Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem #3 please Given a nominal annual rate of interest of 6.6% compounded quarterly, find the equivalent nominal annual rate of discount compounded monthly (round

Problem #3 please

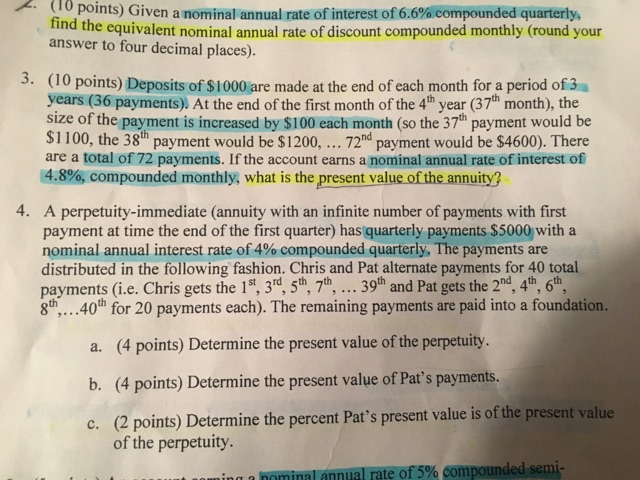

Given a nominal annual rate of interest of 6.6% compounded quarterly, find the equivalent nominal annual rate of discount compounded monthly (round your answer to four decimal places). Deposits of $ 1000 are made at the end of each month for a period of 3 years (36 payments). At the end of the first month of the 4^th year (37^th month), the size of the payment is increased by $100 each month (so the 37^th payment would be $1100, the 38^th payment would be $1200, ... 72^nd payment would be $4600). There arc a total of 72 payments. If the account earns a nominal annual rate of interest of 4.8%, compounded monthly, what is the present value of the annuity? A perpetuity-immediate (annuity with an infinite number of payments with first payment at time the end of the first quarter) has quarterly payments $5000 with a nominal annual interest rate of 4% compounded quarterly. The payments are distributed in the following fashion. Chris and Pat alternate payments for 40 total payments (i.e. Chris gets the 1^st, 3^rd, 5^th, 7^th, ... 39^th and Pat gets the 2^nd, 4^th, 6^th, 8^th, ...40^th for 20 payments each). The remaining payments are paid into a foundation. a. Determine the present value of the perpetuity. b. Determine the present value of Pat's payments. c. Determine the percent Pat's present value is of the present value of the perpetuityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started