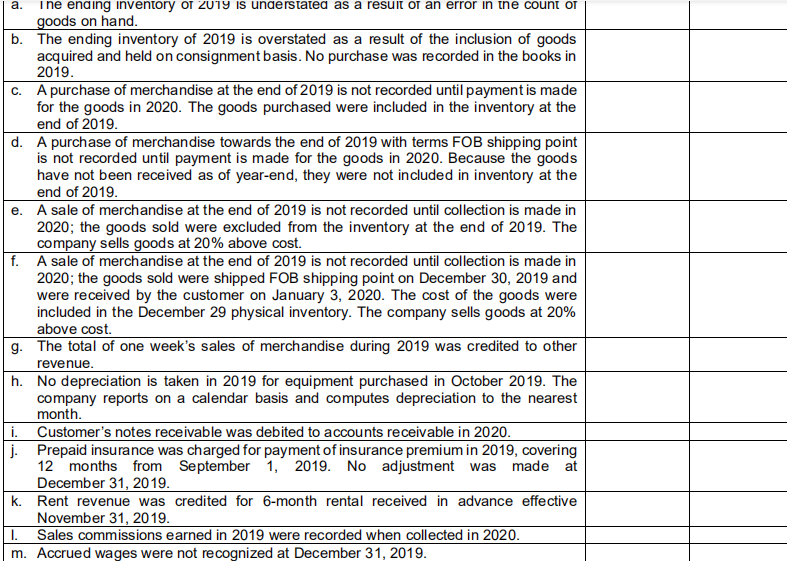

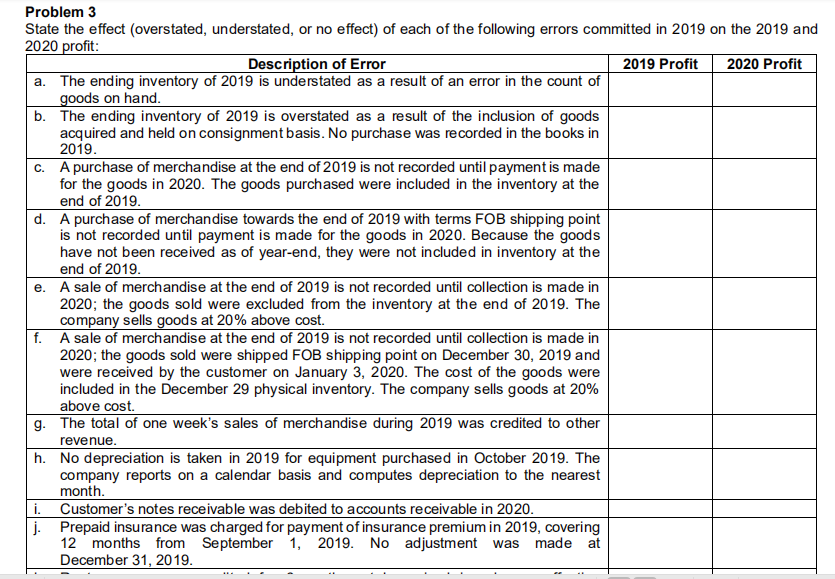

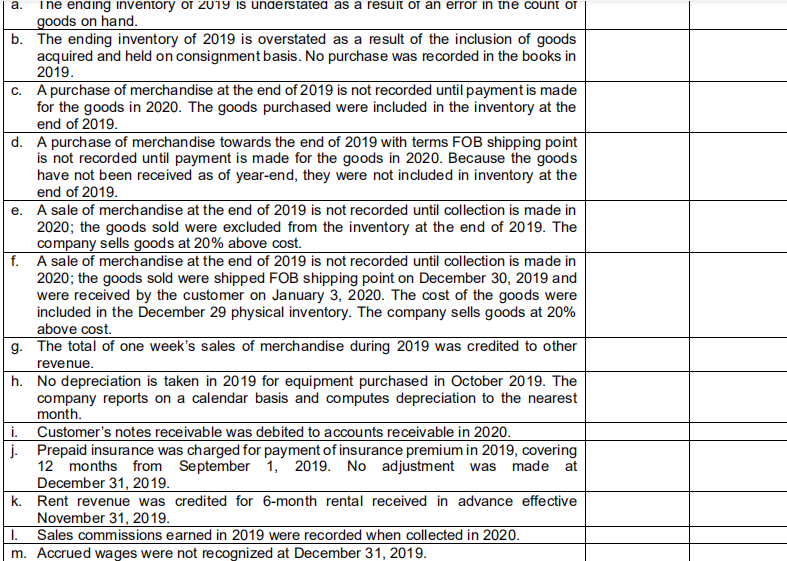

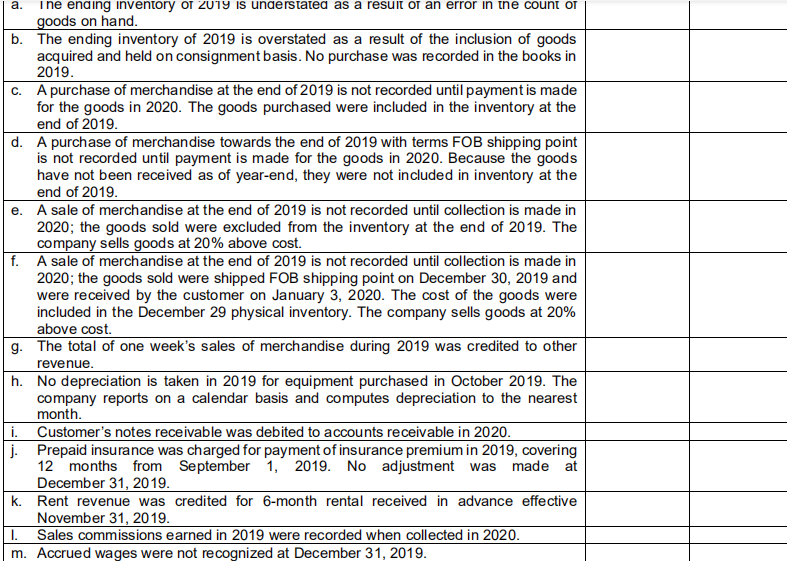

Problem 3 State the effect (overstated, understated, or no effect} of each of the following errors committed in 2019 on the 2019 and 2020 prot: Desert - Ion of Error 2019 Prot 2020 Prot a. The ending inventory of 2019 is understated as a result of an error in the count of l l I IS on hand. b. The ending inventory of 2019 is overstated as a result of the inclusion of goods acquired and held on consignment basis. No purchase was recorded in the books in 2019. c. A purchase of merchandise at the end of 2019 is not recorded until payment is made for the goods in 2020. The goods purchased were included in the inventory at the end of 2019. d. A purchase of merchandise towards the end of 2019 with terms FOB shipping point is not recorded until payment is made for the goods in 2020. Because the goods have not been received as of year-end, they were not included in inventory at the end of 2019. e. A sale of merchandise at the end of 2019 is not recorded until collection is made in 2020; the goods sold were excluded from the inventory at the end of 2019. The company sells goods at 20% above cost. f. A sale of merchandise at the end of 2019 is not recorded until collection is made in 2020; the goods sold were shipped FOB shipping point on December 30, 2019 and were received by the customer on January 3, 2020. The cost of the goods were included in the December 29 physical inventory. The company sells goods at 20% above cost. g. The total of one week's sales of merchandise during 2019 was credited to other revenue. h. No depreciation is taken in 2019 for equipment purchased in October 2019. The company reports on a calendar basis and computes depreciation to the nearest month. i. Customer's notes receivable was debited to accou nts receivable in 2020. j. Prepaid insu rance was charged for payment of insurance premium in 2019, covering 12 