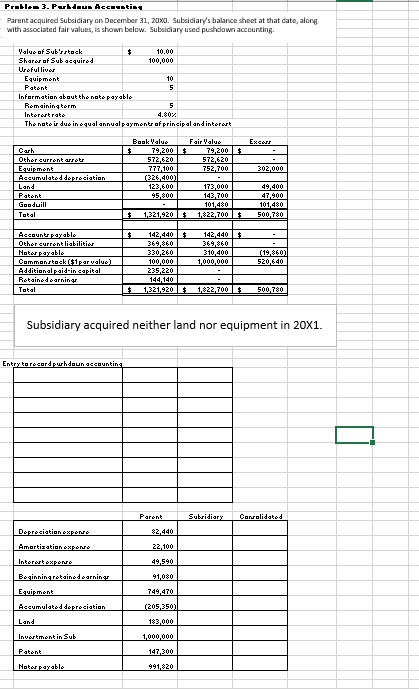

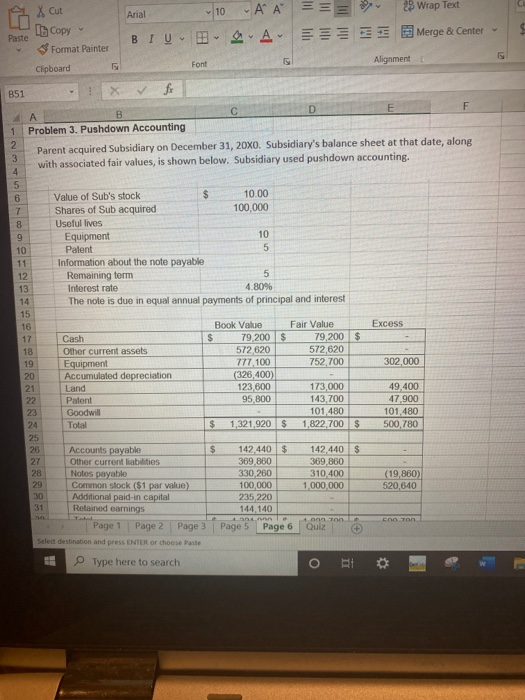

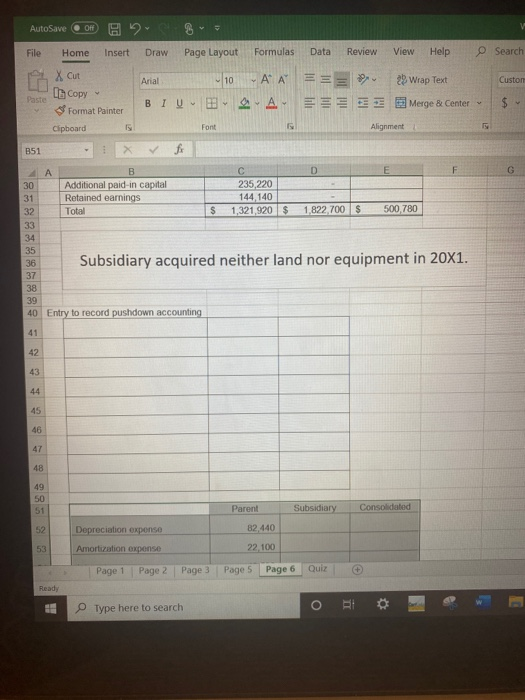

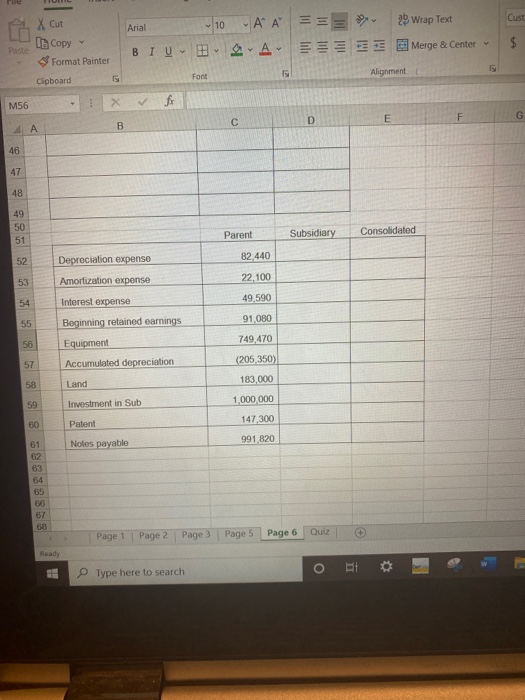

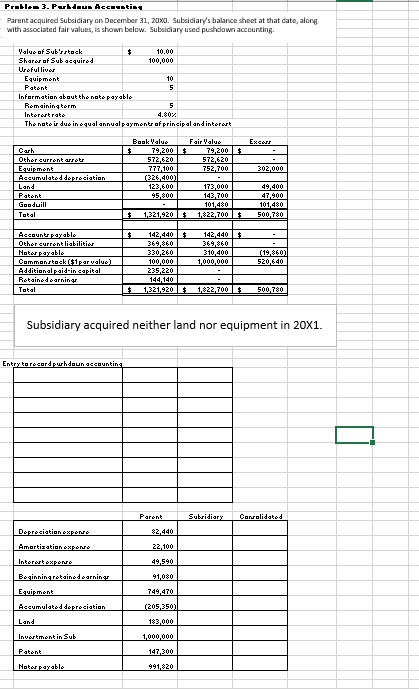

Problem 3. Pukeun Accounting Parent acquired Subsidiary on December 31, 20X0. Subsidiary's balance sheet at that date, along with associated fair values, is shown below. Subsidiary used pushdown accounting. Value of Subrrtack $ 10.00 Sharw of Sub acquired 100,000 Urefulliver Equipment 10 Patent 5 Information about the nato payablo Remaining term 5 Interartrate 4.802 The noto ir duo in qual annual payment of principal and interest Excorr 302.000 Carh Other currenteret | Estimani Accumulate depreciation Land Patent Goodeill Total Book Valve Fair Value $ 79,200 $ 79,200 $ 572,620 572,620 777.100 752,700 (326,400) 123,600 173,000 95,800 143,700 101010 $ 1,321,9203 1,822,7005 49,400 47,900 101,480 500 780 $ 142,440 $ 142,440$ Accounts payable Other current liabilities Noter payable Commonstask (41 ar value) Additional paid-in capital Retained earnina Total 310,400 1,000,000 (19,860) 520,640 330 260 100,000 235 220 144 140 1,321,9205 1.822.700$ 500,780 Subsidiary acquired neither land nor equipment in 20X1. Entry to record puhdoun accounting Parent Sutridiary Coralidated 82,440 Depreciation expone Amortiration expen 22.100 49,590 91,080 Interertexperte Beginning retained earnin Equipment Accumulated depreciation 749,470 (205,35.0) 183,000 1,000,000 Land Investment in Sub Pattant 147.300 Noter payable 991,820 29 Wrap Text Arial X cut Ib Copy Paste Format Painter Clipboard ~10 AM -A- III lile BIU *Merge & Center Font Alignment B51 D B E F 4 1 Problem 3. Pushdown Accounting 2 Parent acquired Subsidiary on December 31, 20X0. Subsidiary's balance sheet at that date, along 3 with associated fair values, is shown below. Subsidiary used pushdown accounting. 4 5 6 Value of Sub's stock $ 10.00 7 Shares of Sub acquired 100,000 8 Useful lives 9 Equipment 10 10 Palent 5 11 Information about the note payable 12 Remaining term 5 13 Interest rate 4.80% The nole is due in equal annual payments of principal and interest 15 16 Book Value Fair Value Excess 17 Cash $ 79 200 $ 79,200 $ 18 Other current assets 572,620 572,620 19 Equipment 777,100 752,700 302.000 20 Accumulated depreciation (326,400) 21 Land 123,600 173,000 49.400 Patent 95,800 143,700 47.900 23 Goodwill 101.480 101,480 24 Total $ 1,321,920 $ 1,822,700 $ 500 780 25 26 Accounts payable $ 142.440 $ 142,440 $ 27 Other current liabilities 369,860 369,860 28 Notes payable 330,260 310,400 (19,860) 29 Common stock ($1 par value) 