Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 3 The Alimentar Company manufactures only one product. The following information concerning the month of December of year N is available (assume the

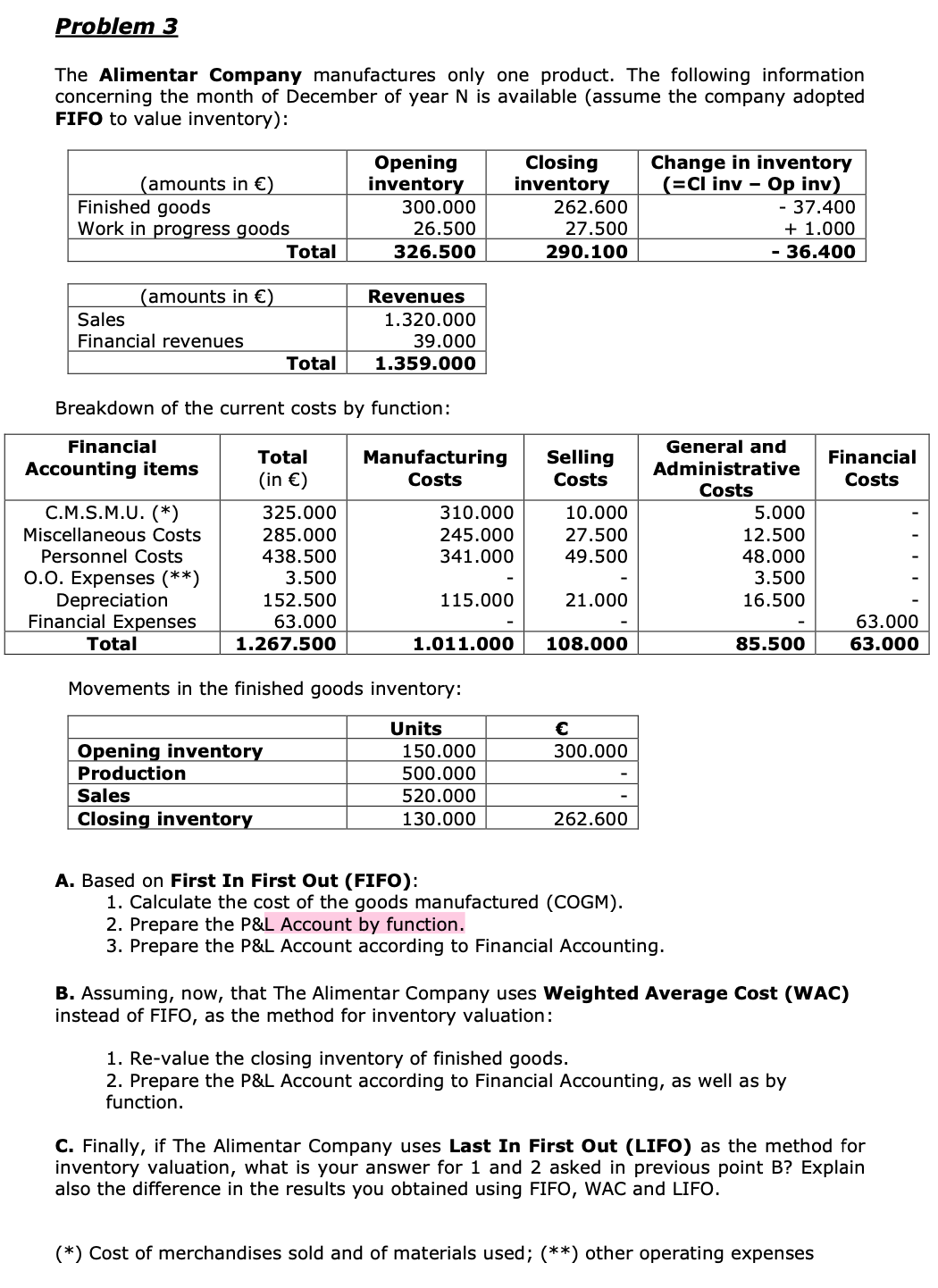

Problem 3 The Alimentar Company manufactures only one product. The following information concerning the month of December of year N is available (assume the company adopted FIFO to value inventory): (amounts in ) Opening inventory Closing inventory Finished goods Work in progress goods 300.000 26.500 Total 326.500 262.600 27.500 290.100 (amounts in ) Revenues Sales 1.320.000 Financial revenues 39.000 Total 1.359.000 Breakdown of the current costs by function: Change in inventory (=CI inv - Op inv) - 37.400 + 1.000 - 36.400 Financial Total Manufacturing Accounting items (in ) Costs Selling Costs General and Administrative Financial Costs Costs C.M.S.M.U. (*) 325.000 310.000 10.000 5.000 Miscellaneous Costs 285.000 245.000 27.500 12.500 Personnel Costs 438.500 341.000 49.500 48.000 O.O. Expenses (**) 3.500 3.500 Depreciation Financial Expenses Total 152.500 115.000 21.000 16.500 63.000 1.267.500 1.011.000 108.000 85.500 63.000 63.000 Movements in the finished goods inventory: Units 150.000 300.000 500.000 520.000 130.000 262.600 Opening inventory Production Sales Closing inventory A. Based on First In First Out (FIFO): 1. Calculate the cost of the goods manufactured (COGM). 2. Prepare the P&L Account by function. 3. Prepare the P&L Account according to Financial Accounting. B. Assuming, now, that The Alimentar Company uses Weighted Average Cost (WAC) instead of FIFO, as the method for inventory valuation: 1. Re-value the closing inventory of finished goods. 2. Prepare the P&L Account according to Financial Accounting, as well as by function. C. Finally, if The Alimentar Company uses Last In First Out (LIFO) as the method for inventory valuation, what is your answer for 1 and 2 asked in previous point B? Explain also the difference in the results you obtained using FIFO, WAC and LIFO. (*) Cost of merchandises sold and of materials used; (**) other operating expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started