Answered step by step

Verified Expert Solution

Question

1 Approved Answer

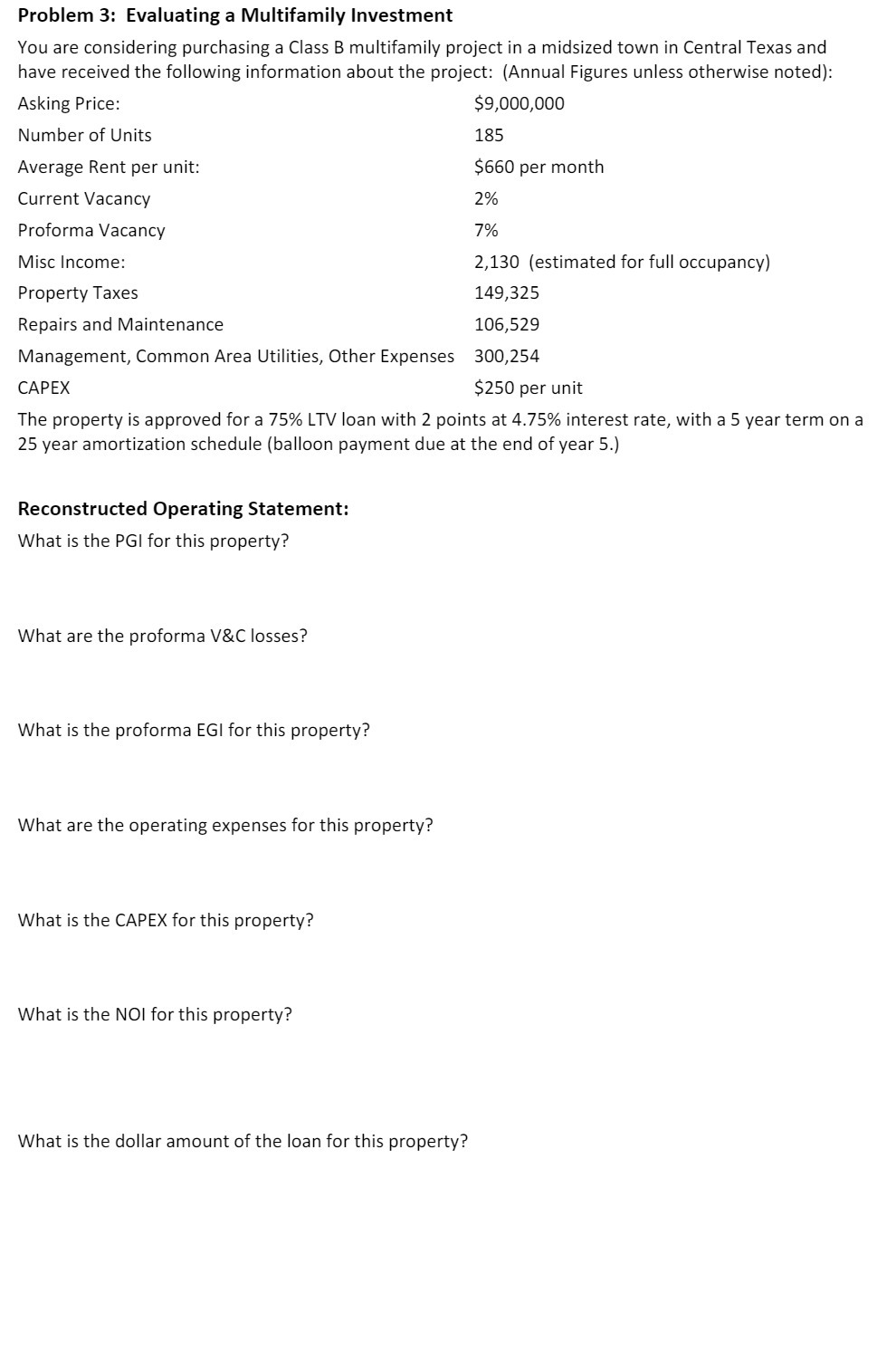

Problem 3: Evaluating a Multifamily Investment You are considering purchasing a Class B multifamily project in a midsized town in Central Texas and have

Problem 3: Evaluating a Multifamily Investment You are considering purchasing a Class B multifamily project in a midsized town in Central Texas and have received the following information about the project: (Annual Figures unless otherwise noted): Asking Price: Number of Units Average Rent per unit: $9,000,000 185 $660 per month Current Vacancy Proforma Vacancy Misc Income: Property Taxes Repairs and Maintenance 2% 7% 2,130 (estimated for full occupancy) 149,325 106,529 Management, Common Area Utilities, Other Expenses 300,254 CAPEX $250 per unit The property is approved for a 75% LTV loan with 2 points at 4.75% interest rate, with a 5 year term on a 25 year amortization schedule (balloon payment due at the end of year 5.) Reconstructed Operating Statement: What is the PGI for this property? What are the proforma V&C losses? What is the proforma EGI for this property? What are the operating expenses for this property? What is the CAPEX for this property? What is the NOI for this property? What is the dollar amount of the loan for this property?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started