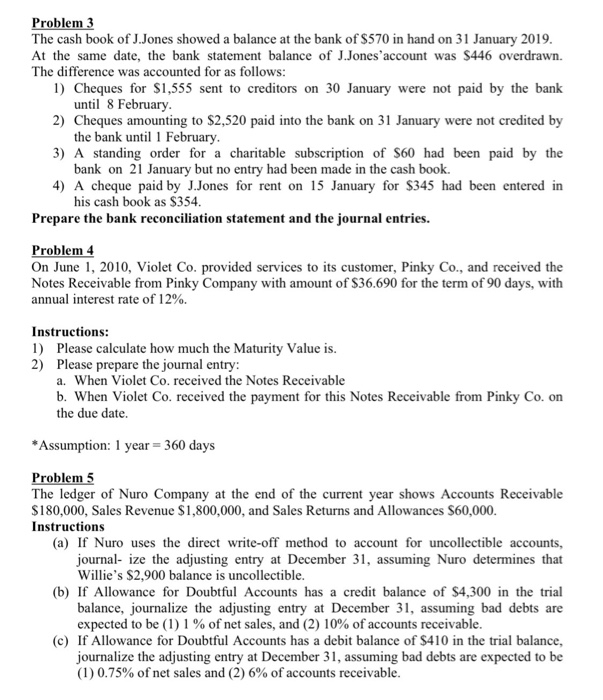

Problem 3 The cash book of J.Jones showed a balance at the bank of $570 in hand on 31 January 2019. At the same date, the bank statement balance of J.Jones'account was $446 overdrawn. The difference was accounted for as follows: 1) Cheques for $1,555 sent to creditors on 30 January were not paid by the bank until 8 February. 2) Cheques amounting to $2,520 paid into the bank on 31 January were not credited by the bank until 1 February. 3) A standing order for a charitable subscription of $60 had been paid by the bank on 21 January but no entry had been made in the cash book. 4) A cheque paid by J.Jones for rent on 15 January for $345 had been entered in his cash book as $354. Prepare the bank reconciliation statement and the journal entries. Problem 4 On June 1, 2010, Violet Co. provided services to its customer, Pinky Co., and received the Notes Receivable from Pinky Company with amount of $36.690 for the term of 90 days, with annual interest rate of 12%. Instructions: 1) Please calculate how much the Maturity Value is. 2) Please prepare the journal entry: a. When Violet Co. received the Notes Receivable b. When Violet Co. received the payment for this Notes Receivable from Pinky Co. on the due date. * Assumption: 1 year = 360 days Problem 5 The ledger of Nuro Company at the end of the current year shows Accounts Receivable $180,000, Sales Revenue $1,800,000, and Sales Returns and Allowances $60,000. Instructions (a) If Nuro uses the direct write-off method to account for uncollectible accounts, journal- ize the adjusting entry at December 31, assuming Nuro determines that Willie's $2,900 balance is uncollectible. (b) If Allowance for Doubtful Accounts has a credit balance of $4,300 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be (1) 1 % of net sales, and (2) 10% of accounts receivable. (c) If Allowance for Doubtful Accounts has a debit balance of $410 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be (1) 0.75% of net sales and (2) 6% of accounts receivable