Question

Problem 3 Moltres Company provided the following information for the preparation of financial statements for 2020: Balances - January 1, 2020 Cash Accounts receivable Inventory

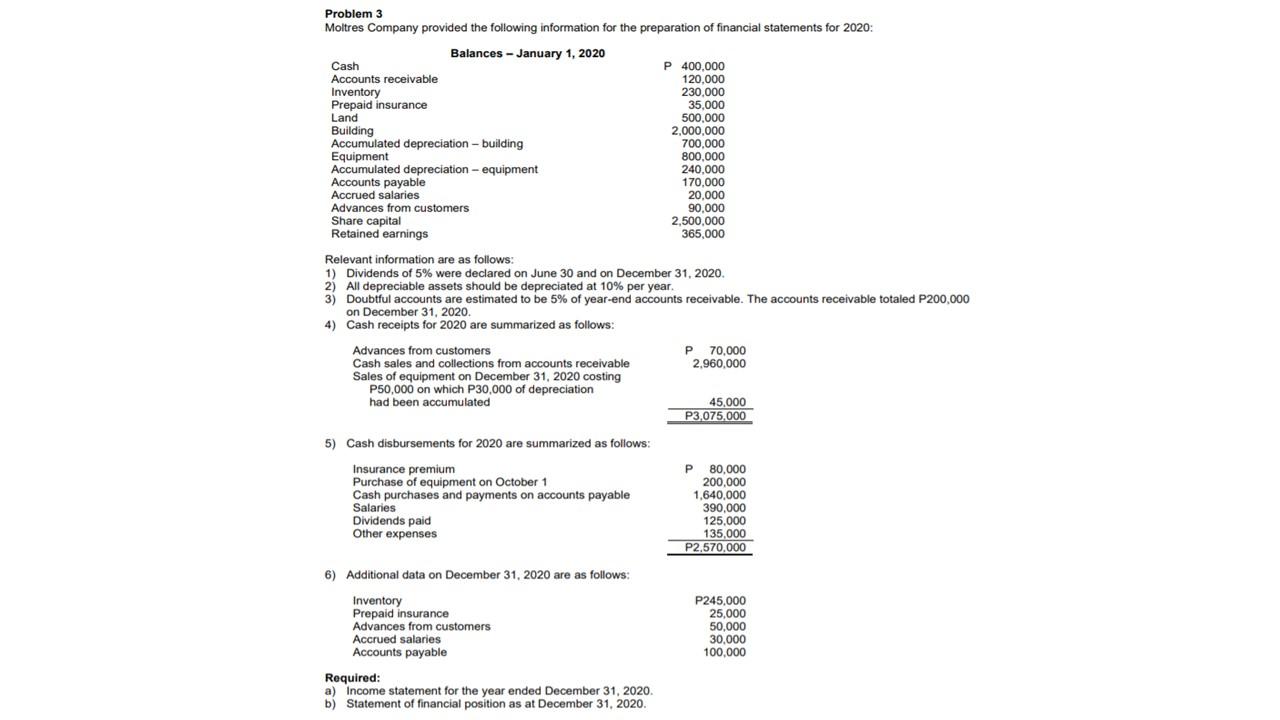

Problem 3 Moltres Company provided the following information for the preparation of financial statements for 2020: Balances - January 1, 2020 Cash Accounts receivable Inventory Prepaid insurance Land Building Accumulated depreciation - building Equipment Accumulated depreciation - equipment Accounts payable Accrued salaries Advances from customers Share capital Retained earnings P 400,000 120,000 230,000 35,000 500,000 2,000,000 700,000 800,000 240,000 170,000 20,000 90,000 2,500,000 365,000 Relevant information are as follows: 1) Dividends of 5% were declared on June 30 and on December 31, 2020. 2) All depreciable assets should be depreciated at 10% per year. 3) Doubtful accounts are estimated to be 5% of year-end accounts receivable. The accounts receivable totaled P200,000 on December 31, 2020. 4) Cash receipts for 2020 are summarized as follows: P 70,000 2,960,000 Advances from customers Cash sales and collections from accounts receivable Sales of equipment on December 31, 2020 costing P50,000 on which P30,000 of depreciation had been accumulated 45,000 P3,075,000 5) Cash disbursements for 2020 are summarized as follows: Insurance premium Purchase of equipment on October 1 Cash purchases and payments on accounts payable Salaries Dividends paid Other expenses P 80,000 200,000 1,640,000 390,000 125,000 135.000 P2,570,000 6) Additional data on December 31, 2020 are as follows: Inventory Prepaid insurance Advances from customers Accrued salaries Accounts payable P245,000 25,000 50,000 30,000 100,000 Required: a) Income statement for the year ended December 31, 2020. b) Statement of financial position as at December 31, 2020.

Problem 3 Moltres Company provided the following information for the preparation of financial statements for 2020: Balances - January 1, 2020 Cash Accounts receivable Inventory Prepaid insurance Land Building Accumulated depreciation - building Equipment Accumulated depreciation - equipment Accounts payable Accrued salaries Advances from customers Share capital Retained earnings P 400,000 120,000 230,000 35,000 500,000 2,000,000 700,000 800,000 240,000 170,000 20,000 90,000 2,500,000 365,000 Relevant information are as follows: 1) Dividends of 5% were declared on June 30 and on December 31, 2020. 2) All depreciable assets should be depreciated at 10% per year. 3) Doubtful accounts are estimated to be 5% of year-end accounts receivable. The accounts receivable totaled P200,000 on December 31, 2020. 4) Cash receipts for 2020 are summarized as follows: P 70,000 2,960,000 Advances from customers Cash sales and collections from accounts receivable Sales of equipment on December 31, 2020 costing P50,000 on which P30,000 of depreciation had been accumulated 45,000 P3,075,000 5) Cash disbursements for 2020 are summarized as follows: Insurance premium Purchase of equipment on October 1 Cash purchases and payments on accounts payable Salaries Dividends paid Other expenses P 80,000 200,000 1,640,000 390,000 125,000 135.000 P2,570,000 6) Additional data on December 31, 2020 are as follows: Inventory Prepaid insurance Advances from customers Accrued salaries Accounts payable P245,000 25,000 50,000 30,000 100,000 Required: a) Income statement for the year ended December 31, 2020. b) Statement of financial position as at December 31, 2020.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started