Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3 On January 1, 2019, High company acquired all of Low Company's outstanding common stock for $842,000 in cash. As of that date,

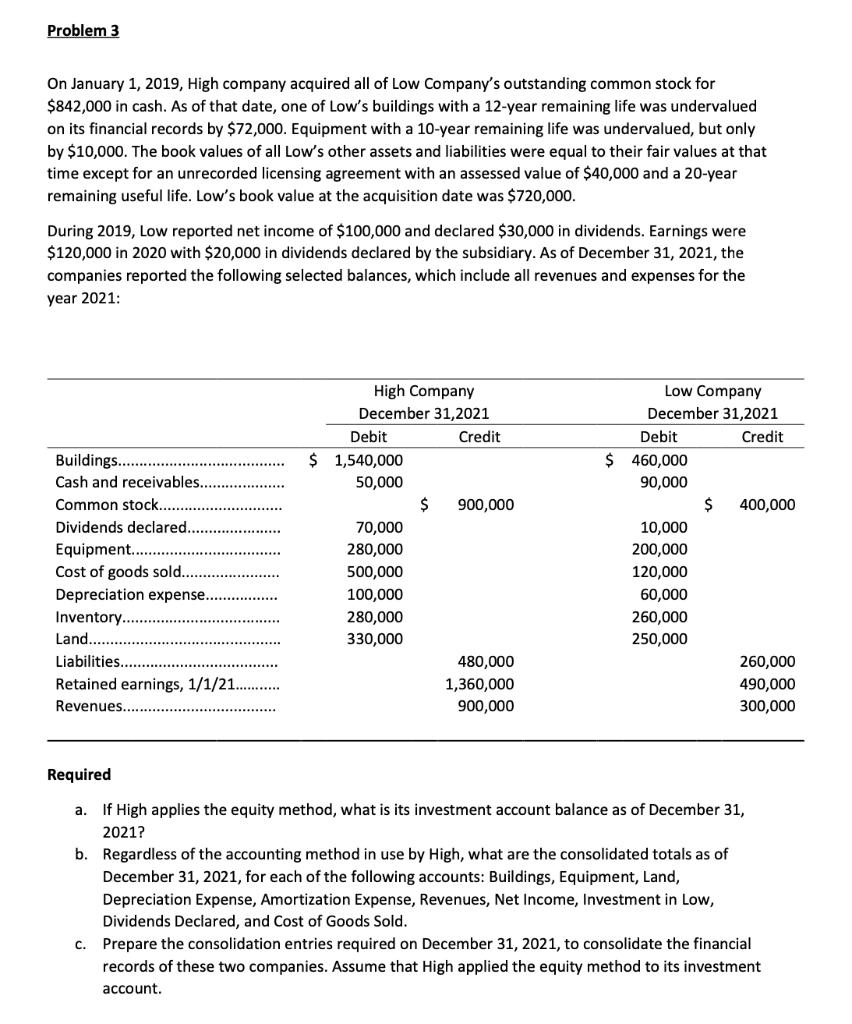

Problem 3 On January 1, 2019, High company acquired all of Low Company's outstanding common stock for $842,000 in cash. As of that date, one of Low's buildings with a 12-year remaining life was undervalued on its financial records by $72,000. Equipment with a 10-year remaining life was undervalued, but only by $10,000. The book values of all Low's other assets and liabilities were equal to their fair values at that time except for an unrecorded licensing agreement with an assessed value of $40,000 and a 20-year remaining useful life. Low's book value at the acquisition date was $720,000. During 2019, Low reported net income of $100,000 and declared $30,000 in dividends. Earnings were $120,000 in 2020 with $20,000 in dividends declared by the subsidiary. As of December 31, 2021, the companies reported the following selected balances, which include all revenues and expenses for the year 2021: High Company December 31,2021 Debit Low Company December 31,2021 Debit Credit Credit Buildings....... $ 1,540,000 $ 460,000 50,000 90,000 Cash and receivables.. Common stock.. 900,000 $ 400,000 Dividends declared. 70,000 10,000 Equipment.... 280,000 200,000 Cost of goods sold... 500,000 120,000 Depreciation expense... 100,000 60,000 Inventory................ 280,000 260,000 Land.. 330,000 250,000 Liabilities.. Retained earnings, 1/1/21. Revenues.... 480,000 1,360,000 900,000 260,000 490,000 300,000 Required a. If High applies the equity method, what is its investment account balance as of December 31, 2021? b. Regardless of the accounting method in use by High, what are the consolidated totals as of December 31, 2021, for each of the following accounts: Buildings, Equipment, Land, Depreciation Expense, Amortization Expense, Revenues, Net Income, Investment in Low, Dividends Declared, and Cost of Goods Sold. c. Prepare the consolidation entries required on December 31, 2021, to consolidate the financial records of these two companies. Assume that High applied the equity method to its investment account. $

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer According to chegg i can only answer one part b The consolidated Buildings account as of Dece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started