $41. The current spot stock price is $40. Consider a two-period binomial model. The stock has annual volatility of 25%, and the risk-free rate is 6% annualized and continuously compounded. The stock does not pay dividends. a. Calculate the length of one period in the binomial model (denoted h ). Then calculate u and d, i.e., the up and down gross returns of the stock per period. Set up the binomial tree of stock price movement using the following binomial tree. (5') b. Calculate and B for the call option at each of the following nodes: u,d, and the initial node 0.(5) c. Calculate the value of the call option at each of the nodes. (Hint: Use the formula: Ci=iSi+Bi, where i denotes node 0 , u, or d) (3') d. What is a self-financing strategy? Discuss why your replicating strategy in (b) and (c) is self-financing at nodes u and d. (5') e. Calculate the risk-neutral probability at each node of u,d, and the initial node 0 . Calculate the call option price using the risk-neutral probability method. (5') Problem 4. (Binomial model continued, 15') Consider the same stock as Problem 3. a. In Problem 3, we constructed a recombining binomial tree. For Problem 4, please construct a non-recombining binomial tree. (5') b. An Asian option is an exotic option, and its terminal payoffs are determined by the strike price K and the average stock price throughout the life of the option. Specifically, consider the following call option with terminal payoffs max{0,SK}, where S is the arithmetic average of the underlying stock prices at time 0 , at the end of 3 months, and at the end of 6 months for a price path. Let K=$40. What are the terminal payoffs of that option? Present them in your binomial tree in part (a). (5') Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started