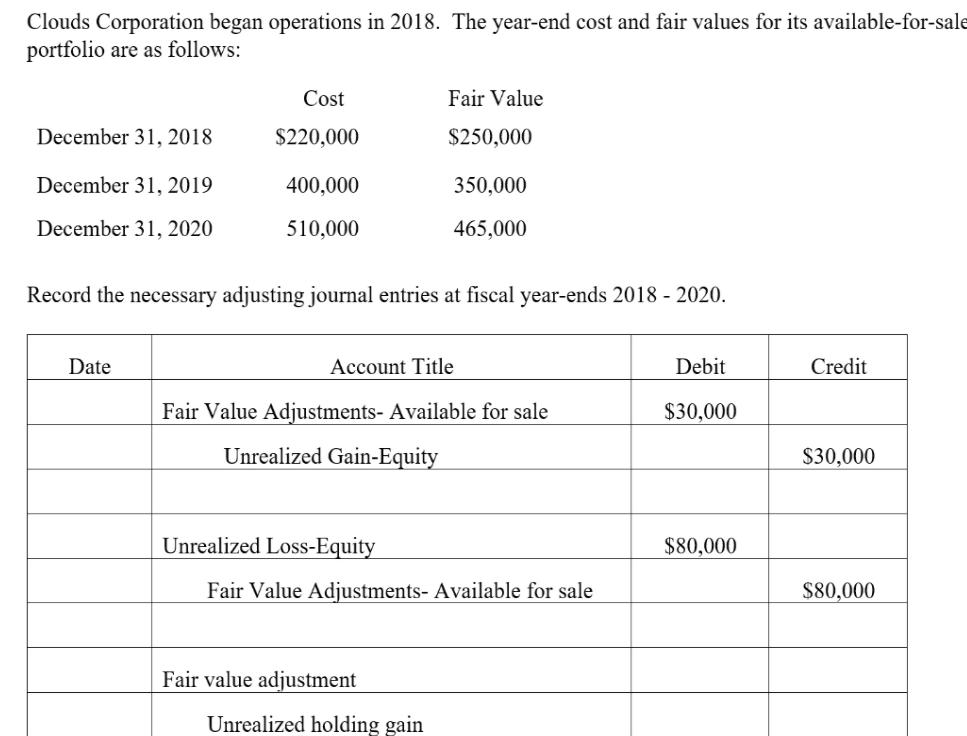

? ?? Clouds Corporation began operations in 2018. The year-end cost and fair values for its available-for-sale portfolio are as follows: December 31, 2018 December

? ??

??

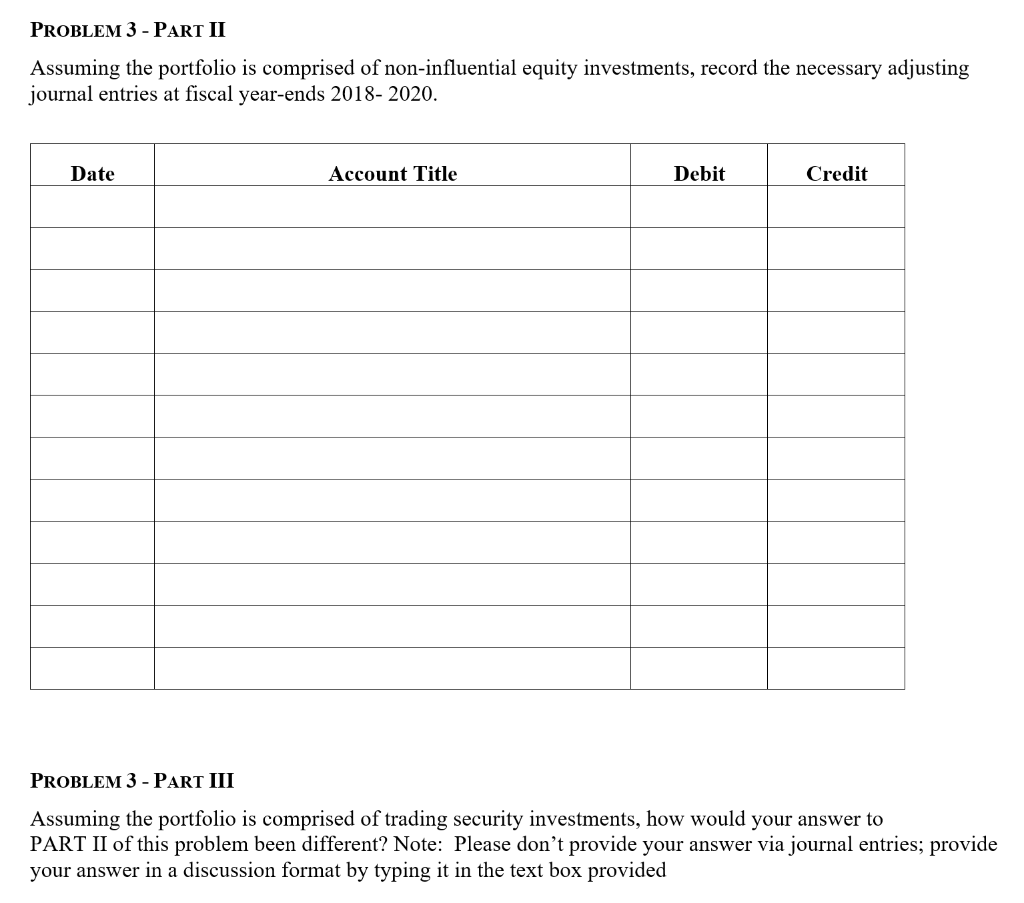

Clouds Corporation began operations in 2018. The year-end cost and fair values for its available-for-sale portfolio are as follows: December 31, 2018 December 31, 2019 December 31, 2020 Cost $220,000 Date 400,000 510,000 Record the necessary adjusting journal entries at fiscal year-ends 2018 - 2020. Unrealized Loss-Equity Fair Value Account Title Fair Value Adjustments- Available for sale Unrealized Gain-Equity $250,000 350,000 465,000 Fair value adjustment Fair Value Adjustments- Available for sale Unrealized holding gain Debit $30,000 $80,000 Credit $30,000 $80,000 PROBLEM 3 - PART II Assuming the portfolio is comprised of non-influential equity investments, record the necessary adjusting journal entries at fiscal year-ends 2018-2020. Date Account Title Debit Credit PROBLEM 3 - PART III Assuming the portfolio is comprised of trading security investments, how would your answer to PART II of this problem been different? Note: Please don't provide your answer via journal entries; provide your answer in a discussion format by typing it in the text box provided

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Date Account Title Debit Credit December 31 2018 Fair value adjustmentAvailable for sale 30000 Unrea...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started