100,000 1,000,000 520,640 30 Additional paid in capital 235,220 31 Retained earnings 144,140 LOLA On To Page 1 Page 2 Page 3 Page 5 Page 6 Quiz Select destination and press ENTER or choose Paste Type here to search s | COOTO o AutoSave On File Home Insert Draw Page Layout Formulas Data Review View Help Search Xcut Arial 10 Custon In Copy == 2 Wrap Text AY 2 Merge & Center Paste BIU $ Format Painter Clipboard Is Font Alignment B51 fr G A B D F 30 Additional paid-in capital 235,220 31 Retained earnings 144, 140 32 Total $ 1,321,920 $ 1,822,700$ 500 780 33 34 35 36 Subsidiary acquired neither land nor equipment in 20X1. 37 38 39 40 Entry to record pushdown accounting 41 42 43 44 45 46 47 48 49 50 51 Parent Subsidiary Consolidated 52 82,440 Depreciation expense Amortization expenso 53 22,100 Page 1 Page 2 Page 3 Page 5 Page 6 Quiz Read 15 Type here to search O Cust Arial 10 X cut LA Copy ~ Format Painter ' ' A 25 Wrap Text Merge & Center $ IM Paste BIU Font Alignment Clipboard x M56 D F G E B AA 46 47 48 49 Parent Subsidiary Consolidated 82,440 Depreciation expense 22,100 8 8 3 98 53 Amortization expense 54 Interest expense 49,590 55 91 080 Beginning retained earnings Equipment Accumulated depreciation 749,470 57 (205 350) 183 000 58 Land 1,000,000 Investment in Sub 59 60 Patent 147 300 991,820 Noles payable 62 63 64 65 67 Page 1 Page 2 + Page 3 Quiz Page 5 Page 6 Ready O Type here to search Problem 3. Pukeun Accounting Parent acquired Subsidiary on December 31, 20X0. Subsidiary's balance sheet at that date, along with associated fair values, is shown below. Subsidiary used pushdown accounting. Value of Subrrtack $ 10.00 Sharw of Sub acquired 100,000 Urefulliver Equipment 10 Patent 5 Information about the nato payablo Remaining term 5 Interartrate 4.802 The noto ir duo in qual annual payment of principal and interest Excorr 302.000 Carh Other currenteret | Estimani Accumulate depreciation Land Patent Goodeill Total Book Valve Fair Value $ 79,200 $ 79,200 $ 572,620 572,620 777.100 752,700 (326,400) 123,600 173,000 95,800 143,700 101010 $ 1,321,9203 1,822,7005 49,400 47,900 101,480 500 780 $ 142,440 $ 142,440$ Accounts payable Other current liabilities Noter payable Commonstask (41 ar value) Additional paid-in capital Retained earnina Total 310,400 1,000,000 (19,860) 520,640 330 260 100,000 235 220 144 140 1,321,9205 1.822.700$ 500,780 Subsidiary acquired neither land nor equipment in 20X1. Entry to record puhdoun accounting Parent Sutridiary Coralidated 82,440 Depreciation expone Amortiration expen 22.100 49,590 91,080 Interertexperte Beginning retained earnin Equipment