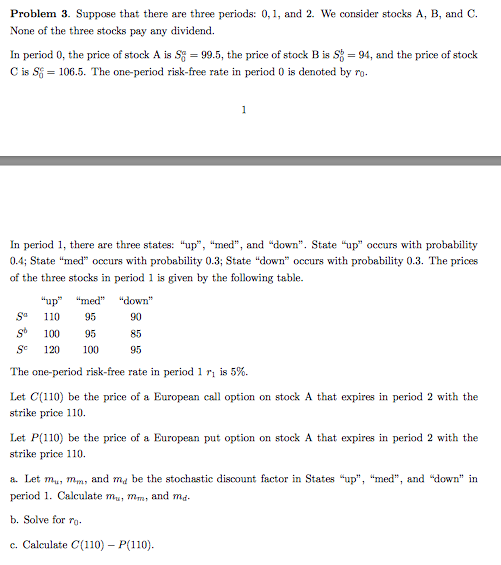

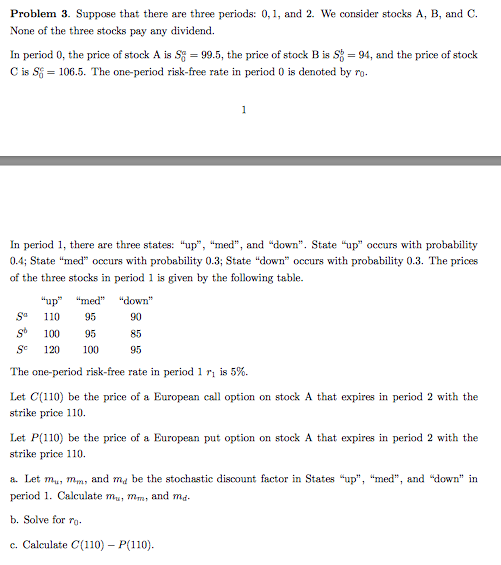

Problem 3. Suppose that there are three periods: 0,1, and 2. We consider stocks A, B, and C. None of the three stocks pay any dividend. In period 0, the price of stock A is so = 99.5, the price of stock Bis 5 =94, and the price of stock C is so = 106.5. The one-period risk-free rate in period 0 is denoted by to. In period 1, there are three states: "up", "med", and "down". State "up" occurs with probability 0.4; State "med" occurs with probability 0.3; State "down" occurs with probability 0.3. The prices of the three stocks in period 1 is given by the following table. up" "med" "down" 5 110 95 90 S 100 95 85 Se 120 100 95 The one-period risk-free rate in period 1 r is 5%. Let C(110) be the price of a European call option on stock A that expires in period 2 with the strike price 110. Let P(110) be the price of a European put option on stock A that expires in period 2 with the strike price 110. 2. Let mu, me, and me be the stochastic discount factor in States "up", "med", and "down" in period 1. Calculate m, mm, and ma- b. Solve for to c. Calculate C(110) - P(110). Problem 3. Suppose that there are three periods: 0,1, and 2. We consider stocks A, B, and C. None of the three stocks pay any dividend. In period 0, the price of stock A is so = 99.5, the price of stock Bis 5 =94, and the price of stock C is so = 106.5. The one-period risk-free rate in period 0 is denoted by to. In period 1, there are three states: "up", "med", and "down". State "up" occurs with probability 0.4; State "med" occurs with probability 0.3; State "down" occurs with probability 0.3. The prices of the three stocks in period 1 is given by the following table. up" "med" "down" 5 110 95 90 S 100 95 85 Se 120 100 95 The one-period risk-free rate in period 1 r is 5%. Let C(110) be the price of a European call option on stock A that expires in period 2 with the strike price 110. Let P(110) be the price of a European put option on stock A that expires in period 2 with the strike price 110. 2. Let mu, me, and me be the stochastic discount factor in States "up", "med", and "down" in period 1. Calculate m, mm, and ma- b. Solve for to c. Calculate C(110) - P(110)