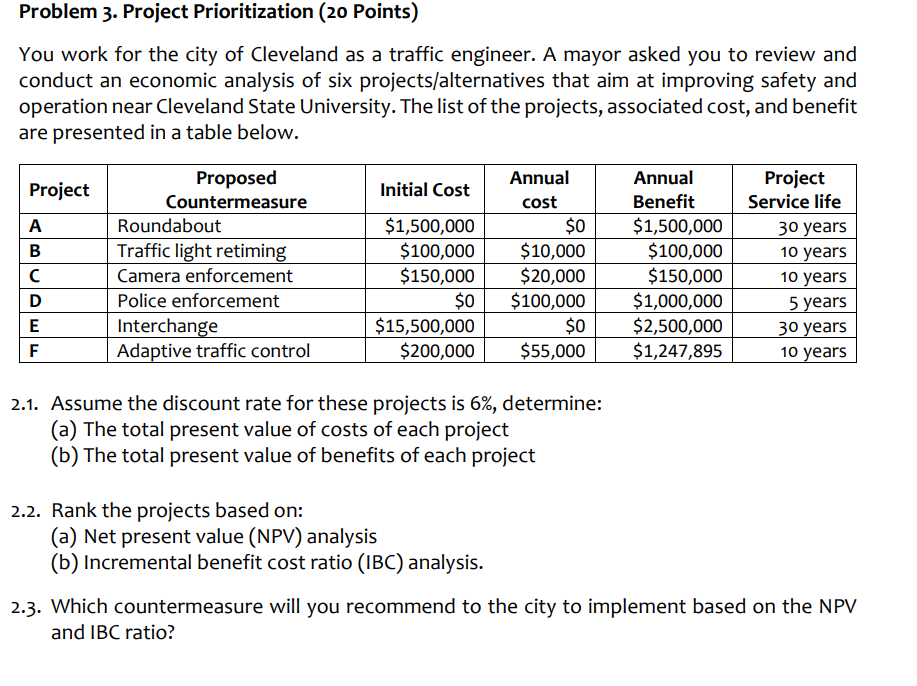

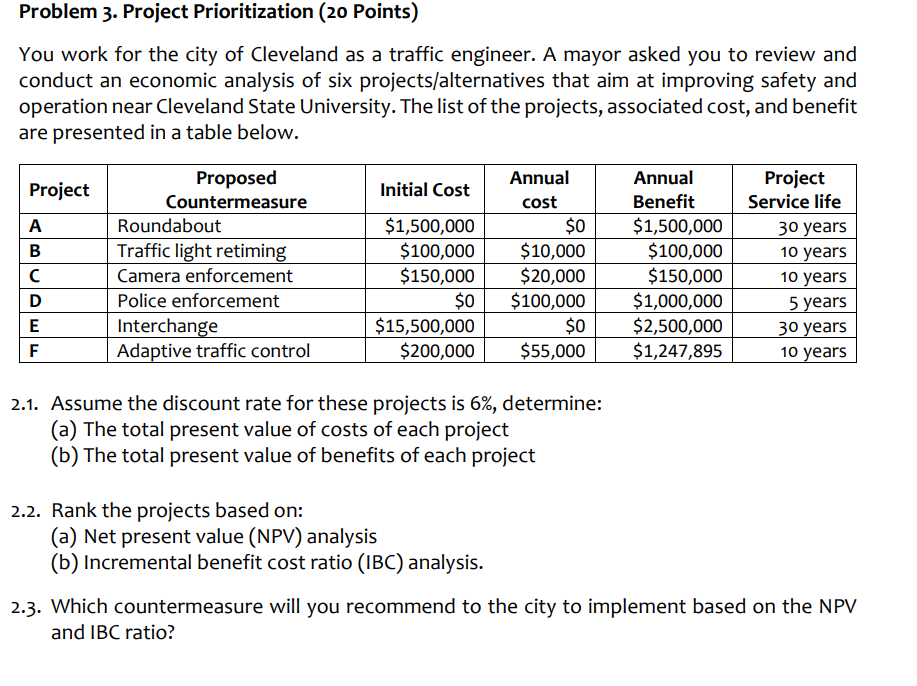

Problem 3. Project Prioritization (20 Points) You work for the city of Cleveland as a traffic engineer. A mayor asked you to review and conduct an economic analysis of six projects/alternatives that aim at improving safety and operation near Cleveland State University. The list of the projects, associated cost, and benefit are presented in a table below. Project Initial Cost A B D E Proposed Countermeasure Roundabout Traffic light retiming Camera enforcement Police enforcement Interchange Adaptive traffic control Annual cost $0 $10,000 $20,000 $100,000 $0 $55,000 $1,500,000 $100,000 $150,000 $0 $15,500,000 $200,000 Annual Benefit $1,500,000 $100,000 $150,000 $1,000,000 $2,500,000 $1,247,895 Project Service life 30 years 10 years 10 years 5 years 30 years 10 years n | | 2.1. Assume the discount rate for these projects is 6%, determine: (a) The total present value of costs of each project (b) The total present value of benefits of each project 2.2. Rank the projects based on: (a) Net present value (NPV) analysis (b) Incremental benefit cost ratio (IBC) analysis. 2.3. Which countermeasure will you recommend to the city to implement based on the NPV and IBC ratio? Problem 3. Project Prioritization (20 Points) You work for the city of Cleveland as a traffic engineer. A mayor asked you to review and conduct an economic analysis of six projects/alternatives that aim at improving safety and operation near Cleveland State University. The list of the projects, associated cost, and benefit are presented in a table below. Project Initial Cost A B D E Proposed Countermeasure Roundabout Traffic light retiming Camera enforcement Police enforcement Interchange Adaptive traffic control Annual cost $0 $10,000 $20,000 $100,000 $0 $55,000 $1,500,000 $100,000 $150,000 $0 $15,500,000 $200,000 Annual Benefit $1,500,000 $100,000 $150,000 $1,000,000 $2,500,000 $1,247,895 Project Service life 30 years 10 years 10 years 5 years 30 years 10 years n | | 2.1. Assume the discount rate for these projects is 6%, determine: (a) The total present value of costs of each project (b) The total present value of benefits of each project 2.2. Rank the projects based on: (a) Net present value (NPV) analysis (b) Incremental benefit cost ratio (IBC) analysis. 2.3. Which countermeasure will you recommend to the city to implement based on the NPV and IBC ratio