Answered step by step

Verified Expert Solution

Question

1 Approved Answer

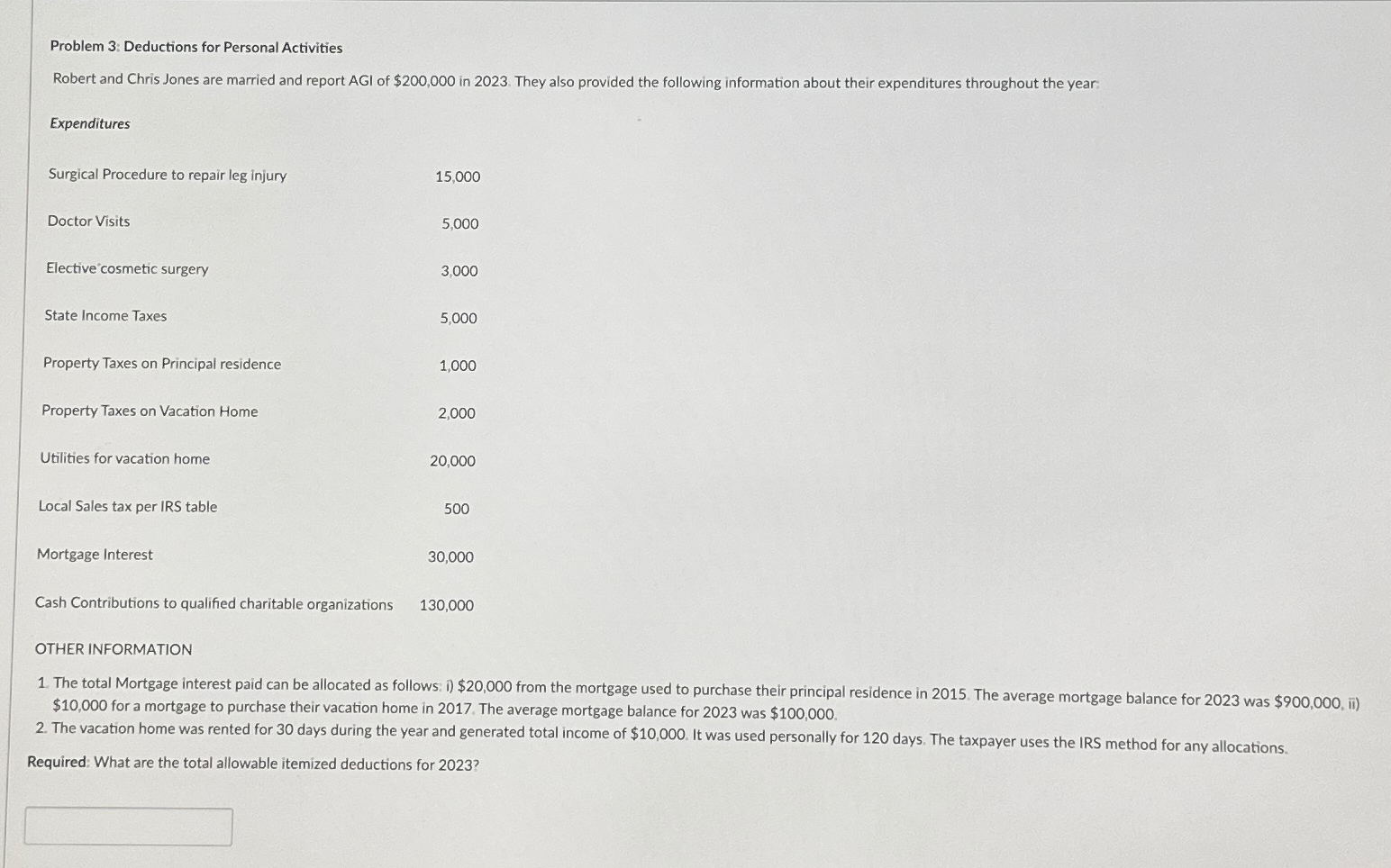

Problem 3 : Deductions for Personal Activities Robert and Chris Jones are married and report AGI of $ 2 0 0 , 0 0 0

Problem : Deductions for Personal Activities

Robert and Chris Jones are married and report AGI of $ in They also provided the following information about their expenditures throughout the year

Expenditures

Surgical Procedure to repair leg injury

Doctor Visits

Elective cosmetic surgery

State Income Taxes

Property Taxes on Principal residence

Property Taxes on Vacation Home

Utilities for vacation home

Local Sales tax per IRS table

Mortgage Interest

Cash Contributions to qualified charitable organizations

OTHER INFORMATION $ for a mortgage to purchase their vacation home in The average mortgage balance for was $

Required: What are the total allowable itemized deductions for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started