Answered step by step

Verified Expert Solution

Question

1 Approved Answer

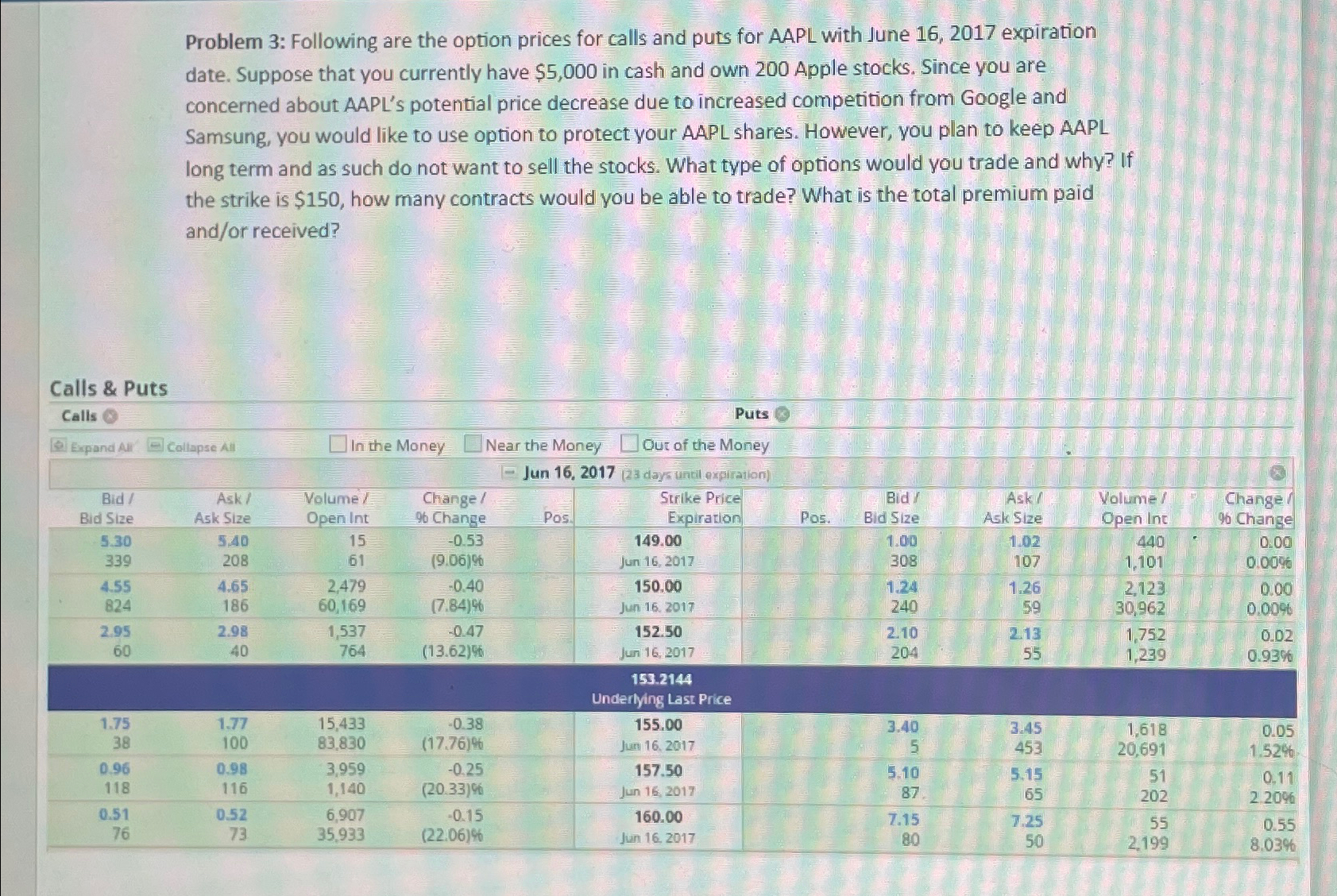

Problem 3 : Following are the option prices for calls and puts for AAPL with June 1 6 , 2 0 1 7 expiration date.

Problem : Following are the option prices for calls and puts for AAPL with June expiration date. Suppose that you currently have $ in cash and own Apple stocks. Since you are concerned about AAPL's potential price decrease due to increased competition from Google and Samsung, you would like to use option to protect your AAPL shares. However, you plan to keep AAPL long term and as such do not want to sell the stocks. What type of options would you trade and why? If the strike is $ how many contracts would you be able to trade? What is the total premium paid andor received?

Calls & Puts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started