Answered step by step

Verified Expert Solution

Question

1 Approved Answer

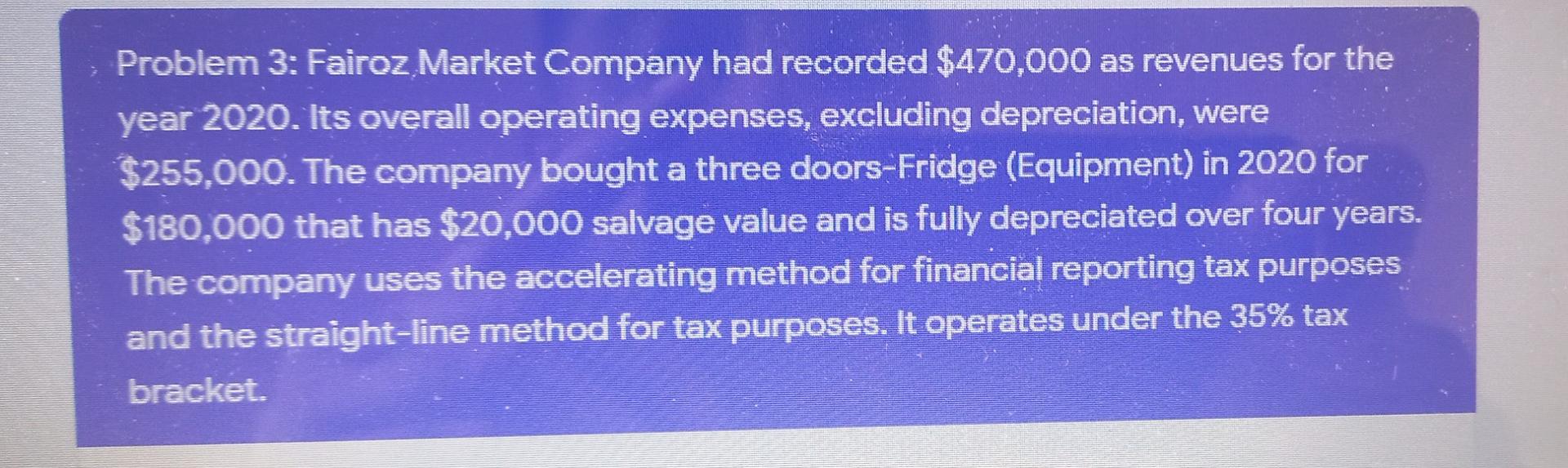

Problem 3: Fairoz Market Company had recorded $470,000 as revenues for the year 2020. Its overall operating expenses, excluding depreciation, were $255,000. The company bought

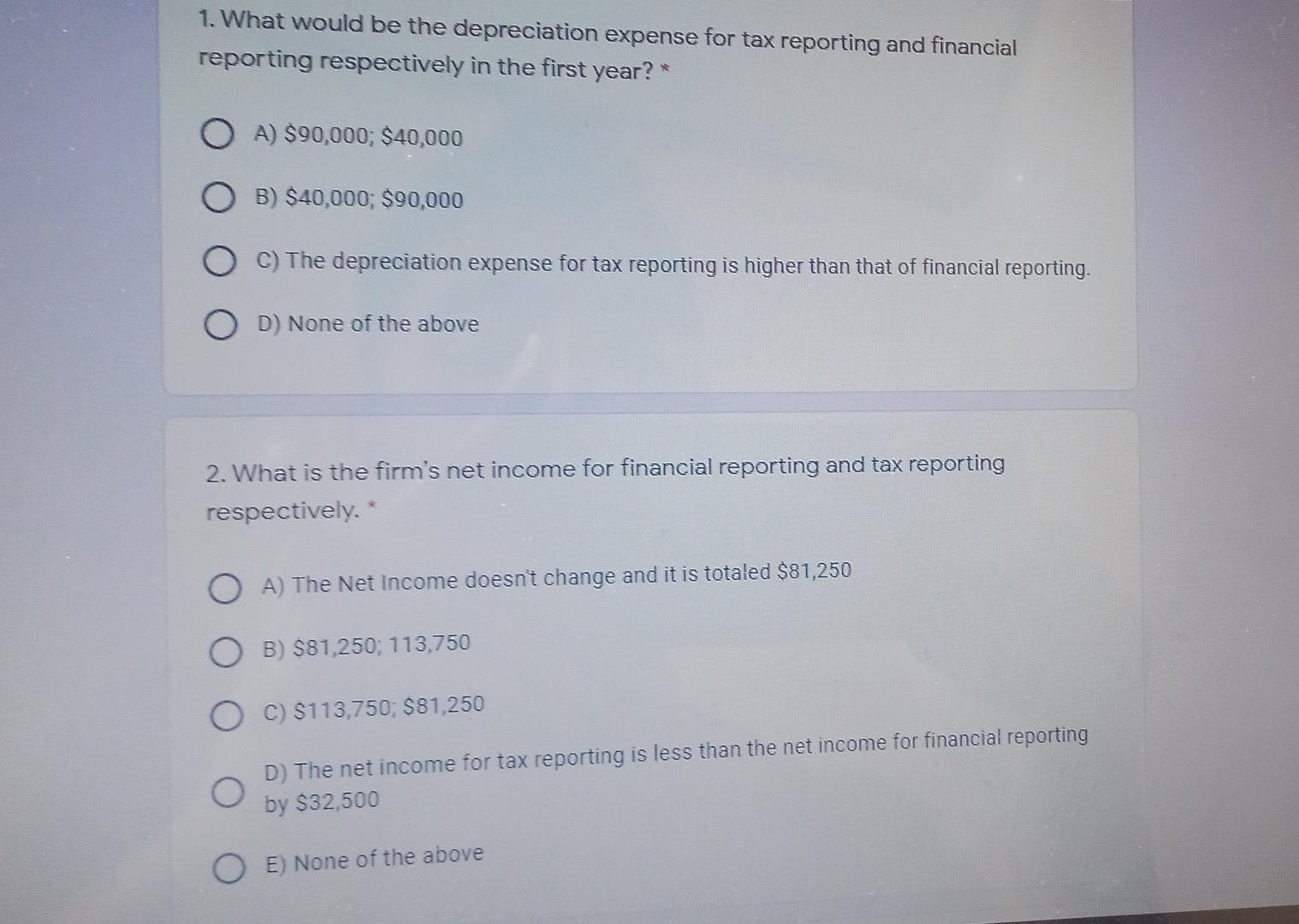

Problem 3: Fairoz Market Company had recorded $470,000 as revenues for the year 2020. Its overall operating expenses, excluding depreciation, were $255,000. The company bought a three doors-Fridge (Equipment) in 2020 for $180,000 that has $20,000 salvage value and is fully depreciated over four years. The company uses the accelerating method for financial reporting tax purposes and the straight-line method for tax purposes. It operates under the 35% tax bracket. 1. What would be the depreciation expense for tax reporting and financial reporting respectively in the first year?* OA) $90,000; $40,000 B) $40,000; $90,000 C) The depreciation expense for tax reporting is higher than that of financial reporting. OD) None of the above 2. What is the firm's net income for financial reporting and tax reporting respectively. O A) The Net Income doesn't change and it is totaled $81,250 OB) $81,250; 113,750 O C) $113,750; $81,250 O D) The net income for tax reporting is less than the net income for financial reporting by $32,500 OE) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started