months from September 1, 2019. No adjustment was made at December 31, 2019. a. me ending Inventory or 2919 is uncersrarec as a resurr or an error In me count or goods on hand. b. The ending inventory of 2919 is overstated as a result of the inclusion of goods acquired and held on consignment basis. No purchase was recorded in the books in 2919. A purchase of merchandise at the end of2919 is not recorded until payment is made for the goods in 2929. The goods purchased were included in the inventory at the end of 2919. d. A purchase of merchandise towards the end of 2919 with terms FOB shipping point is not recorded until payment is made for the goods in 2929. Because the goods have not been received as of year-end, they were not included in inventory at the end of 2919. e. A sale of merchandise at the end of 2919 is not recorded until collection is made in 2929; the goods sold were excluded from the inventory at the end of 2919. The company sells goods at 29% above cost. f. A sale of merchandise at the end of 2919 is not recorded until collection is made in 2929; the goods sold were shipped FDB shipping point on December 39. 2919 and were received by the customer on January 3, 2929. The cost of the goods were included in the December 29 physical inventory. The company sells goods at 29% above cost. g. The total of one week's sales of merchandise durirg 2919 was credited to other revenue. h. No depreciation is taken in 2919 for equipment purchased in October 2919. The company reports on a calendar basis and computes depreciation to the nearest month. i. Customer's notes receivable was debited to accou nts receivable in 2929. Prepaid insu rance was charged for payment of insurance premium in 2919, covering 12 months from September 1, 2919. No adjustment was made at December 31, 2919. Rent revenue was credited for l9-month rental received in advance effective November 312919. Sales commissions earned In 2919 were recorded when collected In 2929. m. Accrued wages were not recognized at December 31, 2919