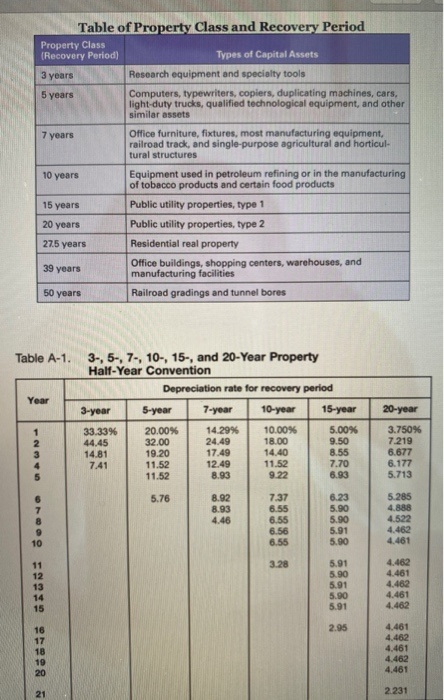

Problem 3: Disposal of assets Gekko Laboratories had purchased some manufacturing equipment five years ago for a total cost of $3,000,000, and has been depreciating those assets using the MACRS rates (i.e., with a 7-year recovery period). Gekko is currently in the market for newer, more efficient equipment, and has already found a buyer, Fox Pharmaceuticals, who is willing to pay $500,000 for the old equipment. If Gekko Labs, which has an effective tax rate of 35%, disposes of the equipment to Fox, then how much after-tax cash flow will be generated for Gekko? Problem 4: Incremental cash flow A $1,000,000 investment (i.e., manufacturing equipment) is depreciated using the modified accelerated cost recovery system. It requires $150,000 in additional inventory and will increase accounts payable by $50,000. It will generate $400,000 in revenue and $150,000 in cash expenses, annually, and the tax rate is 21%. What is the incremental cash flow in years o, 1, 7 and 8? Table of Property Class and Recovery Period Property Class (Recovery Period) Types of Capital Assets 3 years Research equipment and specialty tools 5 years Computers, typewriters, copiers, duplicating machines, cars, light-duty trucks, qualified technological equipment, and other similar assets 7 years Office furniture, fixtures, most manufacturing equipment railroad track, and single-purpose agricultural and horticul- tural structures 10 years 15 years 20 years 27.5 years Equipment used in petroleum refining or in the manufacturing of tobacco products and certain food products Public utility properties, type 1 Public utility properties, type 2 Residential real property Office buildings, shopping centers, warehouses, and manufacturing facilities Railroad gradings and tunnel bores 39 years 50 years Table A-1. 3-, 5-, 7., 10-, 15-, and 20-Year Property Half-Year Convention Depreciation rate for recovery period 3-year 5-year 7-year 10-year 15-year Year 20-year 500 33.33% 44.45 14.81 20.00% 32.00 19.20 11.52 11.52 14.29% 24.49 17.49 12.49 B.93 10.00% 18.00 14.40 11.52 9.22 3.750 7.219 6.677 6.177 5.713 5.76 5.285 4.888 4.522 4.46 4.461 5.90 5.91 5.00 4.462 4.461 4.462 4.461 4.462 5.91 2.95 4.461 4.42 4.461 4.462 4.461 2 231