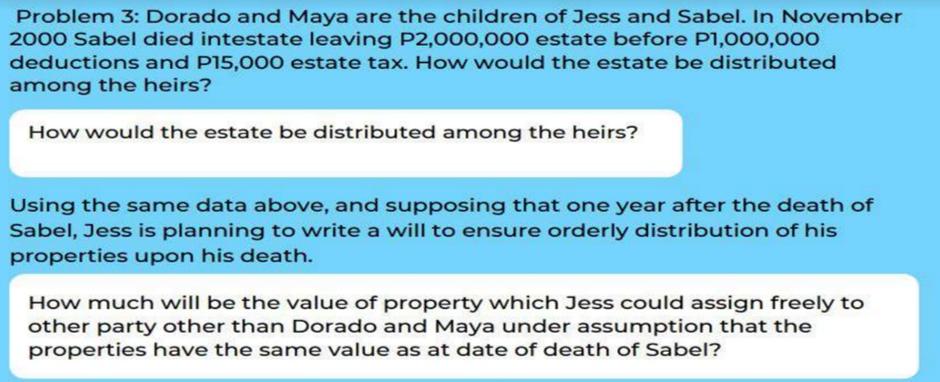

Problem 3: Dorado and Maya are the children of Jess and Sabel. In November 2000 Sabel died intestate leaving P2,000,000 estate before P1,000,000 deductions

Problem 3: Dorado and Maya are the children of Jess and Sabel. In November 2000 Sabel died intestate leaving P2,000,000 estate before P1,000,000 deductions and P15,000 estate tax. How would the estate be distributed among the heirs? How would the estate be distributed among the heirs? Using the same data above, and supposing that one year after the death of Sabel, Jess is planning to write a will to ensure orderly distribution of his properties upon his death. How much will be the value of property which Jess could assign freely to other party other than Dorado and Maya under assumption that the properties have the same value as at date of death of Sabel?

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Distribution of Sabels Estate among Heirs Sabels estate before deductions was P2000000 Aft...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started