Question

Problem 3. In class, we learned the Fisher Hypothesis: Treal From + E(i) It states that the real interest rate is the nominal interest

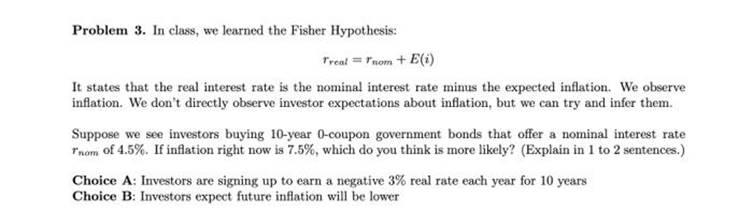

Problem 3. In class, we learned the Fisher Hypothesis: Treal From + E(i) It states that the real interest rate is the nominal interest rate minus the expected inflation. We observe inflation. We don't directly observe investor expectations about inflation, but we can try and infer them. Suppose we see investors buying 10-year 0-coupon government bonds that offer a nominal interest rate Tnom of 4.5%. If inflation right now is 7.5%, which do you think is more likely? (Explain in 1 to 2 sentences.) Choice A: Investors are signing up to earn a negative 3% real rate each year for 10 years Choice B: Investors expect future inflation will be lower

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Decisions And Markets A Course In Asset Pricing

Authors: John Y. Campbell

1st Edition

0691160805, 978-0691160801

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App