Accumulated depreciation 749,470 (205,35.0) 183,000 1,000,000 Land Investment in Sub Pattant 147.300 Noter payable 991,820 29 Wrap Text Arial X cut Ib Copy Paste Format Painter Clipboard ~10 AM -A- III lile BIU *Merge & Center Font Alignment B51 D B E F 4 1 Problem 3. Pushdown Accounting 2 Parent acquired Subsidiary on December 31, 20X0. Subsidiary's balance sheet at that date, along 3 with associated fair values, is shown below. Subsidiary used pushdown accounting. 4 5 6 Value of Sub's stock $ 10.00 7 Shares of Sub acquired 100,000 8 Useful lives 9 Equipment 10 10 Palent 5 11 Information about the note payable 12 Remaining term 5 13 Interest rate 4.80% The nole is due in equal annual payments of principal and interest 15 16 Book Value Fair Value Excess 17 Cash $ 79 200 $ 79,200 $ 18 Other current assets 572,620 572,620 19 Equipment 777,100 752,700 302.000 20 Accumulated depreciation (326,400) 21 Land 123,600 173,000 49.400 Patent 95,800 143,700 47.900 23 Goodwill 101.480 101,480 24 Total $ 1,321,920 $ 1,822,700 $ 500 780 25 26 Accounts payable $ 142.440 $ 142,440 $ 27 Other current liabilities 369,860 369,860 28 Notes payable 330,260 310,400 (19,860) 29 Common stock ($1 par value) 100,000 1,000,000 520,640 30 Additional paid in capital 235,220 31 Retained earnings 144,140 LOLA On To Page 1 Page 2 Page 3 Page 5 Page 6 Quiz Select destination and press ENTER or choose Paste Type here to search s | COOTO o AutoSave On File Home Insert Draw Page Layout Formulas Data Review View Help Search Xcut Arial 10 Custon In Copy == 2 Wrap Text AY 2 Merge & Center Paste BIU $ Format Painter Clipboard Is Font Alignment B51 fr G A B D F 30 Additional paid-in capital 235,220 31 Retained earnings 144, 140 32 Total $ 1,321,920 $ 1,822,700$ 500 780 33 34 35 36 Subsidiary acquired neither land nor equipment in 20X1. 37 38 39 40 Entry to record pushdown accounting 41 42 43 44 45 46 47 48 49 50 51 Parent Subsidiary Consolidated 52 82,440 Depreciation expense Amortization expenso 53 22,100 Page 1 Page 2 Page 3 Page 5 Page 6 Quiz Read 15 Type here to search O Cust Arial 10 X cut LA Copy ~ Format Painter ' ' A 25 Wrap Text Merge & Center $ IM Paste BIU Font Alignment Clipboard x M56 D F G E B AA 46 47 48 49 Parent Subsidiary Consolidated 82,440 Depreciation expense 22,100 8 8 3 98 53 Amortization expense 54 Interest expense 49,590 55 91 080 Beginning retained earnings Equipment Accumulated depreciation 749,470 57 (205 350) 183 000 58 Land 1,000,000 Investment in Sub 59 60 Patent 147 300 991,820 Noles payable 62 63 64 65 67 Page 1 Page 2 + Page 3 Quiz Page 5 Page 6 Ready O Type here to search