Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3 (Required, 30 marks) (*Note: This problem is related to contingent immunization) We use the same setup as in Problem 2. Suppose the

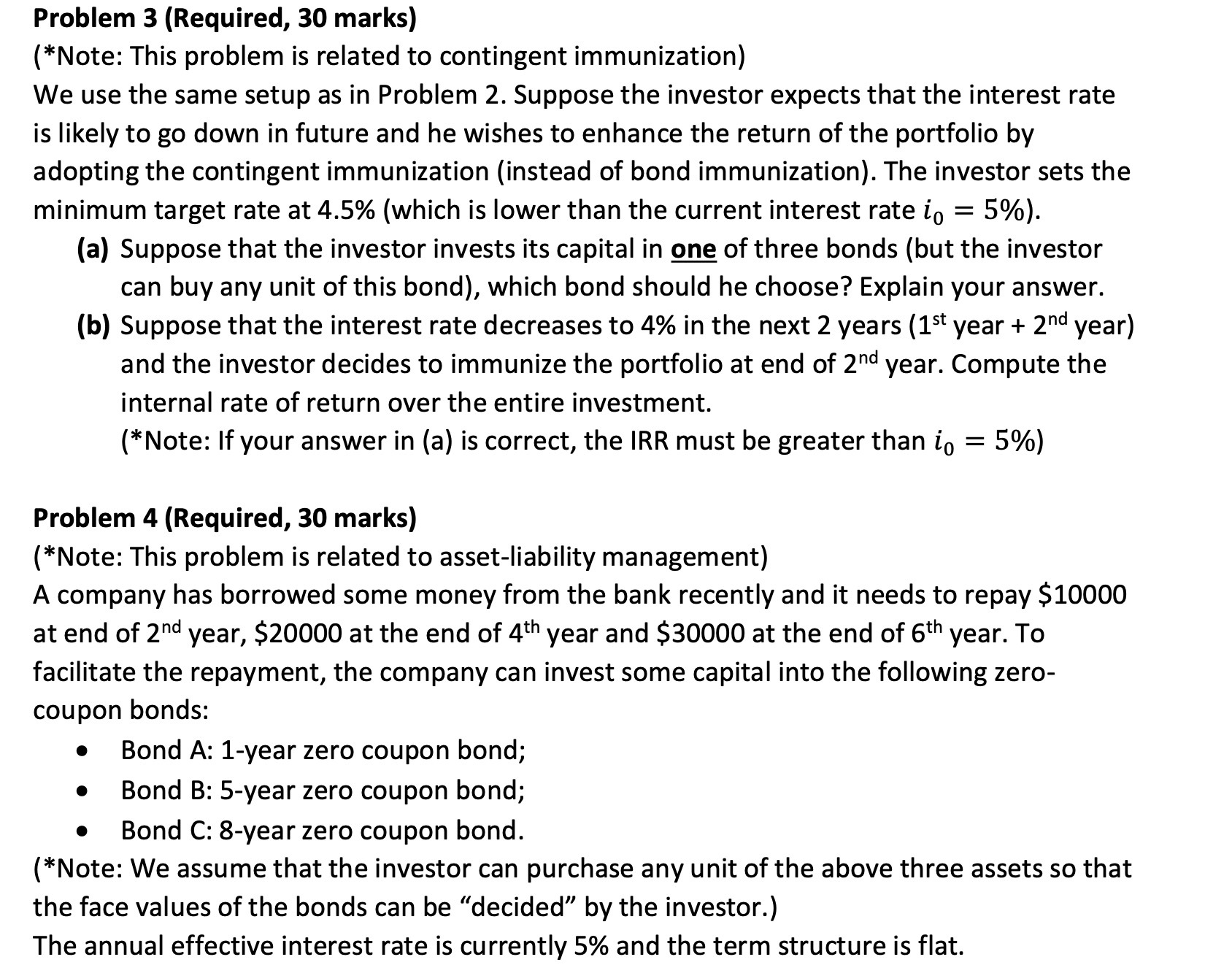

Problem 3 (Required, 30 marks) (*Note: This problem is related to contingent immunization) We use the same setup as in Problem 2. Suppose the investor expects that the interest rate is likely to go down in future and he wishes to enhance the return of the portfolio by adopting the contingent immunization (instead of bond immunization). The investor sets the minimum target rate at 4.5% (which is lower than the current interest rate io = 5%). (a) Suppose that the investor invests its capital in one of three bonds (but the investor can buy any unit of this bond), which bond should he choose? Explain your answer. (b) Suppose that the interest rate decreases to 4% in the next 2 years (1st year + 2nd year) and the investor decides to immunize the portfolio at end of 2nd year. Compute the internal rate of return over the entire investment. (*Note: If your answer in (a) is correct, the IRR must be greater than i = 5%) Problem 4 (Required, 30 marks) (*Note: This problem is related to asset-liability management) A company has borrowed some money from the bank recently and it needs to repay $10000 at end of 2nd year, $20000 at the end of 4th year and $30000 at the end of 6th year. To facilitate the repayment, the company can invest some capital into the following zero- coupon bonds: Bond A: 1-year zero coupon bond; Bond B: 5-year zero coupon bond; Bond C: 8-year zero coupon bond. (*Note: We assume that the investor can purchase any unit of the above three assets so that the face values of the bonds can be "decided" by the investor.) The annual effective interest rate is currently 5% and the term structure is flat.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started