Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3 : Deductions for Personal Activities Robert and Chris Jones are married and report AGI of $ 4 0 0 , 0 0 0

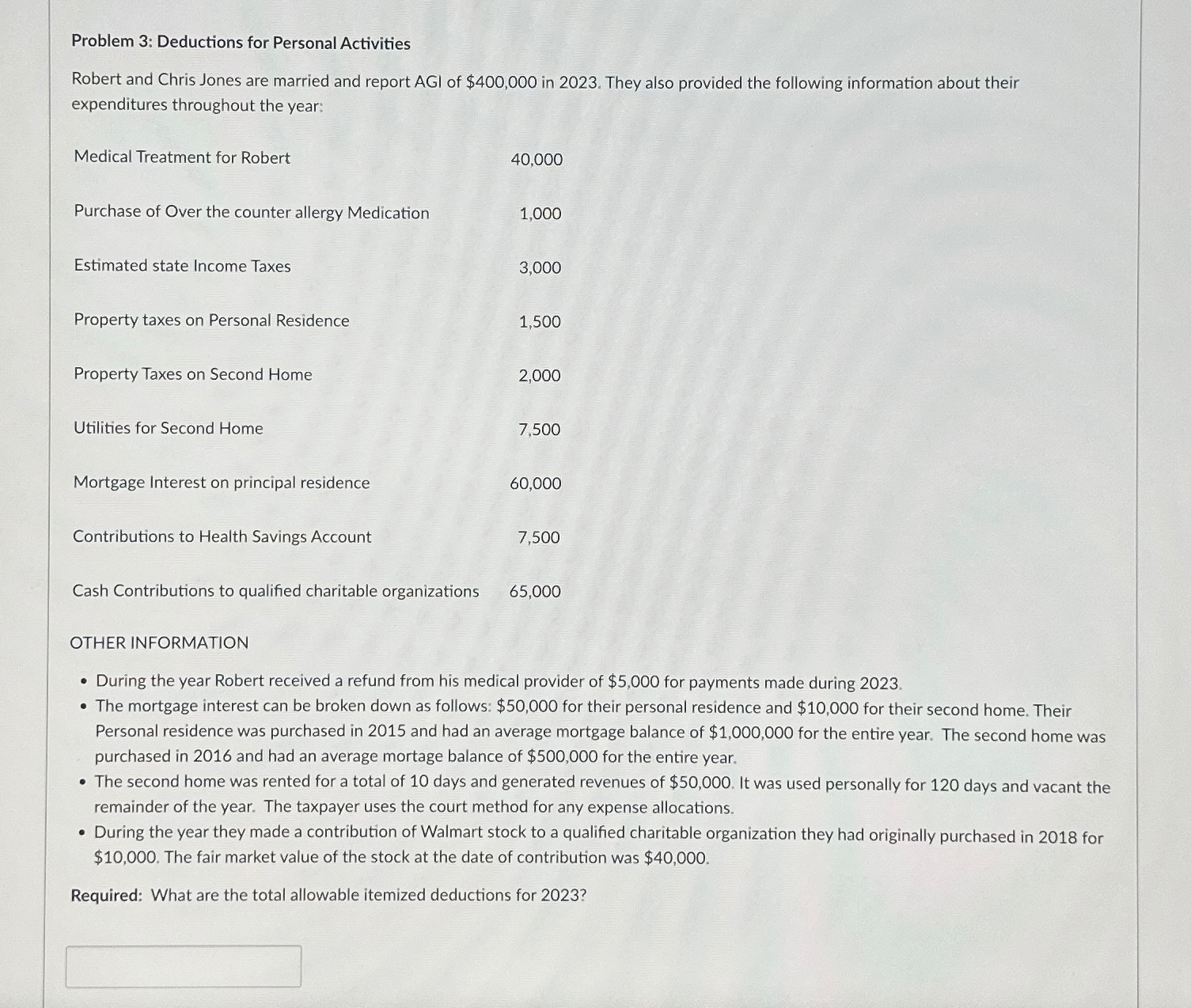

Problem : Deductions for Personal Activities

Robert and Chris Jones are married and report AGI of $ in They also provided the following information about their expenditures throughout the year:

Medical Treatment for Robert

Purchase of Over the counter allergy Medication

Estimated state Income Taxes

Property taxes on Personal Residence

Property Taxes on Second Home

Utilities for Second Home

Mortgage Interest on principal residence

Contributions to Health Savings Account

Cash Contributions to qualified charitable organizations

OTHER INFORMATION

During the year Robert received a refund from his medical provider of $ for payments made during

The mortgage interest can be broken down as follows: $ for their personal residence and $ for their second home. Their Personal residence was purchased in and had an average mortgage balance of $ for the entire year. The second home was purchased in and had an average mortage balance of $ for the entire year.

The second home was rented for a total of days and generated revenues of $ It was used personally for days and vacant the remainder of the year. The taxpayer uses the court method for any expense allocations.

During the year they made a contribution of Walmart stock to a qualified charitable organization they had originally purchased in for $ The fair market value of the stock at the date of contribution was $

Required: What are the total allowable itemized deductions for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started